The ETF Portfolio Strategist - Sunday, June 20

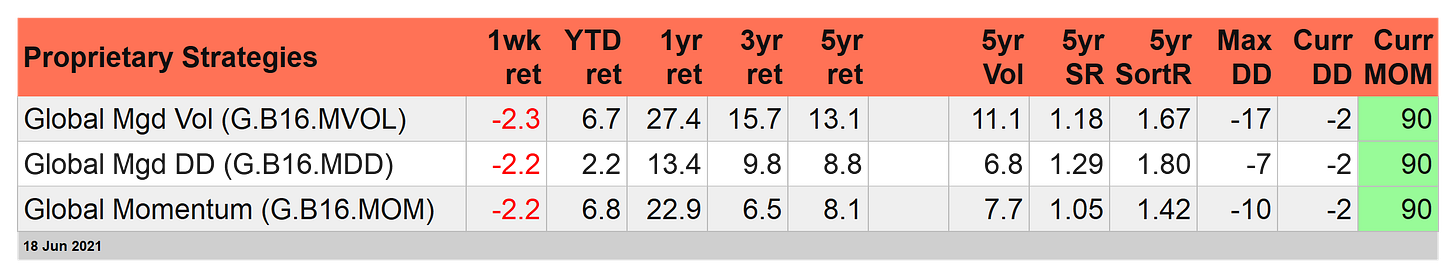

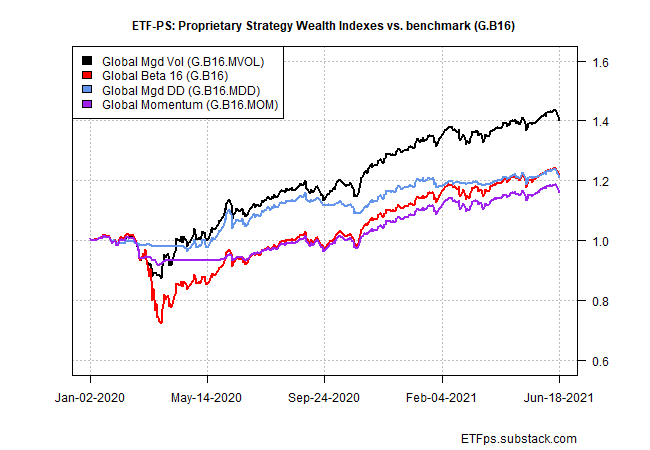

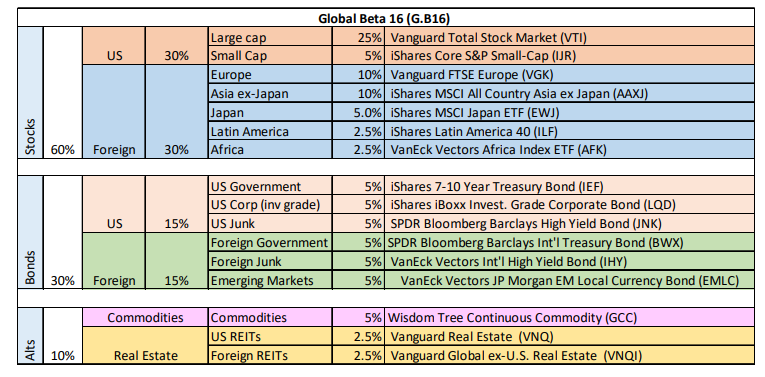

The broad-based declines in global markets last week pinched our three proprietary strategies in line with the benchmark, Global Beta 16 (G.B16). Two of the prop strategies lost a steep 2.2% in the trading week through Friday, June 18. The setbacks match G.16’s weekly decline. Global Managed Volatility (G.B16.MVOL) shed a touch more.

