Rare Signal Generated On GDX

SPX Monitoring purposes; Long SPX on 5/31/22 at 4151.09.

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Neutral

(Click on image to enlarge)

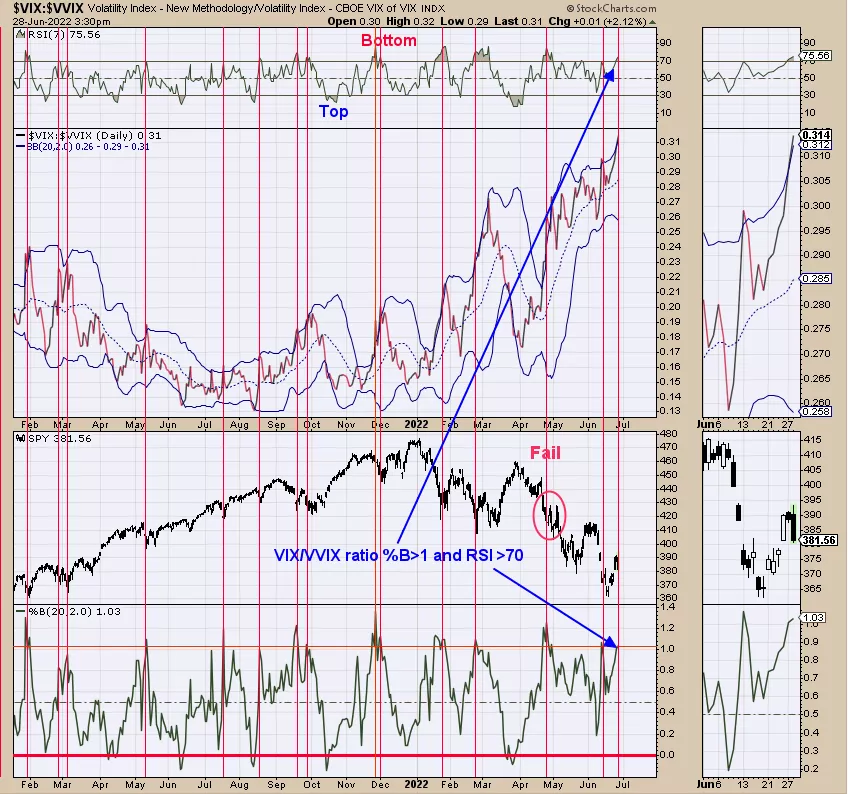

Above is an indicator that does well for signaling short-term reversals. The second window down from the top is the VIX/VVIX ratio. The top window is the RSI for this ratio and the bottom window is the Percent Bollinger band (this indicator signals when the upper Bollinger band is reached with a reading >1 and when the lower BB is reached with a reading <0). When this ratio moves up fast its signals that fear is present and that happens when the RSI is above 70 (currently 75.56) and the Upper Bollinger Band is reached and that is when the Percent Bollinger Band >1 (current reading is 1.03). Today’s decline reached Friday’s up gap and tested that gap on lighter volume which suggests support. Short term trend on the SPX (SPY) leans bullish.

(Click on image to enlarge)

