SPY/RSP Forecast For 2022: Shifting To Equal Weighted Portfolio

Highlights:

- The current SPY/RSP spread of 2.88 is higher than the historical level of 2.75.

- I Know First AI provides a positive outlook on SPY and RSP for the 1-year horizon.

- It is expected that the FER will reduce its security holdings, which will decrease market liquidity, and tighten financial conditions.

The previous year was successful for companies from the S&P 500 index (S&P 500 index tracks the performance of 500 large companies listed on stock exchanges in the United States), for the period of January 4th, 2021 to January 1st, 2022 the S&P 500 increased by 29.61%, while the Russell 2000 increased by 16.40% during the same period of time. It is interesting to point out that while the S&P 500 had an uptrend dynamic during the whole period, the Russel 2000 stayed in the flat since February 2021. So, if 2021 was a year of large companies, should we consider 2022 as a year of small companies that did not have a clear uptrend dynamic during the whole year of 2021?

(Figure 1: The dynamic of S&P 500 and Russell 2000 for the period of January 4th, 2021 to January 1st, 2022)

Firstly, we need to provide an answer to the question: “Why were small companies less popular than the large ones in 2021?”. Let us remember that when Russell 2000 hit in the flat dynamic, the first COVID-19 vaccines were released, and speculation began to appear that the government economic support would be decreased in the future. Small companies are most affected by market uncertainty, and the absence of future government support of the economy has the main effect on small companies.

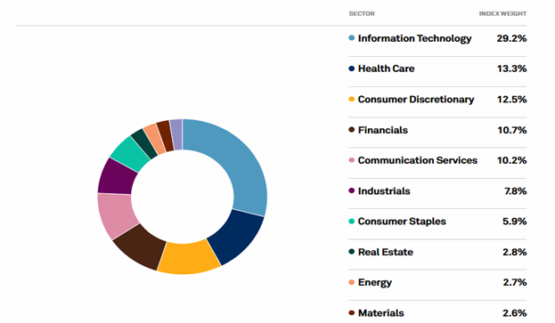

Today we stay between the Coronavirus and Inflation walls that motivate the Fed to increase interest rates and decrease monetary support of the economy. Therefore, despite that small companies look intriguing, I suppose we should not dramatically change our preferences from large-cap stocks to small-cap stocks. However, we can think about shifting our investment preferences between sectors inside of the S&P 500. Currently, Informational Technology and Health Care sectors, which have won the most from the pandemic, take the highest two fractions in the S&P 500.

Below we can see a price dynamic of the SPY and RSP exchange trade funds where RSP beats SPY by 2.53% for the period of January 4th, 2021 – January 14th, 2022. SPY tracks a market-cap-weighted index of US large- and midcap stocks selected by the S&P Committee, at the same time, the ETF RSP tracks an equal-weighted index of S&P 500 companies.

Let us look carefully at the statistics description of ETF SPY and ETF RSP. Below, I calculated the mean and volatility of monthly return (by using monthly adjusted closed prices from YahooFinance.com) for the period of June 2003 – December 2022. According to Table 1, ETF RSP is a riskier asset with a high grade of risk compared with ETF SPY. Moreover, we can notice that the spread return of SPY/RSP is equal to -0.04% with a volatility of 1.30%.

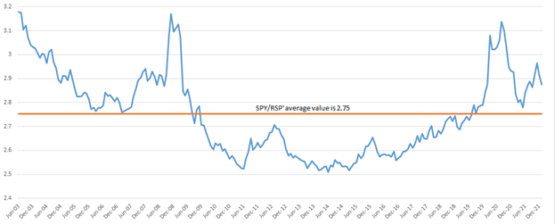

The historical average SPY/RSP spread is equal to 2.75 with a median of 2.73 for the period of June 2003 to January 14, 2022, which is less than the current spread of 2.88. We can also notice that the SPY/RSP spread significantly rose in the period of the Financial Crisis in 2008 and when the pandemic began. Moreover, after the peak in August 2020, when the spread reached of 3.14, it decreased to 2.78 in May 2021, which confirms that the economy has adapted to work in the pandemic reality.

The I Know First AI algorithm provides a positive outlook on SPY and RSP for the 1-year horizon with good predictability. Moreover, RSP has stronger signal and predictability coefficients for all forecasting periods that support my position that RSP is more attractive compared to SPY now.

Despite the fact the Know First AI provides a positive outlook for the 1-year horizon, we need to take into account that the S&P 500 increased by 43% for the period of January 1st, 2020 – January 14th, 2022, and this growth is fully connected with tremendous government support. According to the Federal Reserve Bank of St. Louis, the M2 money supply increased by 39% from February 2020 to November 2021. That’s more than thrice the pace of monetary expansion following the financial crisis of 2008-09 (when M2 increased by 13.7% for the period of January 2008 – December 2009) and substantially greater than the money printing of the inflationary 1970s. Today we are coming in the phase when the Fed will not only decrease its security purchasing but will reduce its holdings, which would tend to drain liquidity from the market and tighten financial conditions.

Moreover, according to FOMC the most recent Summary of Economic Projections, the current headline unemployment rate reached 3.9%, which is less than the equilibrium level determined by FOMC as 4%, and just above the 3.5% reached in February 2020, right before Covid-19 broke out. It allows us to state that most of the economic sectors have adapted to work in the pandemic conditions and investors should consider shifting their holding from sectors that won from Covid-19, like Technology and Health Care sectors, to a broad range of economic sectors.

On the one hand, there is a positive I Know First AI outlook for the 1-year horizon, but on the other hand, we should expect a negative impact on the stock market by the Fed. So, what could be the most rational investment decision in this case? I suppose that we should consider the opportunity to go short in SPY/RSP spread (short – ETF SPY; long – ETF RSP). This strategy would provide a return even in the case if both stocks go down, but SPY will have a higher depreciation rate than RSP. Moreover, as we have seen before, the monthly volatility of the SPY/RSP spread is 1.30%, which is significantly lower than ETF SPY and ETF RSP monthly volatilities of 4.13% and 4.84% respectively. Also, this strategy goes in line with the I Know First AI forecast with a stronger bullish RSP signal compared to the SPY signal.

Conclusion

Covid-19, as with any shock, has provoked disbalances in the economic system that creates profitable investment opportunities. Historically the average SPY/RSP spread is equal to 2.75, which is lower than the current level of 2.88 creating the opportunity to monetize this disbalance. The government support of the economy has set up the S&P 500 rally with a growth of 43% in the last two years. However, the current unemployment level of 3.9% indicates that the economy has fully adapted to work in the pandemic reality and the Fed can focus its attention on inflation, which will have a negative impact on stocks by reducing liquidity in the financial market. At the same time the I Know First AI provides a positive outlook on the ETF SPY and ETF RSP for the 1-year horizon with a higher RSP signal that confirms the current disbalance existence between SPY and RSP. Taking a short position in the SPY/RSP spread (go short in ETF SPY and go long in ETF RSP) is the opportunity that allows monetizing the revealed disbalance with expected negative influence on the market by the Fed.