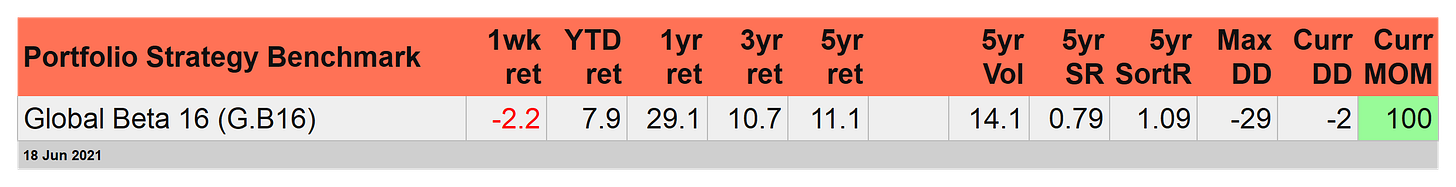

G.B16 continues to lead by a wide margin for year-to-date results, which is a reminder that passively held beta portfolios remain tough to beat in 2021, even after last week’s volatility. The question is whether the latest slide in markets is the start of a new regime, triggered by last week’s news that the Federal Reserve may be considering raising interest rates earlier than previously expected.

For now, our trio of prop strategies continue to outperform decisively on a risk-adjusted basis for the trailing five-year period. Sortino ratios for the trio, for instance, are far ahead of the equivalent for G.B16. If an extended period of market volatility awaits, history suggests that our active strategies will continue to benefit from the extra layers of risk management that G.B16 lacks.

