The Super Bull Argument For Gold

Now that the barbarous relic is finally back in fashion, how high could it really go?

It turns out that gold is THE deflationary asset to own. Who knew?

I was an unmitigated bear on the price of gold after it peaked in 2011. In recent years, the world has been obsessed with yields, chasing them down to historic levels across all asset classes.

But now that much of the world already has, or is about to have negative interest rates, a bizarre new kind of mathematics applies to gold ownership.

Gold’s problem used to be that it yielded absolutely nothing, cost you money to store, and carried hefty transactions costs. That asset class didn’t fit anywhere in a yield obsessed universe.

Now we have a horse of a different color.

Europeans wishing to put money in a bank have to pay for the privilege to do so. Place €1 million on deposit in an overnight account, and you will have only 996,000 Euros in a year. You just lost 40 basis points on your -0.40% negative interest rate.

With gold, you still earn zero, an extravagant return in this upside down world. All of a sudden, zero is a win.

For the first time in human history, that gives you a 40 basis point yield advantage over Euros. Similar numbers now apply to Japanese yen deposits as well.

As a result, the numbers are so compelling that it has sparked a new gold fever among hedge funds and European and Japanese individuals alike.

Websites purveying investment grade coins and bars crashed multiple times last week, due to overwhelming demand (I occasionally have the same problem). Some retailers have run out of stock.

And last week, the fever went pandemic, as silver rocketed 14.28%, and others like Platinum (PPLT) and Palladium (PALL) were also frenetically bid.

So I’ll take this opportunity to review a short history of the gold market (GLD) for the young and the uninformed.

Since it peaked in the summer of 2011, the barbarous relic was beaten like the proverbial red headed stepchild, dragging silver (SLV) down with it. It faced a perfect storm.

Gold was traditionally sought after as an inflation hedge. But with economic growth weak, wages stagnant, and much work still being outsourced abroad, deflation became rampant.

The biggest buyers of gold in the world, the Indians, have seen their purchasing power drop by half, thanks to the collapse of the rupee against the US dollar. The government increased taxes on gold in order to staunch precious capital outflows.

You could also blame China for declining interest in the yellow metal since it is now in its fifth year of falling economic growth.

Chart gold against the Shanghai index, and the similarity is striking, until negative interest rates became widespread in 2016.

The brief bid gold caught in 2015 over war fears in Syria, the Ukraine, and then Iraq was worth an impressive $160 rise.

That is when the diplomats got involved and hostilities were at least delayed, causing gold to roll over like the Bismarck.

In the meantime, gold supply/demand balance was changing dramatically.

While no one was looking, the average price of gold production soared from $5 in 1920 to $1,300 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal.

It’s almost as if the gold mining industry is the only one in the world which sees real inflation, since costs soared at a 15% annual rate for the past five years.

This is a function of what I call “peak gold.” They’re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff.

You know those tires on heavy dump trucks? They now cost $200,000 each, and buyers face a three-year waiting list to buy one.

Barrick Gold (ABX) didn’t try to mine gold at 15,000 feet in the Andes, where freezing water is a major problem, because they like the fresh air.

What this means is that when the spot price of gold fell below the cost of production, miners simply shut down their most marginal facilities, drying up supply.

No one is going to want to supply the sparkly stuff at a loss. That should prevent gold from falling dramatically.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that the barbarous relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD).

They claim the move in the yellow metal we are seeing now is only the beginning of a 30-fold rise in prices, similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

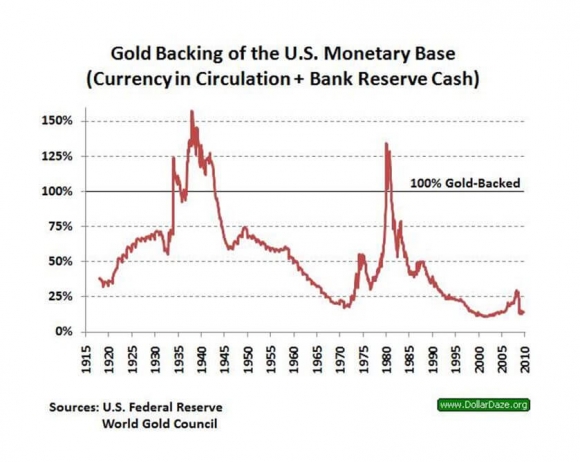

So when the chart below popped up in my in-box showing the gold backing of the US monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using.

To match the gain seen since the 1936 monetary value peak of $35 an ounce, when the money supply was collapsing during the Great Depression, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by 800% from the recent $1,050 low. That would take our barbarous relic friend up to $8,400 an ounce.

To match the move from the $35/ounce, 1972 low to the $950/ounce, 1979 top in absolute dollar terms, we need to see another 27.14 times move to $28,497/ounce.

Have I gotten you interested yet?

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter. But I am not that bullish. These figures make my own $2,300/ounce long-term prediction positively wimp-like by comparison.

The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own krugerrands in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of unrequited demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold.

South Africa, the world’s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence, my more subdued forecast.

But then again, I could be wrong.

In the end, gold may have to wait for a return of inflation to resume its push to new highs. The previous bear market in gold lasted 18 years, from 1980, to 1998, so don’t hold your breath.

What should we look for? The surprise that your friends get an out of the blue pay increase, the largest component of the inflation calculation.

This is happening now in technology, but nowhere else. When I visit open houses in my neighborhood in San Francisco, half the visitors are thirty somethings wearing hoodies offering to pay cash.

It could be a long wait for real inflation, possibly into the mid 2020’s, when shocking wage hikes spread elsewhere.

You may have noticed that I have been playing gold from the long side virtually every month since it bottomed in January. I’ll be back in there again, given a good low risk, high return entry point.

As for the many investment advisor readers who have stayed long gold all along to hedge their clients other risk assets, good for you.

You’re finally learning!

The Diary of a Mad Hedge Fund Trader, published since 2008, ...

more

Hey John, Great article but the 1979 numbers are off. I should know, I tried selling spot gold as I was Comex member at 850 an ounce and couldn't, that was top tick.... never went higher.....