AI Stocks: After Data Center Construction Boom, Will Profits Flow?

Photo by Mohamed Nohassi on Unsplash

The lure of riches and tight capacity today has money flooding into the construction of Artificial Intelligence (AI) data centers. The irony is that, typically, the more money that floods into an area, the less likely any of the players will make the same juicy profits that attracted them, reaped in the years before the spending boom, notes Ed Yardeni, editor of Yardeni QuickTakes.

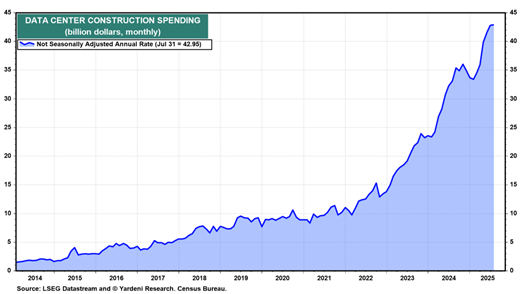

Data center construction — just the cost of constructing the building — has increased to an annual rate of $43 billion, up 30% year-over-year and 322% higher than $10.2 billion four years ago. Add in the costs of chips and servers, and you’re talking about real money.

Cloud providers like Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), and Amazon.com Inc. (AMZN) enjoyed 20%-30% annual revenue growth rates last year. So, it’s understandable that players like Oracle Corp. (ORCL), xAI, Meta Platforms Inc. (META), and others would jump into the lucrative market.

One of the biggest users of AI data center capacity is OpenAI. The company — which is expected to generate $13 billion in revenue this year but earn no profit — recently said it was likely to spend around $16 billion to rent computing servers alone this year. That number could rise to $400 billion in 2029. And now it too is building data centers for its own use.

As for AI stocks, OpenAI is privately held, but many of the other cloud providers are public. Microsoft and Oracle are members of the S&P 500 Systems Software stock price index, which has climbed roughly 24.8% year-to-date. The industry is expected to grow earnings by 15.2% this year and 14.3% in 2026. Its forward P/E is 33.7, near the top end of its range in all periods except the 2000 dot-com bubble.

Alphabet and Meta are in the S&P 500 Interactive Media Services stock price index, which has climbed 26.6% year-to-date. The industry is expected to grow earnings 21.5% in 2025 and 6.7% next year. At 23.6, the index’s forward P/E is near recent highs, but still well below its highs around 30 back in 2020.

About the Author

Dr. Ed Yardeni is the president of Yardeni Research, Inc., a provider of global investment strategy and asset allocation analyses and recommendations. He previously served as chief investment strategist for Oak Associates, Prudential Equity Group, and Deutsche Bank's US equities division in New York City.

Dr. Yardeni taught at Columbia University's Graduate School of Business and was an economist with the Federal Reserve Bank of New York. He is frequently quoted in the financial press, including The Wall Street Journal, Financial Times, The New York Times, The Washington Post, and Barron's.

More By This Author:

CNP: A Utility Profiting From Surging Power DemandXAR: A Fund For Capitalizing On The Defense Drone Revolution

USD/JPY: Broken Down Amid Broad Dollar Pressure

MoneyShow Editor’s Note: Ed will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. more