"Rate Of Change"

SPX Monitoring purposes; Neutral.

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Neutral

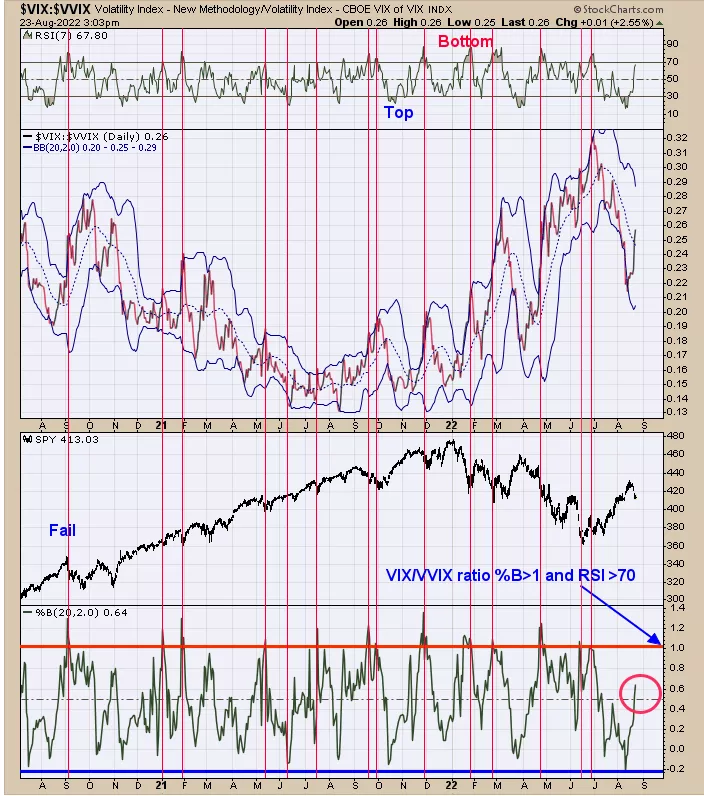

The bottom window is the “percent Bollinger Band” for the VIX/VVIX ratio. Short-term lows can form in the market when the “Percent Bollinger Bands” for the VIX/VVIX ratio reaches above its upper Band and that happens when the “Percent Bollinger Bands” >1; the current reading is +.64. A rapid rise in the VIX/VVIX ratio shows there is panic in the market and panic forms when the market is near a low. Don’t have the readings quite yet to form a solid low in the market.

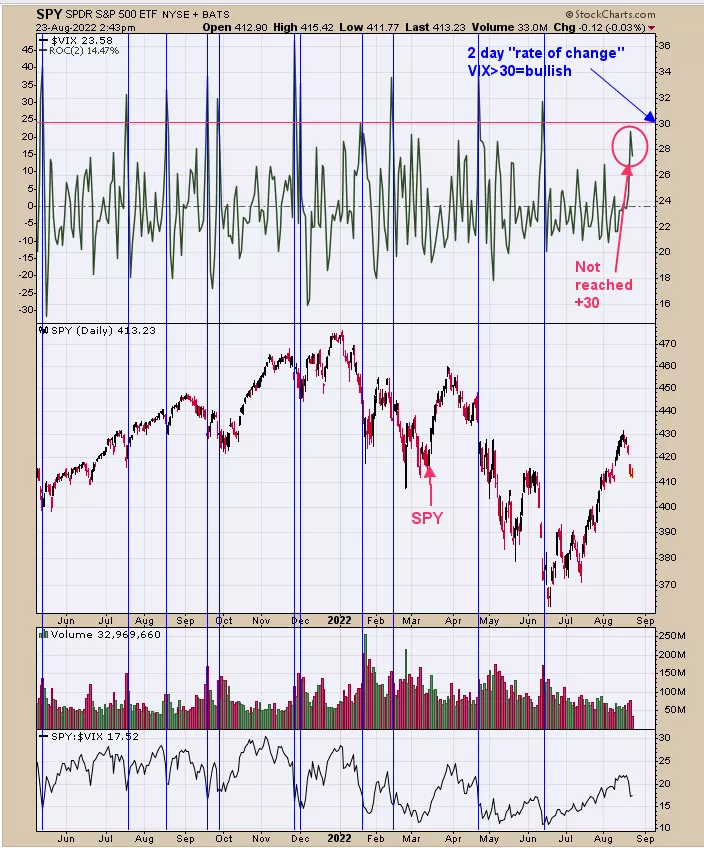

Ticks closed yesterday at -817 which shows exhaustion but TRIN closed at 1.14 which is near neutral and the combination is not giving a clear signal for a low here. The VIX can help to define a low (show panic) if it rises quickly. The two-day “Rate of change” for the VIX >30 shows panic in the market and yesterday’s reading came in at +24 and not quite the level that is needed to show a low in the market. Today’s volume was lighter than Monday’s volume and so the market may attempt to bounce short-term and test yesterday’s down gap. Don’t believe a worthwhile low has formed yet. We are in the Third quarter of the year which is the worst-performing quarter of the year. May see a back-and-fill market into late September.

Above is the weekly ETF for Silver “SLV”. This chart goes back to 2007 and shows the times when the weekly RSI for SLV traded below 30. During the Week of July 22, the weekly RSI for SLV closed at 28.43. We pointed out the other times on the chart above when the weekly RSI fell below 30 and all came near intermediate-term lows and some were long-term lows. Notice also SLV is at a support line dating back to 2014 which adds to the bullish setup.

More By This Author:

Seasonality Period

Neutral On S&P 500 And Long On Gold

Moon Cycle Effect On The Gold Market

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more