Esperion: Japanese Drug Approval, Otsuka Payments To Help This Biotech Play

Image Source: Unsplash

Esperion Therapeutics Inc. (ESPR) and its partner Otsuka recently announced regulatory approval for NEXLETOL (bempedoic acid; oral ATP citrate lyase [ACLY] inhibitor) for hypercholesterolemia in Japan. Pending pricing, which Esperion estimates will take roughly one to two months, the company should receive a $120 million milestone from Otsuka, writes John McCamant, editor of Medical Technology Stock Letter.

Esperion will also receive strong tiered royalties as high as 30% (ranging from 15%-30%) on Japanese net sales. In our view, this approval represents a significant revenue opportunity with Japan being the third largest potential market (after the US and Europe), where original estimates have probably been too conservative.

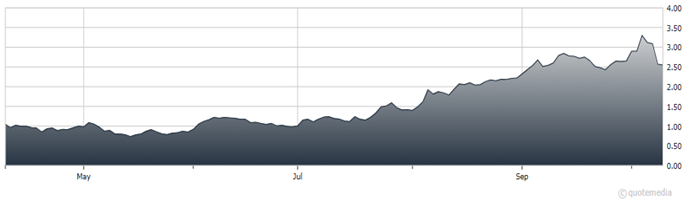

Esperion Therapeutics Inc. (ESPR) Stock Chart

In addition, bempedoic acid has shown even superior data in Japanese patients, and importantly these patients may also have higher rates of statin intolerance. Esperion has stated that Otsuka is very excited about this launch and has a very large team ready to go. An estimated 15 million patients could be statin-intolerant and both in need and eligible for therapy.

The economics of the deal help Esperion to keep an attractive piece of the value here. Post-approval, we view the $120 million milestone next quarter as very likely, and the potential royalties up to 30% means a significant portion of the sales could come back to Esperion.

Other positives for Esperion Therapeutics were the recent guideline updates in Europe that were very favorable on bempedoic acid. That bodes well for the expectation for new ones to come out in the US in early-Q1'26. There is also potential for upside on additional IP extensions should the remaining ANDA filers settle (three down, six more to go).

About the Author

John McCamant joined the leading investment newsletter, Medical Technology Stock Letter, as an associate editor in 1987 and was named editor in August 2000. He has spent over 35 years on the front lines of biotechnology investing. In his previous role as an equities analyst for the American Healthcare fund, Mr. McCamant uncovered investment opportunities and guided investment strategy.

More By This Author:

AI Stocks: After Data Center Construction Boom, Will Profits Flow?CNP: A Utility Profiting From Surging Power Demand

XAR: A Fund For Capitalizing On The Defense Drone Revolution