Sharp S&P Sector Swings Suggest Shifts

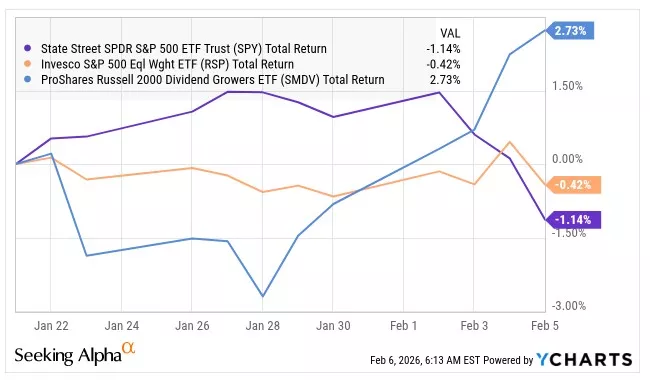

16 days ago, I wrote an article about ETFs that I thought could handle a big problem that many investors may be facing with the extreme run-up in a few large-cap stocks over the past three years. I suggested two ETFs here that would help diversify equity portfolios, RSP and SMDV. The ideas were very different, as RSP, the Invesco S&P 500 Equal Weight ETF, holds all of the S&P 500 names but weights them equally rather than by market cap. SMDV, the Invesco S&P 500 Equal Weight ETF, holds 104 high quality smaller names. Here is how State Street SPDR S&P 500 ETF Trust/ State Street (SPY) has done relative to these two since the close of business on 1/21:

I still like SMDV, which has returned 10.5% so far in 2026, and I also still like RSP, which has returned 3.7% compared to the SPY return of -0.6%. I wrote about another ETF that investors should consider, the Invesco High Yield Dividend Index ETF (PEY), and it has rallied further, up now 9% in 2026.

With that said, I want to look a bit deeper today at the action in the S&P 500 and share some additional ideas for investors and advisers to consider.

Sector Action in the S&P 500

The Standard & Poor's 500 Index had 10 sectors for a long time, and, since 2015, it has had 11 with the addition of Real Estate. The very largest sectors are Information Technology at 32.5%, Financials at 13.1%, Communications Services at 108% and Consumer Discretionary at 10.4%, according to State Street, which oversees SPY. SPY has dropped in price by 0.6% as of 2/5, and Vanguard S&P 500 ETF (VOO) has dropped the same.

Looking at the returns of the largest part of the S&P 500 by sector, they are all down, with Technology down the most. Technology Sector SPRD ETF (XLK) and the similar but larger Vanguard Information Technology Index Fund ETF (VGT) are down 5.8% and 6.0%, respectively. At the same time, Energy Select Sector SPDR (XLE) is up 16.8% and Consumer Staples Select Sector SPDR ETF (XLP) is up 12.0%. Unfortunately for SPY, these are quite smaller than the four largest sectors that are all down.

I pointed out above that the RSP return is up year-to-date, and this is because the smaller stocks in the S&P 500 carry more weight than the larger ones.One can extend that look to the Russell 2000 Index, and the iShares Russell 2000 Index Fund (IWM) has gained 3.9%. Looking a bit deeper at both IWM and SPY, Value is outpacing Growth.

With the S&P 500 still up in price by 77% since the end of 2022, many investors probably don't care about the slight decline in 2026. Since the peak in January, SPY has dropped 2.6%. This is not fun, but it is pretty normal in the scheme of things. It is nothing like the action in early April last year! I continue to believe that investors should be taking action to reduce the risks of very high exposure to large-cap Technology stocks and the Magnificent 7.

Some Ways to Diversify

The very easiest way for most investors to diversify is to go into a more sector-neutral approach to large-caps. This is not necessarily the best way, but for many investors and for their advisers, it reduces the perceived risk of smaller stocks. RSP, which I discussed last month, currently has a sector exposure that is very different from the S&P 500. Here is the breakdown as of 1/31 according to Invesco:

it has more Energy and Consumer Staples than SPY, but the combined 12% is not the sole driver of the better performance for the ETF recently. Importantly, the Technology weighting is a lot lower than it is for SPY.

The other two ETFs that I shared here last month are very different from one another. PEY might work for these investors, as it is focused on large-cap names. Its sector weightings are very different from SPY according to Invesco:

The annual rebalancing will take place in March, and things could change. I like that the ETF has big exposure to Utilities, which have pulled back from their peaks recently. I also like that the Technology exposure and Consumer Discretionary exposure sare so low. This ETF can diversify investors.

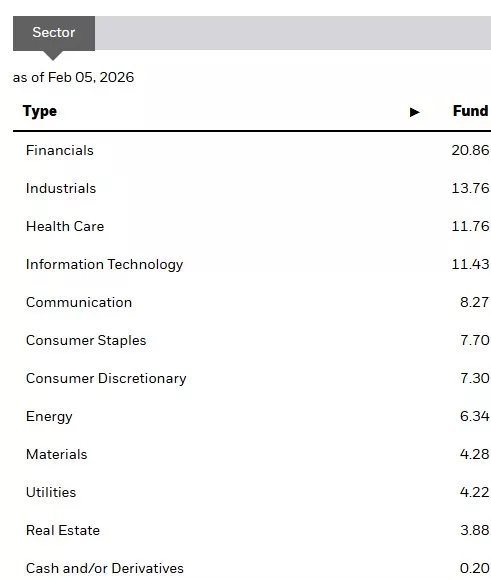

SMDV is a bit more difficult for many investors,but it can diversify as well due to its focus on smaller companies and the quality metrics of the index. The sectors here are very different from SPY as well. According to Invesco, the ETF is highly exposed to Financials, Industrials and Utilities with just a tiny bit of Technology stocks. Here is the SMDV ETF allocation as of 2/05:

