Seasonality Period

SPX Monitoring purposes; Neutral.

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Neutral

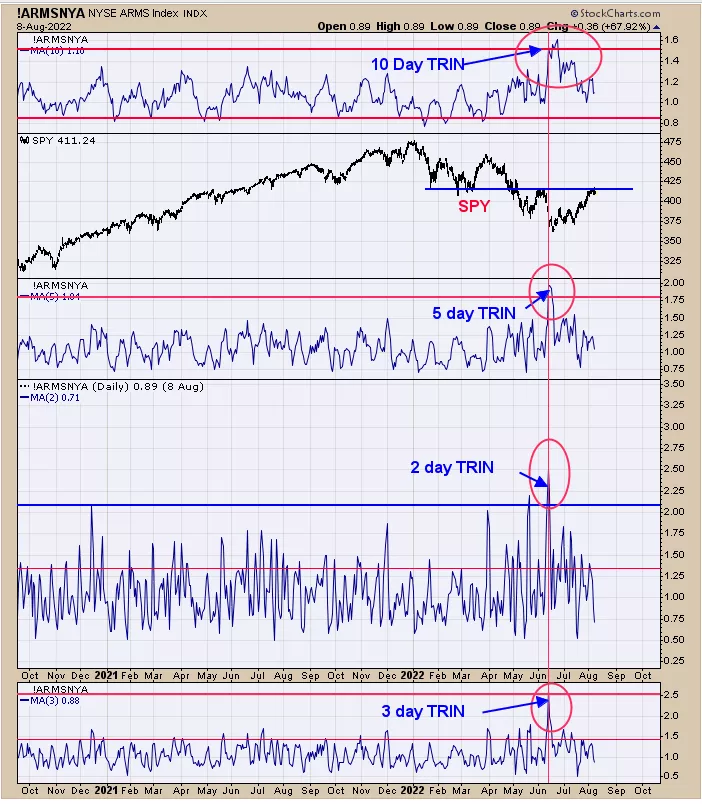

The SPY has gone virtually sideways over the last week and a half. The longer the sideways pattern the larger move once the breakout occurs. The sideways pattern doesn’t give the direction of the breakout; we have to rely on indicators to give us hints of what that direction will be. The closing Ticks readings suggest a pullback is coming. The numbers in red are the Tick closes and closes above +350 suggesting short-term exhaustion. The last three days of last week came in at +374, +419, and +474. The Trin closed on 8/1 at 1.45; 8/2 at 1.38; 8/3 at 1.17 and 8/4 at 1.23 which all lean bullish. In general, we have bullish trin closes and bearish tick closes which works out to be neutral for the market short term. Seasonality is bearish to September 30. Its possible that a trading range may be developing during this Seasonality period. A bit longer term is for a fourth-quarter rally that could run into year-end. For that to happen we would need the tick and trin to show panic readings before the rally starts and that could happen at the end of September. Don’t see a good setup for the moment and will remain neutral.

The top window is the 10-day average of the TRIN; the next window is down the daily SPY; next down is the 5-day average of the TRIN; next lower is the two-day average of the TRIN and the bottom window is the three-day average of the TRIN. Implied panic in the market is recorded when the TRIN closes above 1.30 and Panic forms at the bottoms in the market. The more panic readings there are the more lasting the bottom. When the 10-day TRIN reaches above 1.50 the market is near an intermediate-term low. Going into the mid-June low the 2, 3, 5, and 10-day TRIN all reached panic levels suggesting the mid-June low could be the low for the year.

More By This Author:

Neutral On S&P 500 And Long On Gold

Moon Cycle Effect On The Gold Market

Rare Signal Generated On GDX

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more