Unlocking ASX Trading Success: James Hardie Industries

JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis

Our latest Elliott Wave analysis provides an update on the Australian Stock Exchange (ASX), focusing on JAMES HARDIE INDUSTRIES PLC (JHX).

Current market trends suggest that ASX:JHX shares may continue their decline in the medium term. Given the present risk factors, the Long strategy requires careful consideration. This analysis will outline key price levels and potential trends, offering a scientific and intuitive approach to market forecasting.

JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis

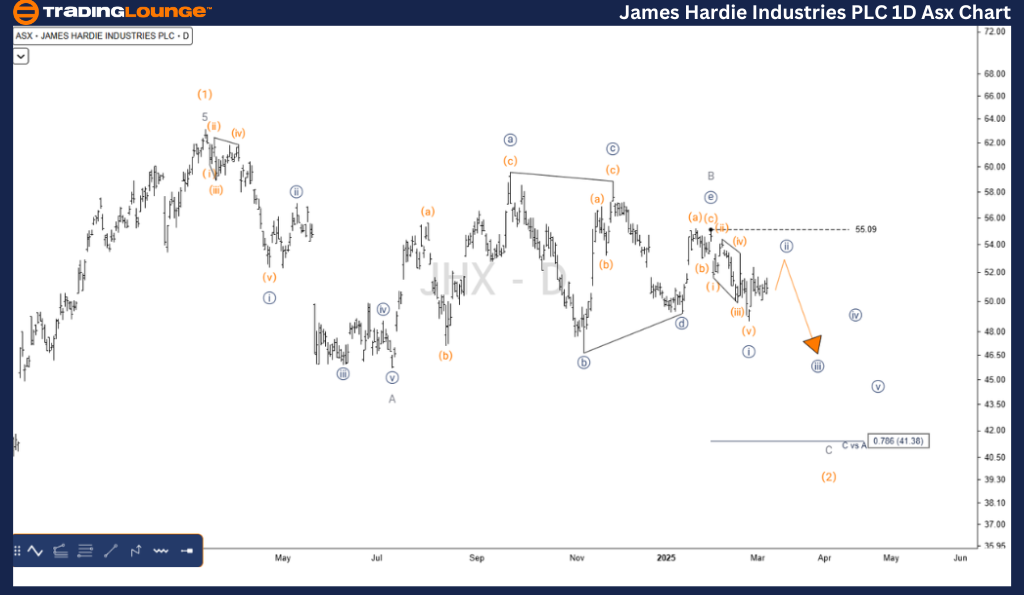

JHX 1D Chart (Semilog Scale) Analysis

- Function: Major Trend (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave C - Grey of Wave (2) - Orange

Details:

- Wave (2) - Orange may not be complete and is currently developing as a Zigzag.

- Recent price action indicates a prolonged sideways move, suggesting the formation of a Triangle labeled Wave B - Grey.

- This pattern has recently concluded, paving the way for Wave C - Grey to push lower, potentially penetrating the 49.16 USD level, further confirming this outlook.

Key Price Levels:

- Invalidation Point: 55.09 USD

- Key Level: 49.16 USD

JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis

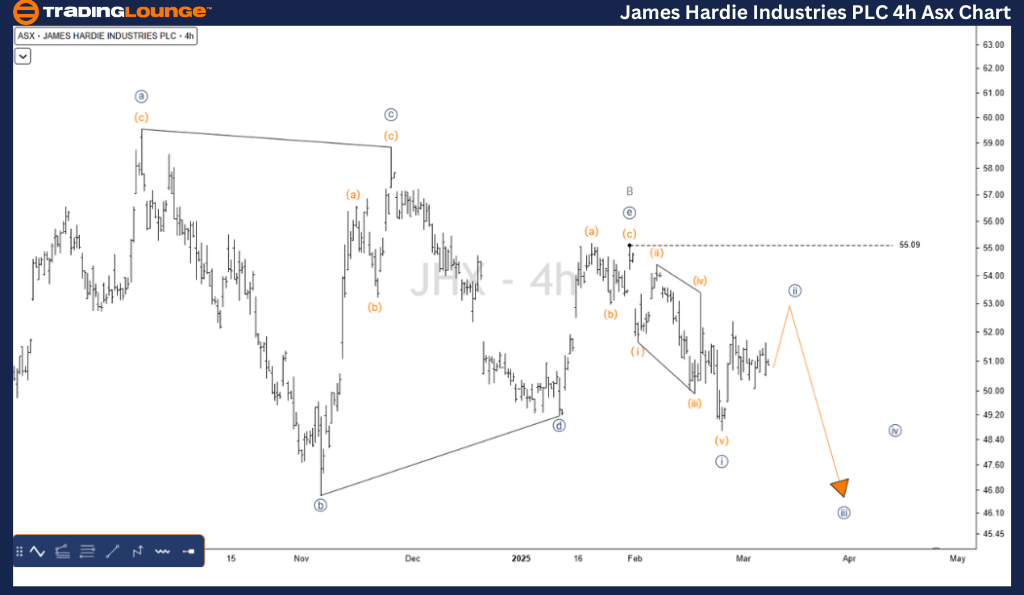

TradingLounge (4-Hour Chart)

- Function: Major Trend (Intermediate Degree, Orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((ii)) - Navy of Wave C - Grey of Wave (2) - Orange

Details:

- A closer look suggests that Wave ((e)) - Navy of Wave B - Grey has just completed a three-wave Zigzag, peaking at 55.09 USD.

- Current market behavior points toward a bearish outlook, indicating that a downward move is highly probable.

Key Price Levels:

- Invalidation Point: 55.09 USD

- Key Level: 49.16 USD

Conclusion

Our analysis and forecast offer insights into the current market trends and potential trading opportunities for JAMES HARDIE INDUSTRIES PLC (JHX). By identifying validation and invalidation price points, traders can gain confidence in Elliott Wave projections. This approach ensures an objective and professional perspective on market movements.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Unlocking ASX Trading Success: Newmont Corporation - Thursday, March 6

Elliott Wave Technical Analysis: Lululemon Athletica Inc.

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Thursday, March 6

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more