The Fed Should Pause

(Click on image to enlarge)

There is a tremendous amount of uncertainty and disagreement about what the Fed will and should do on Wednesday. Nick Timiraos provided an excellent overview in an article on the front page of Tuesday’s Wall Street Journal (“Fed’s Interest-Rate Decision Gets Extra Tricky”.

On the one hand are the economists who point to the persistence of high inflation in the recent economic reports and think the Fed should raise 25 basis points. On the other hand are those who point to the failure of Silicon Valley Bank and continuing fear about regional banks (i.e. First Republic) as a reason to pause.

Personally, I fail to understand why the Fed shouldn’t be prudent and not risk further igniting the banking crisis by hiking right into it. After all – if things blow over – they can go ahead and raise at their next meeting on May 3. Why must they raise right now with so much fear and uncertainty surrounding the banking situation? It makes no sense to me.

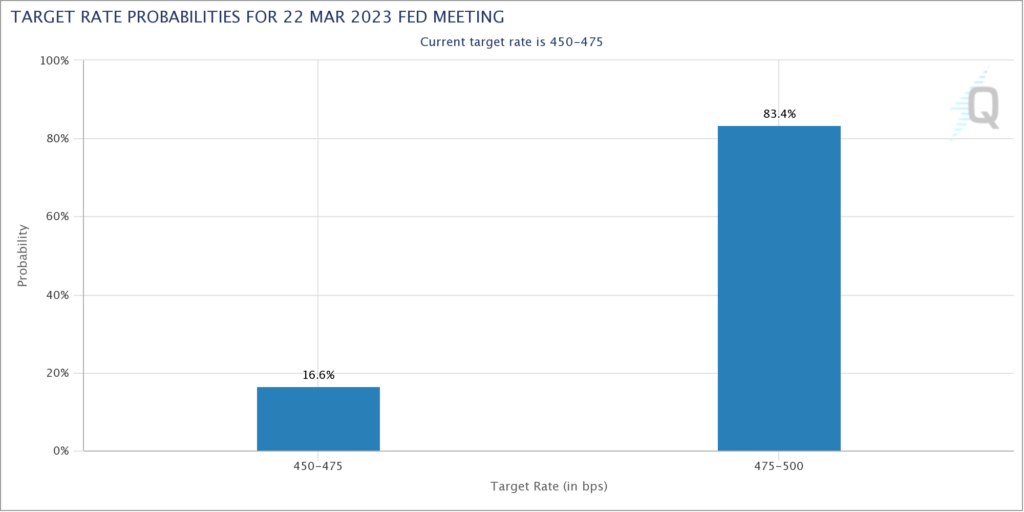

Nevertheless – as you can see in the Fed Futures chart at the top of this blog – markets are placing a 5/6 probability that the Fed will raise by 25 basis points.

"This is this classic idiom of what the #Fed will do versus what they should do. I think the Fed will raise #rates 25 bps tomorrow. I do not believe that they should raise rates 25 bps tomorrow," says @rbccm's Tom Porcelli pic.twitter.com/omgWmOEXp8

— Worldwide Exchange (@CNBCWEX) March 21, 2023

More By This Author:

First Republic On The Brink

Inflation Is Dead; Deflation Is At Hand

FRC Is Not SIVB