KSS Is In A Death Spiral; No Reason To Buy Bad Companies

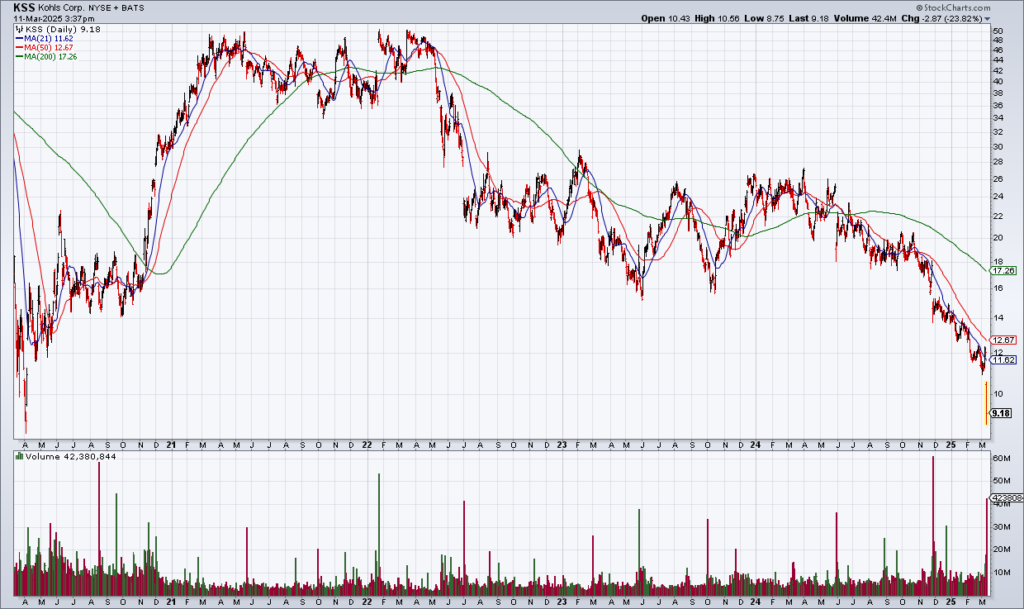

(Click on image to enlarge)

Department store Kohl’s (KSS) reported another disastrous quarter Tuesday morning before the open and shares are being taken to the woodshed (-24%). KSS shares are now down more than 80% over the last three years. I used to be fatally attracted to this type of stock and it’s important to understand why you need to avoid them.

Perhaps you’re a Kohl’s shopper and like the stores. The 1,000+ Sephoras within Kohl’s are very popular among women with comps up 13% in the 4Q24 compared to a year ago. You might be a Sephora fan tempted to buy shares in the hope that there’s real value here. Maybe they can turn it around. How could the stock be worth $50 three years ago and only $9 now?

But the reality is that the numbers prove beyond a shadow of a doubt that KSS is in a death spiral. 2024 comps came in at -6.5%. It’s been like this for years: 2023: -4.7%, 2022: -6.6%. And KSS sees no turnaround in 2025, guiding comps to -4% to -6%. If you compound those numbers, same stores sales will have declined 21% over the last four years at the end of 2025 at the midpoint of guidance. I don’t know what’s going on but that’s all you need to know to know that KSS is in very big trouble. They cut their dividend by 75% this morning – from 50 cents/quarter to 12.5 cents/quarter – because they don’t have the free cash flow to pay the old level.

Most of the well known companies that trade on the NYSE and NASDAQ are excellent or at least good enough. While there are reasons to prefer some over others, for the most part you will do fine buying stocks in companies you like and holding them for the long term. That’s the great thing about the stock market. You don’t have to a be a genius to make money in it. You simply have to ride what Warren Buffett has aptly called “The American Tailwind”.

But there are some exceptions. There are bad stocks that some of you – like I was previously – are temperamentally drawn to because they look like they might be bargains after big drawdowns. The reality is that they are usually down big for good reason. The first lesson of investing is to be invested. Have equity in the market. Most stocks will do just fine over the long run because of “The American Tailwind”. But there are bad companies that will fail like Kohl’s and you must learn to avoid them.

More By This Author:

Bull Market In Jeopardy As Trump Trade SoursNVDA Earnings And The State Of The Market

Realty Income: A High Yielding REIT Income Investors And Retirees Need To Know About