Monitoring Investment Trends With ETF Pairs

Risk-off sentiment continues to dominate market behavior. In other words, nothing much has changed vs. recent history.

A noticeable downside shift for the copper/gold ratio suggests that the recent reversal in the 10-year Treasury yield has room to run, which is to say that the demand for safe-haven government bonds is perking up. The copper/gold ratio is considered a proxy for expectations for the 10-year rate and on that basis, there’s still a strong downside bias for this widely followed yield.

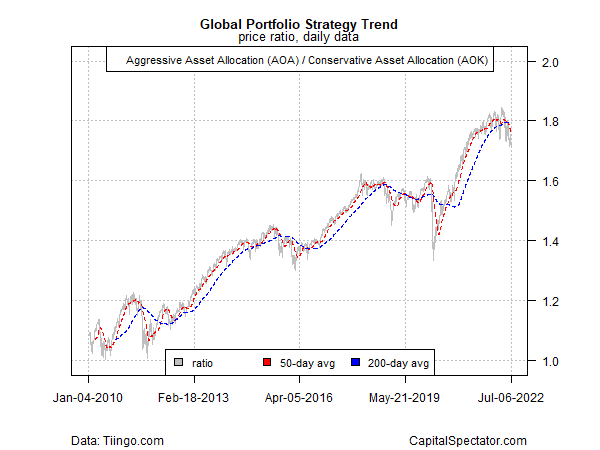

Meanwhile, a proxy for the risk-on/risk-off profile for global portfolio strategies is rolling over after a run of holding steady. The shift suggests that these are still early days for the bearish sentiment of late for multi-asset class portfolios.

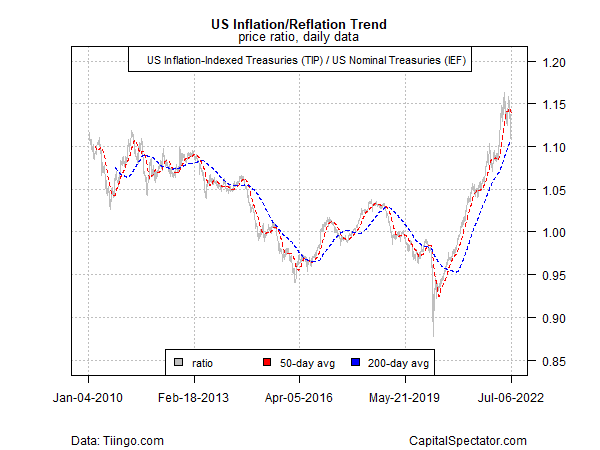

Turning to the inflation/reflation bias, the ratio for an inflation-indexed Treasuries ETF (TIP) and a nominal Treasuries ETF (IEF) suggests this trend may be peaking. It’s too early to make that call, but the TIP:IEF ratio has fallen sharply in recent days. If the reversal continues, it may be a sign the inflation bias of late is reversing. A convincing signal would be a fall of the ratio’s 50-day average below the 200-day average. For the moment, however, that’s nowhere on the immediate horizon.

Speaking of reversals, the slide in the risk-on appetite for stocks appears to be just getting started, based on the ratio for SPDR S&P 500 (SPY)/Vanguard US Bonds (BND).

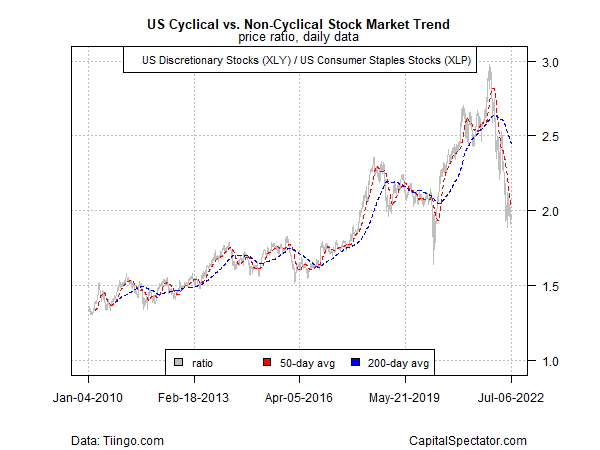

Meanwhile, the dramatic risk-off sentiment for cyclical stocks shows no sign of easing.

Ditto for the big fade for the risk-on appetite for stocks via the ratio for the broad market (SPY) vs. low-volatility stocks (USMV).

Finally, the recent shift to upward momentum in favor of value stocks continues to trend higher.

More By This Author:

Risk Premia Forecasts: Major Asset Classes - Wednesday, July 6Factor Diversification Offers Relief, But Only In Relative Terms

June 2022 Performance Review - Major Asset Classes

Disclosures: None.