Factor Diversification Offers Relief, But Only In Relative Terms

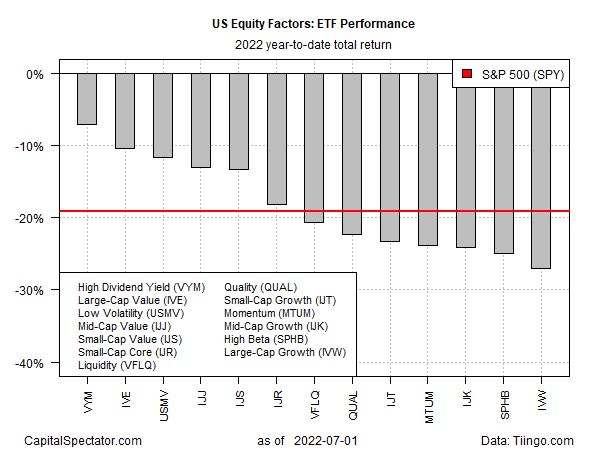

Diversifying an equity portfolio based on risk factors has paid off this year, but only in relative terms, according to a set of ETF proxies. Across-the-board losses for equities have hammered portfolios in 2022, but the degree of red ink varies dramatically, depending on how you carved up factor exposure.

At the extremes, there’s a wide gap in the year-to-date setbacks. Posting a relatively light haircut so far this year is Vanguard High Dividend Yield (VYM), which is off 7.0% in 2022. That stings, but it’s a fraction of the 27.1% tumble for large-cap growth via iShares S&P 500 Growth (IVW). The US stock market overall, based on SPDR S&P 500 (SPY), has lost more than 19% this year.

Is this par for the course? Roughly speaking, yes. You can’t get blood out of a stone and you shouldn’t expect equity factors to perform miracles, i.e., delivering radically different results than broad equity beta risk. Short of extraordinary financial engineering, the usual suspects for equity factors reflect, for good or ill, a fair degree of market beta. For the year so far, the skew has been clearly in the negative column. Over longer periods the degree of help and hindrance varies, depending on the time period and factor. But the market beta is always embedded in factor results by more than a trivial degree.

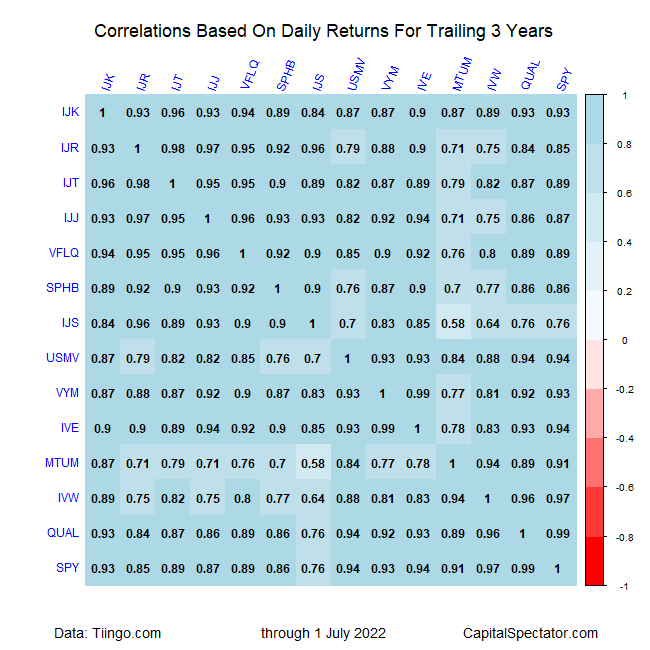

For some perspective on managing expectations, consider how the factor ETFs in the chart above stack up in terms of return correlation over the past three years through Friday’s close (July 1). Comparing the funds with the broad market (SPY, shown in the bottom row) indicates that for most funds the correlation is relatively strong: 0.85 or higher. The outlier is small-cap value stocks (IJS), with a 0.76 correlation vs. SPY. Note: correlations range from -1.0 (perfect negative correlation) to zero (no correlation) to 1.0 (perfect positive correlation).

Correlations are moderately lower for some factor pairings. The lowest for the time period profiled above: 0.58 for momentum (MTUM) and small caps (IJS). The implication: there’s more diversification relevance for mixing factors.

The main takeaway: diversifying by equity factor can improve the risk-return profile vs. holding one broadly defined equity fund such as SPY. But the improvement has limits. That doesn’t mean you should ignore factor diversification, but expecting it to dramatically reduce the effects of broad equity market risk is expecting too much.

More By This Author:

June 2022 Performance Review - Major Asset ClassesWhen Is It “Safe” To Invest In Stocks After Corrections?

How Long Will Interest Rates Rise?

Disclosures: None.