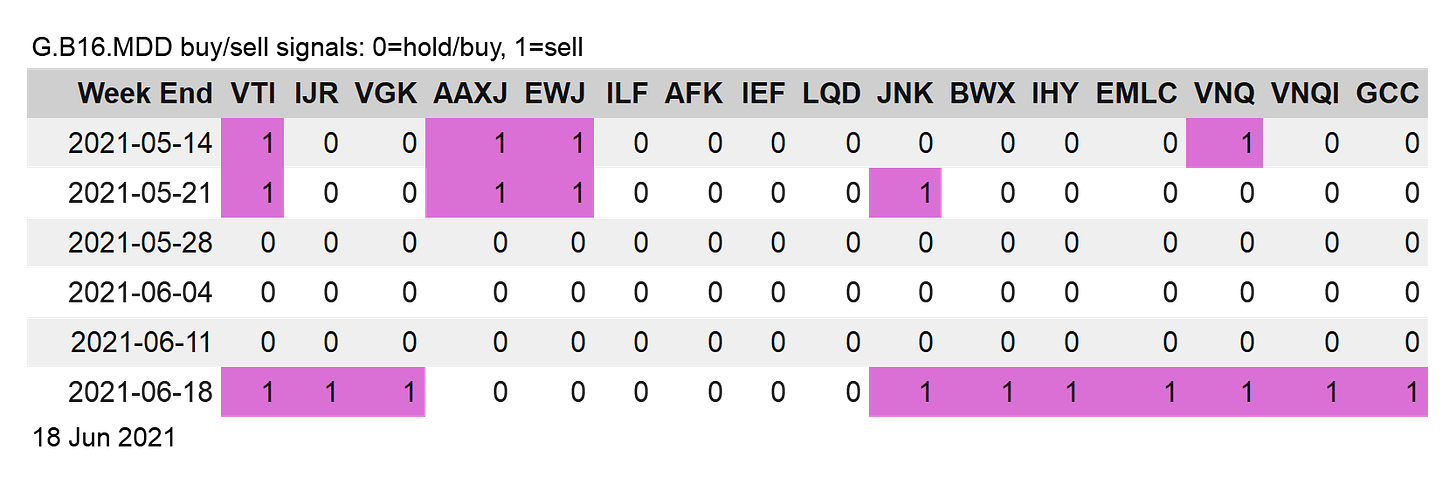

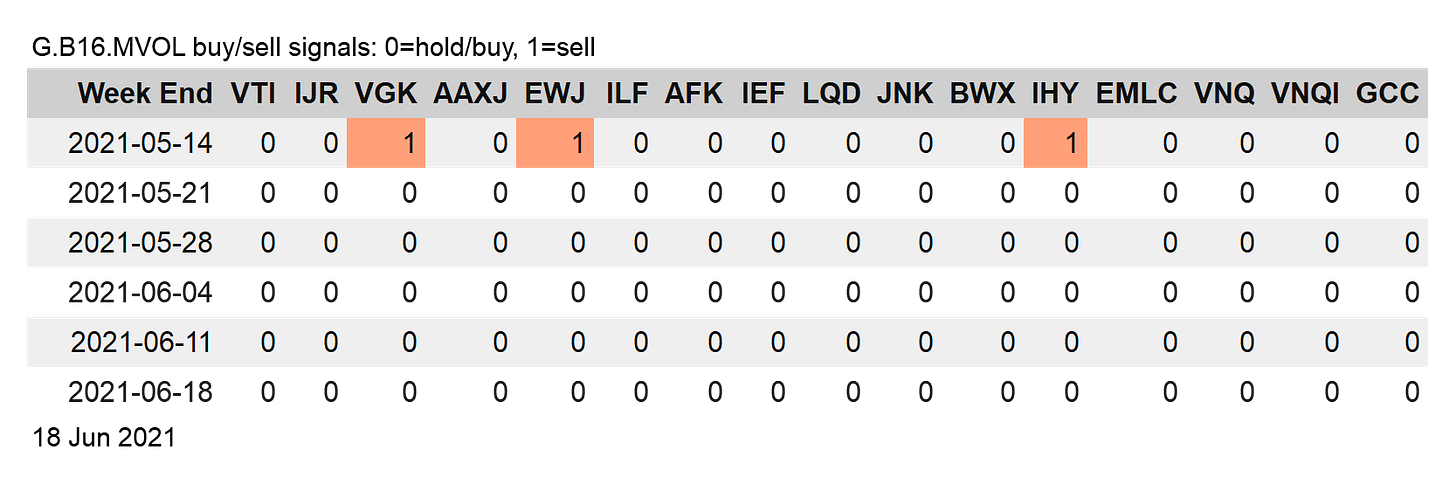

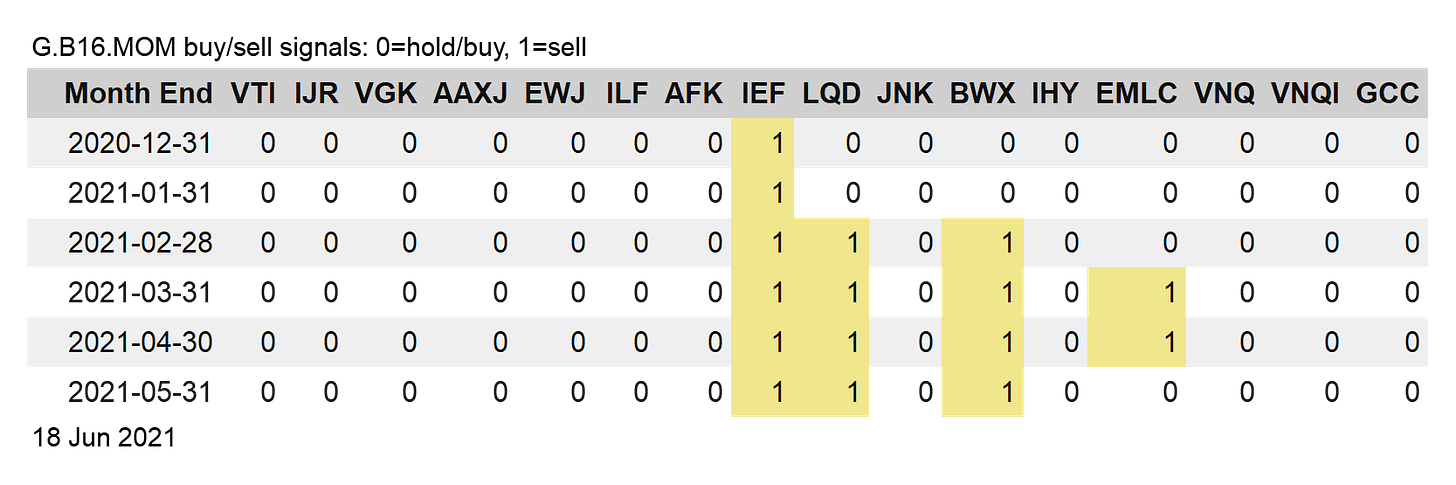

On the rebalancing front, Global Managed Drawdown (G.B16.MDD) is preparing for more trouble: the strategy shifted to a mostly risk-off profile as of Friday’s close. G.B16.MVOL, on the other hand, still has all-out risk-on profile while G.B16.MOM’s month-end rebalancing activity, if any, awaits next week.