Not Even Nvidia Could Prevent The Plunge

Image Source: Pixabay

As highly anticipated as Nvidia’s earnings were and as huge the following reaction was, Thursday was an even more consequential day in the stock market. First, as I wrote about on Wednesday, I fully expected to see Nvidia to blow out earnings and the stock to soar above $1000 in the after hours trading. I don’t think there was any great stretch there or new revelation.

The biggest test would be after the open to see what the stock did. For a while it was looking promising as it gained momentum. And while it still closed higher than it opened, it was well off the intra-day high as the stock market sold off sharply.

I think the easy money has been made over and over, and the smart money has sold or is in the process of selling. I think it is absolutely the wrong move to buy the stock here because of the 10:1 stock split which means zero for the value of the company. This is where fools and their money are soon parted.

(Click on image to enlarge)

It was funny to listen to the media and pundits gush about Nvidia and the soaring stock market all morning. One high profile woman from SoFi who has been bearish on technology for 18 months finally gave it a “green light” to buy. Another guy made fun of people who were selling shares into the rally. Stuff you usually don’t see in younger bull markets.

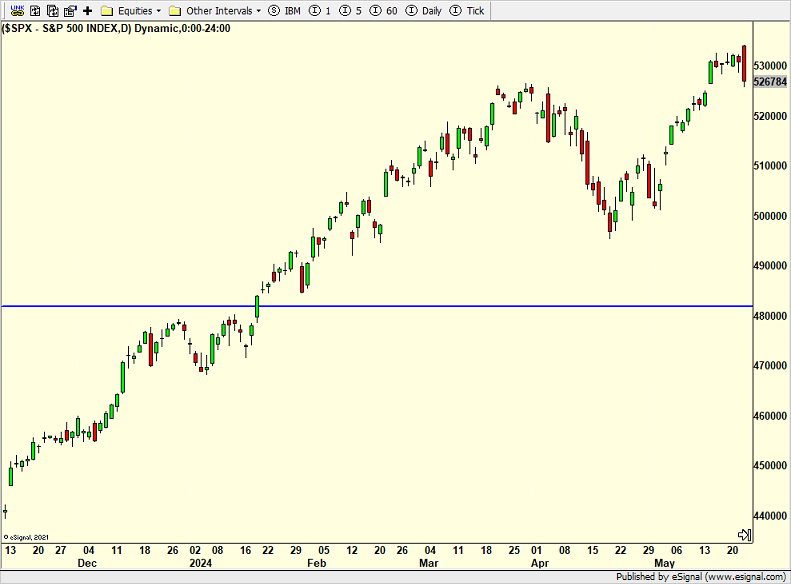

Only a few hours later, the media turned 180 degrees to bemoan that the Nvidia’s jump couldn’t keep the stock market from plummeting from its morning peak. In fact, the major stock market indices saw a number of all-time highs on Thursday morning before succumbing to real and present selling pressure for most of the day. We saw five-day highs turn into five-day lows in a matter of hours.

Look at the far right of the chart below. That nasty, red candle has many folks calling for a bear market or 10% correction. While it does look ugly on the chart, it has no predictive power for more than a few days to a few weeks. Stocks usually bounce a day later, and then see new five-day lows.

(Click on image to enlarge)

The takeaway to all this is to consider pruning some Nvidia shares and perhaps some weaker semiconductor stocks while buying weakness in the stock market in June. The rally isn’t over. The bull market isn’t over.

Meanwhile, the unofficial beginning of summer is here. Weather looks decent in CT. I sense some swimming and maybe some golf. Most importantly, thank you to those who serve and have served, especially to those who have made the ultimate sacrifice for our country and freedom.

On Wednesday, we bought levered S&P 500. We also sold PCY and some CYPIX. On Thursday, we sold BP, NET, EMB, CYPIX, and some RYOCX.

More By This Author:

Nvidia – Poised To Hit $1000+ After HoursLow Volatility Is Bullish – Ignore The Lazy

Dotcom Bubble Again?

Please see HC's full disclosure here.