Should You Get The KOLD ETF This Spring?

I want to tell you that you should short natural gas. I want to tell you that the $8.50/mcf natural gas that we saw this week is crazy, that the price is going to come down hard. The market is hugely backwardated – meaning prices are much lower in the months farther out on “the strip.” The easy way to get short is through the levered inverse ETF Proshares UltraShort Bloomberg Natural Gas (KOLD).

I want to tell you this because everything I have seen over the last 20 years is telling me this is the perfect setup. I mean, $8.50 gas?

I have lived through 20 years of watching every pop in natural gas come right back down as producers ramp production and flood the market with product. My gut instinct when I see a 8-handle on gas: Sell it all. But I can’t do it, I can’t tell you to short this.

I’m not saying be long. I’m just saying don’t short. Sit this one out. Why? Because there are two big reasons that natural gas might not go down this time.

I know, I know, I’m really going out on the limb here. But again, this is $8 gas we are talking about here. This should be a sure thing. You should want to buy KOLD like it is a blue light special.

Instead, two big shifts are going on with natural gas. These shifts make it really hard to know the right price for gas. It could be different this time. At least for a while.

Producer Calls are Depressing

I just finished listening to my seventh natural gas producer conference call. It is hard to believe that natural gas is $8+ after listening to these execs. You would be hard pressed to find a more dour group. The low mood is not without reason. These are executives schooled in the era of production growth. Now, with a gas price that should be fueling hyper-growth for their business, most are sitting around with their hands tied.

How so? Takeaway capacity. It is just not there. Building it could take years. Consider EQT (EQT), which produced 5.1 bcf/d of natural gas in the first quarter (about 5% of US production). CEO Toby Rice basically said they would not, could not, increase production in response to the strong gas price.

We’re sticking to maintenance mode. We’ve been pretty vocal about this. Without more pipelines, the prudent thing for us to do is to continue to stay in a maintenance mode. So that’s been our mentality in the past. It’s our mentality until we start getting some more pipelines put in.

Instead, EQT will be directing cash to buybacks and dividends. Ditto for CNX Resources (CNX), producer of 1.7 bcf/d of natural gas and liquids, almost entirely in the Marcellus and Utica basins. CNX CEO Nick Deluliis had some particularly harsh words.

The domestic natural gas, oil, and pipeline industries in the nation, they can’t ramp up production to anything close to the levels that the U.S. and the EU is clamoring for anytime soon. And that’s not because of industry unwillingness. No. Instead, it’s simply and starkly because the policy is consciously and methodically looking to strangle infrastructure investments in the pipes, processing, power generation, and in the LNG infrastructure.

On top of the regulatory environment, CNX sees the capital markets as a second constraint. Their solution? Become debt free.

It's the same story for Range Resources (RRC); no plans to raise capital expenditures. Coterra Energy (CTRA), the recently merged Cabot and Cimerex play, produced 3.1 Bcf/d of natural gas in Q4. Conterra guided to a decline to 2.7 – 2.85 Bcf/d in 2022.

Coterra is actually increasing production, just not natural gas. Coterra’s production is balanced between the Permian and Marcellus. They are putting their capex towards the Permian, which favors oil over gas.

Only Southwestern Energy (SWN) has offered a glimmer of growth among the mid-cap names. Southwestern produced 1.8 bcf/d of natural gas in Q1, up from 1.7 bcf/d in Q4. Production should reach 2 bcf/d by year-end. What was the reason for the increase? Simple – they can.

Southwestern has a large position in the Haynesville – in Louisiana – where regulatory constraints are loose and pipelines are aplenty. With a couple of acquisitions late last year, Southwestern increased their Haynesville land position significantly. The Haynesville is now the focus of their capital spend.

But even Southwestern has constraints. While there is growth in the Haynesville area, it will be offset by declines in Appalachia. Comstock, another Haynesville play that produced 1.3 Bcf/d in Q4, is also forecasting modest growth – 4-5% year-over-year.

The Story of Three Basins

There are really only 3 basins on the Lower 48 that can put a meaningful dent in natural gas production. Appalachia, Permian, and Haynesville.

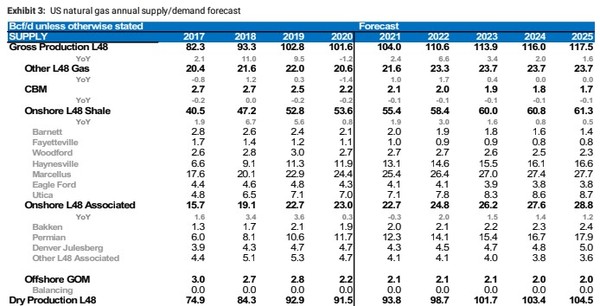

Source: Morgan Stanley

Most of those miserable executives talking about capacity constraints produce mainly from the Marcellus/Utica in Appalachia. That leaves the Haynesville and the Permian areas, where there also appears to be plenty of takeaway capacity.

