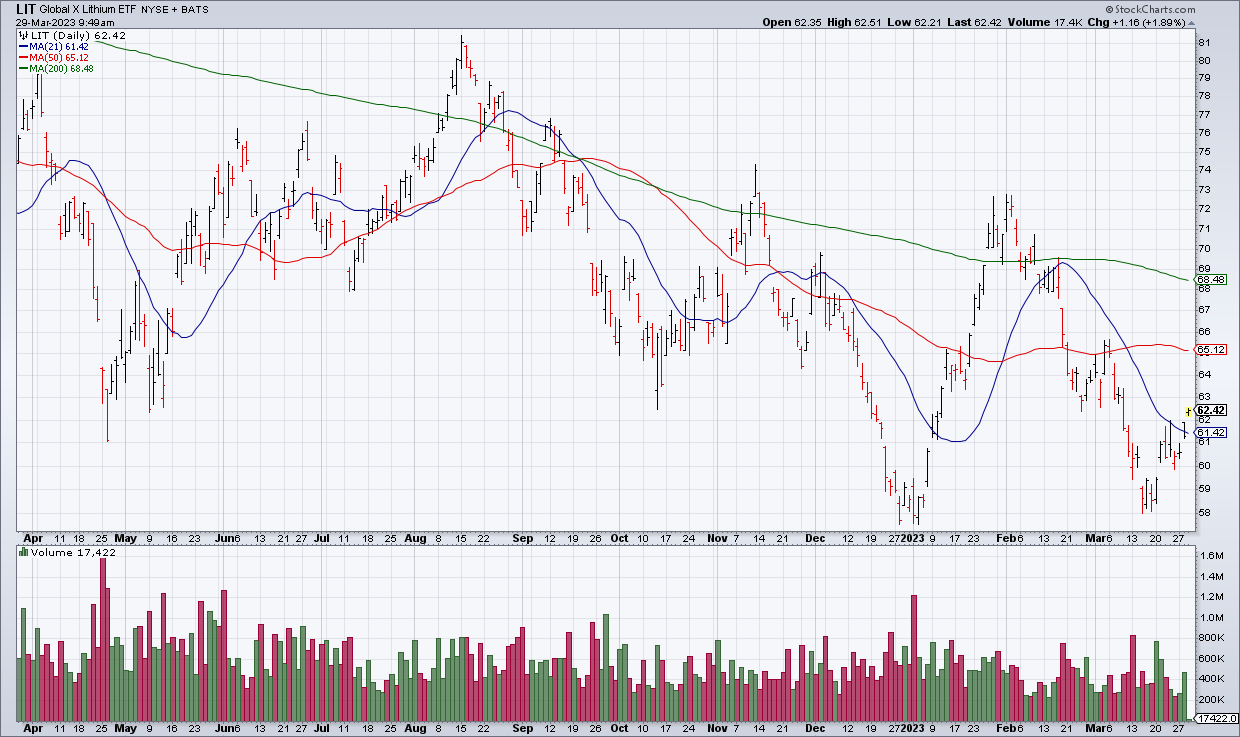

Play EVs With LIT

On Tuesday, US lithium miner Albemarle (ALB) made a bid for Australian miner Liontown. Liontown shares jumped nearly 70% on the Australian stock exchange, igniting interest in the lithium market. Like it or not, electric vehicles (EVs) are the future. Most investors are playing the space via the leading producer, Tesla (TSLA). But the Lithium ETF (LIT) provides a more diversified and comprehensive approach.

With 40 holdings that cover the entire industry from miners to EV producers, the $3.25 billion ETF provides excellent coverage. While I’m concerned about the effects of a recession on EV demand, longer-term the automobile market is going electric and LIT should live up to its name.

(Click on image to enlarge)

More By This Author:

Sell The Pop In GME As Its Business Remains In Terminal Decline

The Fed Should Pause

First Republic On The Brink