First Republic On The Brink

(Click on image to enlarge)

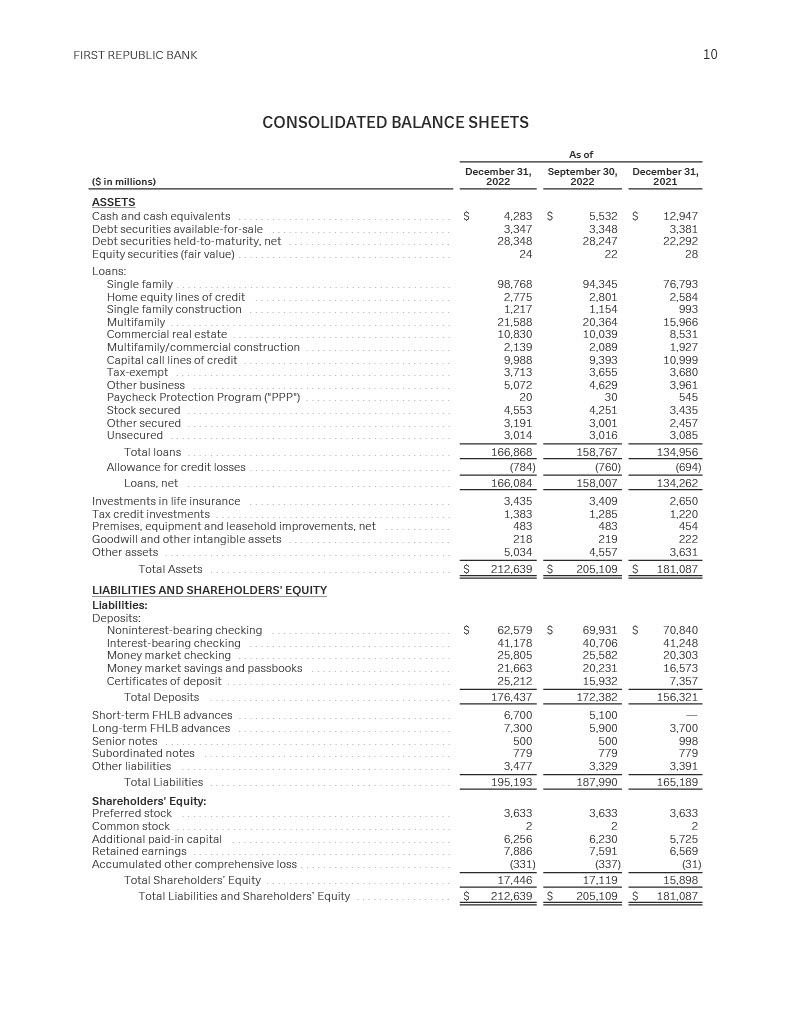

I have no doubt that First Republic (FRC) is a superior bank. At the same time, any bank under a fractional reserve model is subject to a loss of confidence by its depositors resulting in a bank run. And an article on the front page of today’s WSJ suggests that FRC is on the brink of being unable to meet redemptions – despite a $30 billion infusion by the country’s largest banks on Friday. According to the article (“First Republic Looms Large For Regulators” [SUBSCRIPTION REQUIRED], Monday, March 20, A1), customers have pulled about $70 billion in deposits since the crisis originating at Silicon Valley Bank. At the top of this blog is FRC’s Balance Sheet as of 4Q22. As you can see, at that time they had $176.4 billion in deposits. In other words, customers have pulled about 40% of FRC’s deposits during the crisis. Simply put: If that continues, FRC cannot survive.

More By This Author:

Inflation Is Dead; Deflation Is At HandFRC Is Not SIVB

The Fog Of War: Silicon Valley Bank, First Republic, Fractional Reserve Banking And Bank Runs

If you don't understand why $FRC is the outlier here you shouldn't be making commentary.

just because $FRC is making bad decisions doesn’t mean the other 2 are. $WAL and $PACW have already said that their financials are sound and they don’t have to dilute their stock like FRC is doing. Plus they are keeping their dividend as of right now. You are comparing apples to oranges.

Why do you think I don't understand? I nearly doubled an account on this stock alone. And no, I'm not comparing apples to oranges. I am highlighting the risk one bank can pose to the other (also regional) banks.