But natural gas is not the reason you drill the Permian. Gas is associated with oil production, and how much natural gas is produced depends more on oil prices than on natural gas. Chevron (CVX) has become a big player in the Permian. It accounts for 20% of their capital budget this year.

Chevron sees lots of room for growth (both oil and associated gas): “We don’t flare in the Permian and so we’ve got to be sure we’ve got gas takeaway or we aren’t going to produce any oil. And so it’s a high priority for our midstream tea. But we don’t see pinch points anytime soon.”

Chevron’s US natural gas production grew from 1.7 Bcf/d to 1.8 bcf/d in Q1 largely on the back of the Permian. They expect to grow Permian production 5-10% this year.

The other big Permian player, Exxon (XOM) produced 560,000 boe/d from the Permian in Q1 and is expecting to grow Permian production 25% this year. Pioneer Natural Resources (PXD), another big Permian producer, produced 0.8 bcf/d of natural gas in Q4, which was double the year before. Pioneer CEO Scott Sheffield had been one of the loudest voices saying he would not grow production.

Occidental Petroleum (OXY) another large Permian and Rocky Mountain producer with 1.3 bcf/d production in Q4, said at the time of their Q4 release: “ we have no need and no intent to invest in production growth this year.”

Incentives Now and In The Future

What complicates matters this time around is that we are not just incentivizing natural gas demand for next winter. We need to look further ahead. Since the Russian-Ukrainian war, the gas market has taken more of a forward-looking view, realizing that it has to replace Russian gas quickly.

LNG, LNG, LNG. The world needs more LNG. It is about to get it. When the company reported, Baker Hughes (BKR) CEO Lorenzo Simenilli put out an extremely bullish LNG forecast to 2030:

“Given the current LNG price environment and the quickly changing dynamics, we believe that global LNG capacity will likely exceed 800 MTPA by the end of this decade to meet growing demand forecast. This compares to the current global installed base of 460 MTPA and projects under construction totaling almost 150 MTPA.”

That works out to almost 50 Bcf/d of new installed capacity in the next eight years.

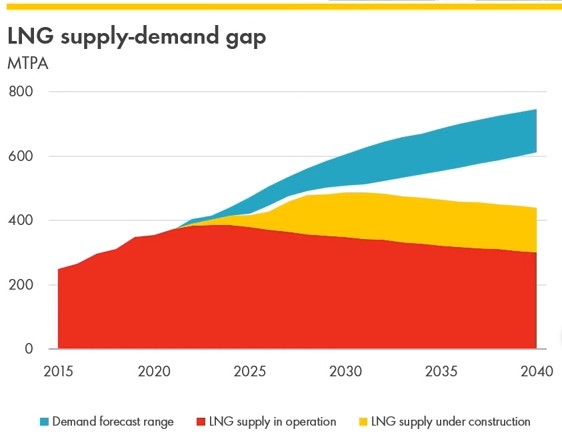

In February, Shell (SHEL) gave their annual LNG outlook. Near the end of the conference call, they gave us their estimate of the supply gap that was developing.

Source: Shell 2022 LNG Outlook Presentation

This was before the Russian invasion of Ukraine. What Baker Hughes is now telling us is that this supply gap, which already looked pretty bad, has grown – potentially by a lot – and we are going to need a lot more gas over the next five to 10 years in order to fill it.

Where is the Growth Going to Come From?

When I step away from all these company calls and consider how much gas we will need if Baker Hughes and Shell are right, and I weigh that against how much we can get from our big basins given the constraints, well, I just find it hard to be too bearish.

Producers in the Appalachian are telling us they can’t grow–but I’m not convinced that’s true. What certainly is true is that there is no more LNG exports for a couple years – so any big demand increase is capped.

Producers from the Permian can grow, and some of them will grow, but others are reluctant, and anyway the growth depends far more on oil prices than gas. The Haynesville can certainly grow, as can the second-tier basins, but at what price will they grow enough? And remember, they are growing production now for the hope of big LNG prices when the next US LNG train comes online – not for another couple years.

That is the question that the market is trying to figure out. What price of natural gas do we need to get ready to meet all this LNG demand? In other words, $7-8 gas is incentivizing the marginal basins to produce more gas now so the gas is there where the LNG comes.

We know that more gas will come as prices rise. Now is $7-8 the right price to incentivize production? I still think it's too high. It could be $5. It could be $6. It probably isn’t $4, and it definitely isn’t $3. But a finger-waving guess that $7 is too high is far from a good reason to go short natural gas.

There are times to be long, times to be short, and times to just step aside. Let the market figure this one out first. This is one of those times.

One smart way to get long this trade (and short natural gas) via KOLD is to do it as a paired trade where you go long a natural gas producer. Because multiples are low, the world still has to figure out how to replace Russian molecules — sentiment could keep these stocks higher than the highly backwardated natural gas curve.

Disclaimer: Under no circumstances should any material