While these ETFs are all up in 2026, I still like each of them and still include them in my Intelligent ETF Investor model portfolio. I do have some other ideas that investors and their advisors who are concerned about their current exposure to the S&P 500 or to very large stocks should consider. I currently include 81 ETFs on my ETF watchlist, and there are 61 that are equity-focused.While I don't include these in my model portfolio currently and don't include one on my Focus List at this time, I want to share my opinion on them.

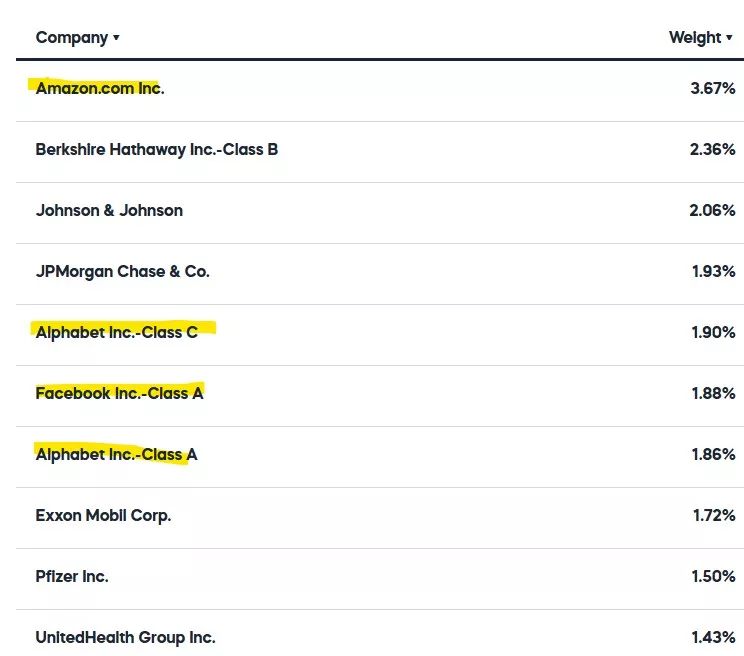

The first one, iShares Russell 1000 Value Index Fund (IWD), should work for large-cap investors as an alternative. iShares discusses it on its website, describing it as offering exposure to undervalued companies. The ETF is big at $68.6 billion, and it holds 866 securities. The management fee is very low at 0.18%. The largest holding is 3%, and the sector exposures are very different from the S&P 500:

The other one, the ProShares S&P 500 Ex-Technology ETF (SPXT), is not yet on my ETF watchlist. According to ProShares, it can diversify away from the Technology sector. It holds 433 stocks, and charges a management fee of 0.13% for the $271 billion ETF. I like that it avoids Technology and can be a good way to add additional large-cap exposure but not to add this sector, but it owns a lot of stocks that are not technically Technology but seem like it:

So, these are some ETFs to consider for those who are concerned about their exposure to very large companies and trying to diversify.

A Look at Price Action Over the Past 10 Years

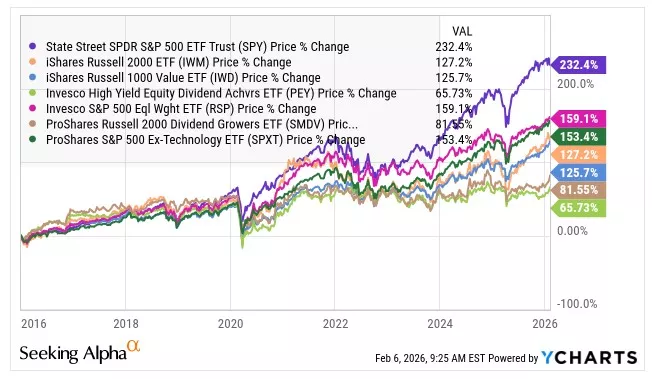

Here is a chart of the total return for all of these ETFs since the end of 2015:

The outperformance of SPY has been over the past few years, and it has far outperformed for a long time. The ETFs that I include in my model portfolio are the two lowest returning over this period, and the third one that I include is the second best but far behind SPY. The two that I talked about today for the first time have returned a lot less than SPY.

Conclusion

Many investors and traders may see an opportunity with the reversal of large-caps and the Technology sector, and it may be. I continue to be very concerned about stocks due to the massive U.S. debt, the risks of inflation continuing and how long it has been since we have had a contraction in the economy. For those that want to diversify, I continue to like the stocks I discussed previously (and weight them at 42% of my ETF model portfolio), though are all up nicely to start the year. I also like IWD. I discussed SPXT, but this ETF does not earn a buy rating from me at this time (and is not on my ETF watchlist).

More By This Author:

Why Investors Should Pay For PEY

Be Careful With The Stock Of Curaleaf

Consider These ETFs To Diversify

Disclosure: I own none of the ETFs mentioned personally, but my wife owns PEY and SMDV