SPY: Four Strategies For A Market Where Retail Investors Are "All In"

Image Source: Pexels

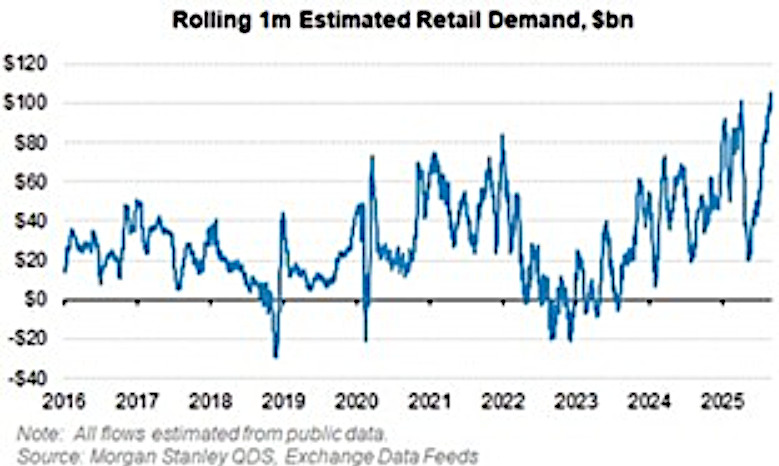

Recent data from Morgan Stanley jumped out at me. Simply put, retail investors are all in. When retail flows hit extremes like this, it’s a sign you’re late in the cycle, not at the start, suggests Lance Roberts, editor of the Bull Bear Report.

Over the last month, retail investors have poured more than $100 billion into equities, which is the largest one-month buying surge on record, according to Morgan Stanley. It’s not portfolio rebalancing. It’s not institutions quietly adding exposure. It’s speculation, momentum, and fear of missing out driving record flows.

That also took the total amount of equities bought this year to $630 billion – on pace for $800 billion for the full year.

While it is easy to develop a "bearish" mentality when viewing these factors, the market can stay irrational longer than most investors can stay solvent. So, you don’t fight the tape. However, you also don’t trust it blindly. Here are four tactics to navigate this kind of environment:

- Tighten your exit rules. Late-cycle rallies often end with sharp reversals. Don’t guess when. Let price tell you. Use trend breaks, moving averages, or trailing stops. Get out fast when leadership weakens.

- Rotate into relative strength. Chase the names and sectors outperforming on a three-to-six-month basis. Momentum works in these environments — until it doesn’t. But you don’t wait for value to catch up. Stay in what’s working.

- Limit exposure to high-beta trades. You can have some speculative exposure, but keep it small and defined. Don’t let high-beta positions dominate your portfolio. When momentum turns, these names get hit the hardest.

- Build optionality into your cash. Cash isn’t bearish. It’s strategic. In late-cycle markets, you want dry powder. If volatility returns or sentiment shifts, you’ll have the flexibility to act — without being forced to sell on the way down.

Retail buys with both fists, but that doesn’t mean you must chase. You must participate purposefully, control risk, and be ready to step back when the music stops.

About the Author

Lance Roberts has been involved in the investing world for more than 25 years. From private banking and investment management to private and venture capital, he has pretty much been there and done that. Mr. Roberts common sense approach and real world examples have appealed to a broad investing audience for two decades.

He is the chief investment strategist for RIA Advisors and lead editor of the Real Investment Report, a weekly subscriber-based newsletter distributed to over 100,000 people nationwide. The newsletter covers economic, political, and market topics as they relate to your money and life.

More By This Author:

Gold At $4k: Why The Precious Metal Keeps Outperforming Stocks

Esperion: Japanese Drug Approval, Otsuka Payments To Help This Biotech Play

AI Stocks: After Data Center Construction Boom, Will Profits Flow?