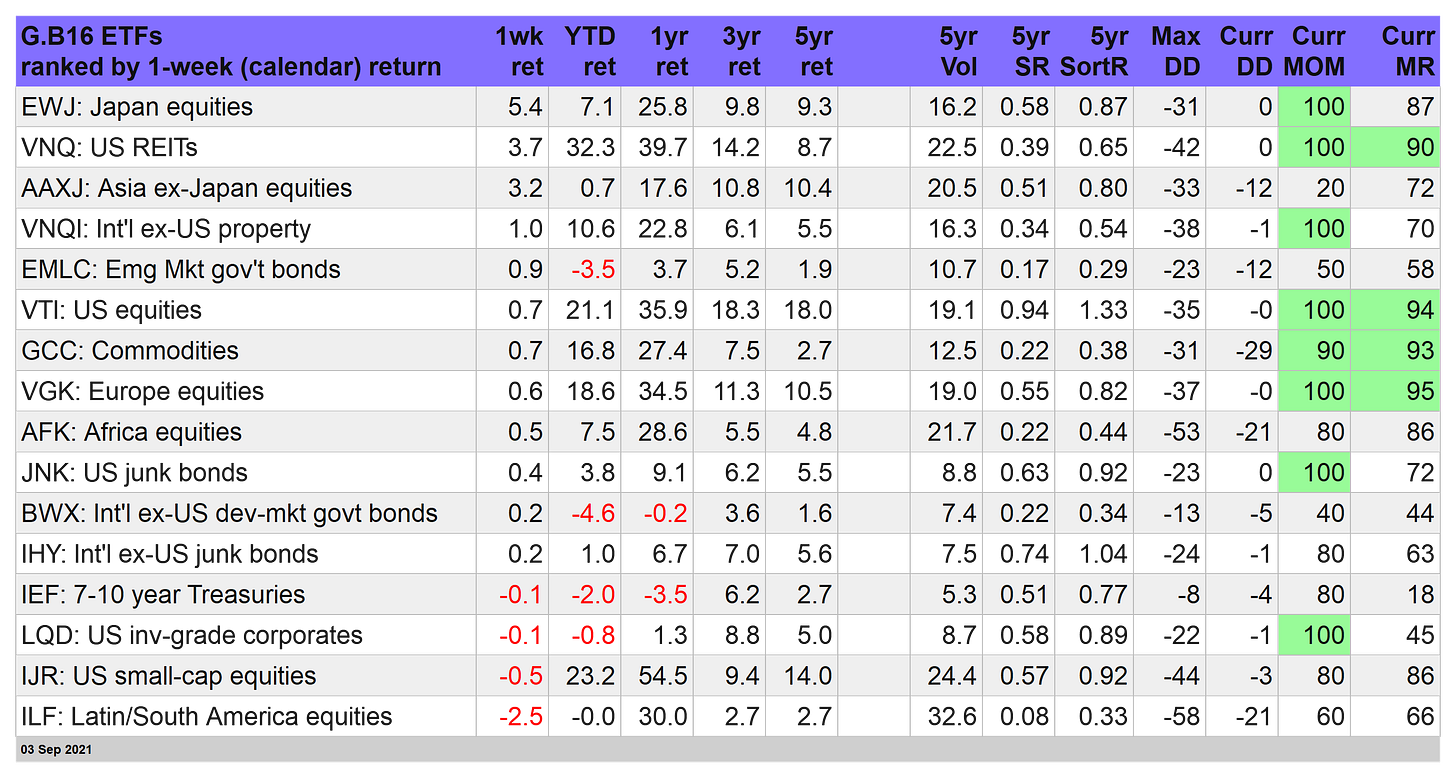

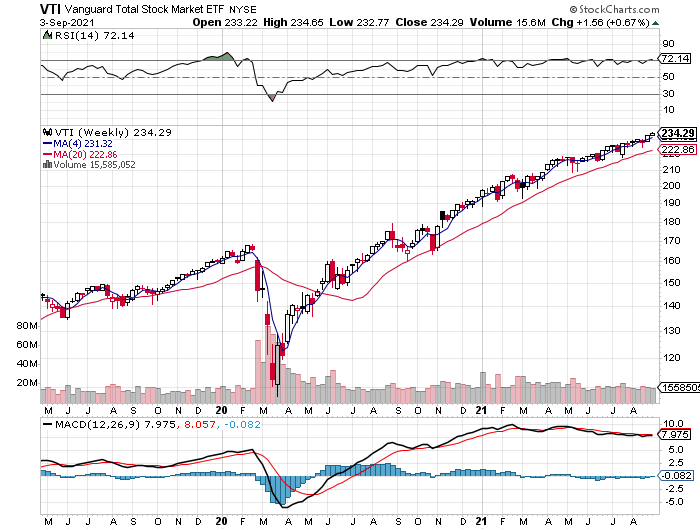

The ETF Portfolio Strategist - Saturday, Sept. 4

The Trend Remains your Friend

This is getting repetitive, but in a good (or at least profitable) way. The bullish momentum that’s been in force for much of the year remained in play this week as most global markets ended on a positive note by the close of trading through Friday, Sept. 3.

The upside outlier for our standard 16-fund global opportunity set: Japan. Triggered by the surprise announcement that the country’s prime minister would step down, the news unleashed a wave of buying. The logic, if you can call it that, is that a new leader may bring a much-needed break from the troubled tenure of Yoshihide Suga, who’s become politically toxic after his widely criticized handling of the pandemic.

Will new leadership fare any better? Unclear, but for the moment the crowd is relieved that someone else, anyone, will give it a try. The iShares MSCI Japan ETF (EWJ) surged 5.4% this week, largely on Friday’s rally following the news of Suga’s departure. EWJ ended the session at a record close.