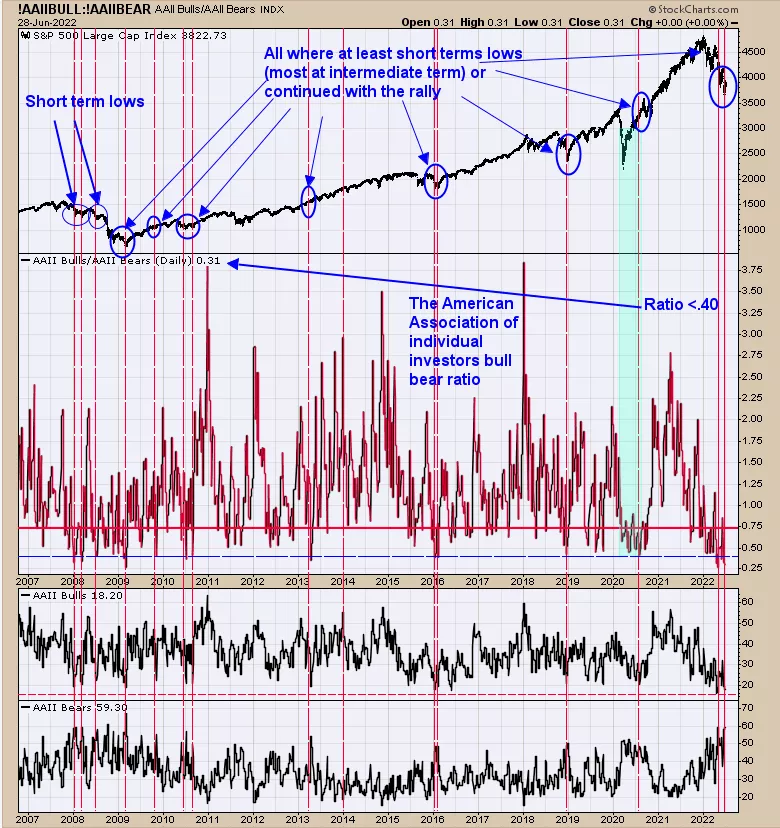

Above is The American Association of Individual Investors Bull Bear Ratio (AAIIBBR). The chart is updated today and the current reading stands at .31. Readings of .40 and below have at least marked short-term lows and some marked intermediate-term lows. With the AAIIBBR staying below .40 and in the buy area the SPY is expected to climb higher short term. Today’s pull back tested Friday’s up gap on lighter volume, which suggests Friday’s up gap has support. Don’t think the rally from the mid-June low is over and the 420 SPY range is the next upside resistance.

(Click on image to enlarge)

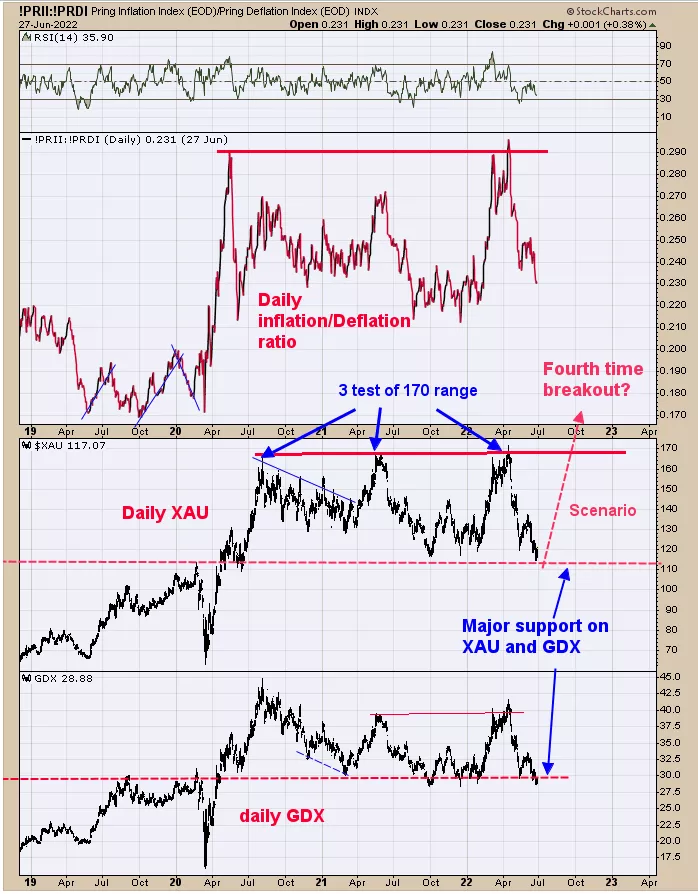

Yesterday and Last Thursday, we said, “Rare signal generated on GDX. The last time this type of signal was generated was last October low. The signal is the RSI for the Bullish Percent index for the Gold Miners index. When the RSI for the Bullish Percent index falls below 5 (current reading is 4.40) the market was at an intermediate-term low.” This bullish signal lines up at major support for both GDX and XAU (note on chart above). Both XAU and GDX have been in a sideways trading range since August 2020. It's likely the current buy signal will work out and both XAU and GDX will rally back to their resistance which is 170 on the XAU and 40 range on GDX. For the XAU the next time up to resistance near 170 will be the fourth time. The more times an area is tested the more likely the breakout will occur, so it is likely the breakout will come on the fourth test. This sideways trading range for both XAU and GDX has been going on for nearly two years and a two-year trading range suggests the next rise could last two years.

New Book release "The Secret Science of Price and Volume" by Timothy rd, buy www.Amazon.com.

Signals are provided as general information only and are ...

more