U.S. Stocks Rose Last Week Amid Widespread Losses Elsewhere

Image Source: Unsplash

American shares continue to trade in a tight range, posting a modest gain last week. But for most global markets, the trading week through Friday, July 8, delivered losses, based on a set of ETFs.

US stocks are in a holding pattern after an extended correction for much of the year so far. The question is whether the pause marks the end of the slide? It’s too early to know with any confidence at this point.

Key factors that will likely keep uncertainty high: the ongoing Ukraine war and the Federal Reserve’s commitment to continue raising interest rates to fight inflation. Both factors are likely to persist for the immediate future, which will keep investors on edge.

Markets will be focused on two key US economic reports for June this week: consumer inflation (Wed., July 13) and retail sales (Fri., July 15). The outlook is mixed for inflation: economists expect headline CPI to edge higher while core inflation is projected to ease, based on the consensus forecasts via Econoday.com. Meanwhile, retail spending is on track for a strong rebound, economists predict.

The main takeaway: these estimates suggest the Fed will continue hiking rates for the near term, starting with the next policy meeting. Fed funds futures are pricing in a 90%-plus probability for another 75-basis-points increase at the July 27 FOMC meeting.

Meanwhile, most of the major asset classes fell last week. Other than US stocks, US junk bonds and emerging markets stocks, everything else lost ground. The biggest loser: inflation-linked bonds in foreign markets (WIP), which tumbled nearly 3%.

Despite widespread declines in global markets, the Global Market Index (GMI.F) rose 0.8% last week. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

For the one-year trailing period, losses continue to dominate across the major asset classes. Commodities (GCC) are the exception. Despite recent weakness, prices for raw materials overall continue to post a strong gain vs. the year-earlier level.

GMI.F, however, remains deep in the red for the one-year period, posting a 13.8% loss.

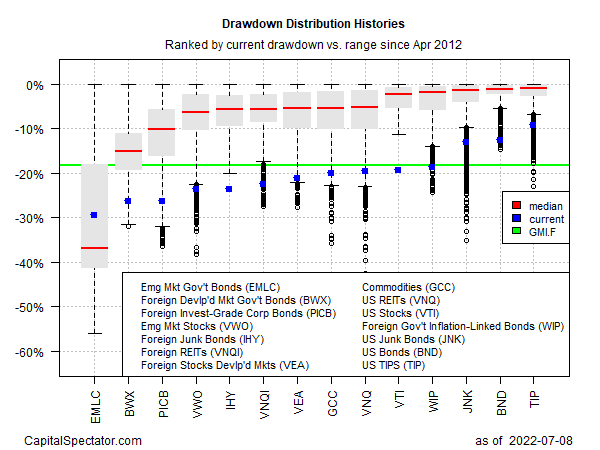

Profiling the ETFs listed above via drawdown shows that nearly all the funds are posting peak-to-trough declines deeper than -10%. The exception: a relatively mild -9.4% drawdown for iShares TIPS Bond (TIP). The deepest drawdown for the major asset classes: emerging markets bonds (EMLC) with a near-30% slide from the previous peak.

GMI.F’s current drawdown: -18.3%.

More By This Author:

Monitoring Investment Trends With ETF Pairs

Risk Premia Forecasts: Major Asset Classes - Wednesday, July 6

Factor Diversification Offers Relief, But Only In Relative Terms

Disclosures: None.