The Market Is About To Get Smashed

(Click on image to enlarge)

First a caveat. While formerly a permabear, I have seen the light and become a Warren Buffett-style long term investor (see “The Enduring Investment Principles of Warren Buffett”, January 14, 2025). After a long period of being bearish and wrong that I now consider the first phase of my professional investing career, I have come to understand that over the long term the market goes up because of what Buffett has aptly termed The American Tailwind as well as persistent inflation that we usually don’t feel in the short term but compounds over the long term.

As a result, shorting stocks in nominal terms over long periods of time is inevitably a Loser’s Game. That said, the market will experience nasty bear markets from time to time as it has throughout history and there’s no reason not to take advantage of them. Let’s turn now to the current market situation.

After a fast and nasty 10% correction in the S&P, the market has stabilized in recent days. But – as I suggested in “My Conversation With Warren Buffett About The Correction” (Friday March 14, 2025) – that was likely only the first round at the beginning of a bear market that I argued would take the S&P down 25% in 2025 (“Why The S&P Will Drop 25% In 2025”, December 10, 2024).

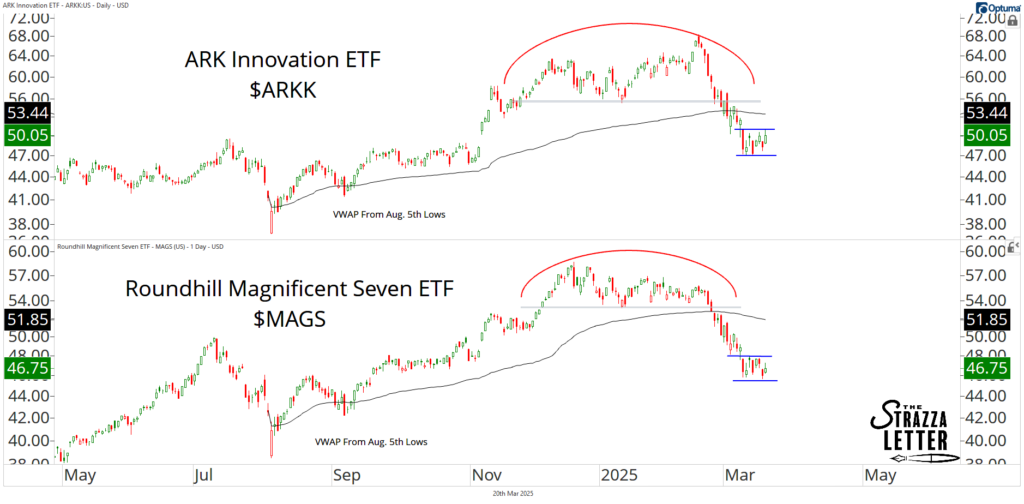

The bounce has been notably weak with most leading stocks and ETFs forming “Bear Flags” as Steve Strazza nicely illustrated for MAGS and ARKK in the chart at the top of this blog. You can see the same thing on charts of QQQ, SMH (Semis) and ITB (Homebuilders).

My sense is that the rug is about to be pulled out from under those who think the initial correction is the end of it and the market will begin a new leg down shortly. As I argued in “My Conversation With Warren Buffett”, now is a time to be making your watch lists for stocks you ultimately want to buy and perhaps initiating small starter positions. But it is not a time to go All-In in the expectation that the bull market is about to resume and new highs are just around the corner.

While nobody has a crystal ball, my sense is that bigger bargains are coming – and if you’re patient you will be able to deploy capital at highly favorable prices in the next 6-18 months. It’s for just this scenario that Buffett has accumulated his huge cash pile and, as I wrote last Friday, I’m betting that’s how he’s assessing the current situation too.

More By This Author:

NKE: This Is When You BuyWarren Buffett On The Correction

KSS Is In A Death Spiral; No Reason To Buy Bad Companies