Impressive, but a change of government by itself probably isn’t the basis for an extended rally. This is Japan, after all, and the politics are complicated. A new prime minister with the pro-growth bona fides of Shinzo Abe (Suga’s predecessor) would be bullish. But until it’s clear who’s going to run the show (and we’re a long way from clarity on that front), Friday’s jump looks like a speculative, short-term move.

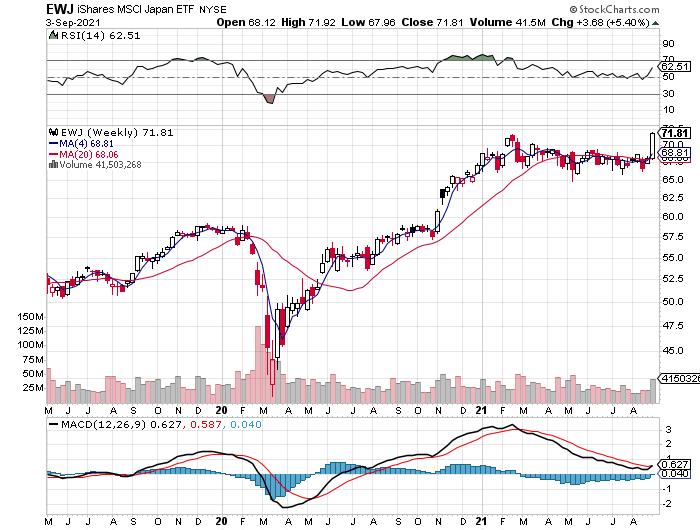

In the US, real estate investment trusts (REITs) were the week’s hot asset class. Vanguard US Real Estate (VNQ) rose a strong 3.7%, lifting the ETF to a new record high. The fund has closed up for seven straight days. After Friday’s news of a sharply softer-than-expected gain in US payrolls for August, the comparatively high-yielding VNQ is looking strong again from a payout perspective.

The big miss on jobs implies that the Federal Reserve will have to delay any tapering of asset purchases, which in turn implies that rates hikes are further out in the future than previously thought. As a result, VNQ’s 2.5% yield (based on the trailing 12-month period, which may or may not indicate future payouts) is attracting a fresh look in a world where the US 10-year Treasury yield is a comparatively thin 1.33%.

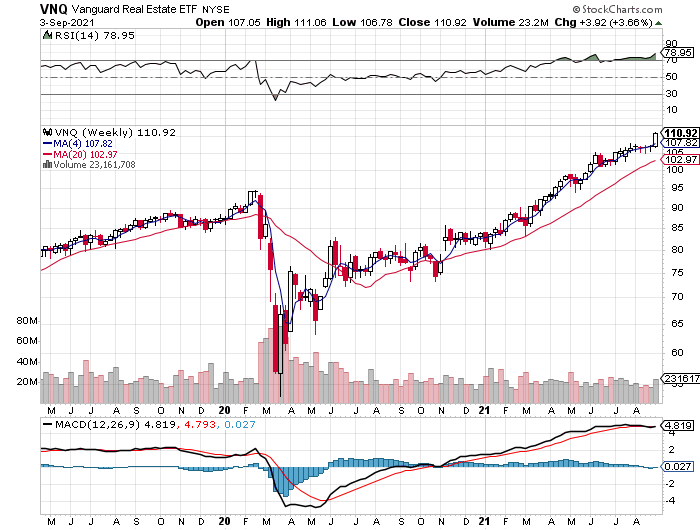

US stocks, meanwhile, continue to deliver a smooth upside trend — a trend so smooth, in fact, that it would elicit cries of disbelief if the price chart reflected a privately run hedge fund. The publicly traded Vanguard Total US Stock Market (VTI) may defy financial gravity, but there’s no doubting this year’s stellar rally as the fund added another 0.7% this week.

This week’s losers were limited to US bonds (IEF and LQD), small-cap equities (IJR) and the biggest setback, iShares Latin America 40 ETF (ILF), which gave up 2.5% for the trading week.

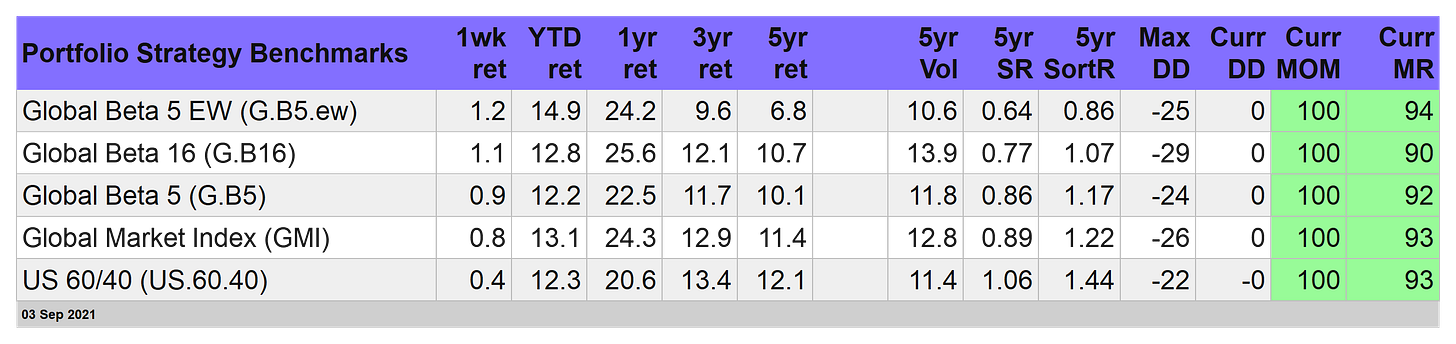

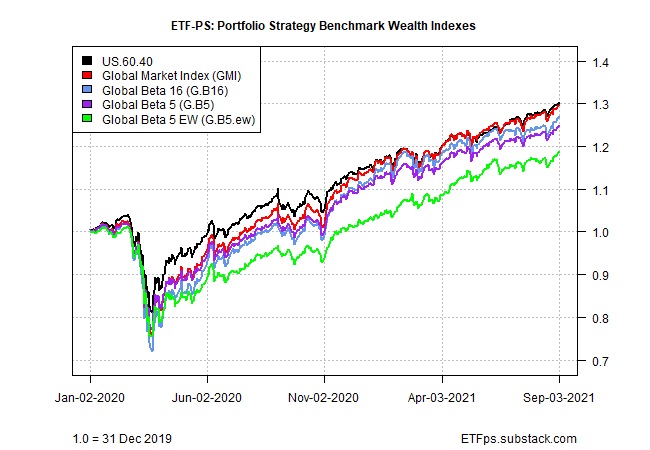

A rising tide lifts all strategy benchmarks, again

Global diversification is back in the driver’s seat this week. Although the US 60/40 stocks/bonds benchmark gained 0.4%, the US.60.40 index was the weak hand this week.

Leading this week’s rallies: Global Beta 5 EW (G.B5.ew), an equal-weight mix of the major asset classes. This benchmark popped 1.2%, securing its leadership anew for year-to-results. G.B5.ew is now up 14.9% so far in 2021, comfortably ahead of the rest of the field.

Heavily weighting portfolios with US assets hasn’t fallen out of favor just yet, particularly for investors embracing a “let ‘er run” attitude. But the ongoing leadership this year in portfolios with some degree of non-US assets suggests that a transition in global asset allocation preferences is underway.