(Much) More Downside To Come?

On April 18, 2022, I wrote an article, titled "The Path Of Least Resistance - Are The Markets Ready For A Bigger Correction?" In this article, I explained how both the fundamentals and technicals were working against stocks, and that the stocks were heading lower.

Now, not even a month later, the S&P500 had fallen another 400 points. Yesterday it closed at 4001.05. From the recent (and all-time) high of 4816.82, it is now down 20%. The Dow is down almost 13% from its high, and Nasdaq is performing the worse, down 27.5%.

There are many different definitions of a "bear" market. An accepted and often quoted measure is when the market is down 20% from its recent peak - this present market certainly fits that description. With inflation high (the latest report due this morning at 8:30 EST), the COVID pandemic still rampant, and war in Ukraine still raging, I don't believe the correction is over yet.

However, the SPX 4000 level may provide temporary relief. The SPX has dipped below 4000 the past two days. Some buyers seem to be rushing in out of habit. With "buying the dip" being the mantra for the past decade, it would only seem logical. But, perhaps, the mantra needs to be switched to "selling the pop" for now?

Markets have become much more volatile, but VIX is still hanging in the low 30s. Even Bitcoin has fallen from 65,000 to now just above 30,000 - a correction of greater than 50%. A very curious thing is that gold hasn't gone anywhere. In fact, gold has fallen "with" the stocks in the past week, now trading below 1850.

Some cheap ways to hedge against the markets is to play the VIX or the short ETFs:

(Click on image to enlarge)

VXX established a near-term bottom in January this year. A curious pop to $41.5 on March 15 this year, and it is now looking quite bullish.

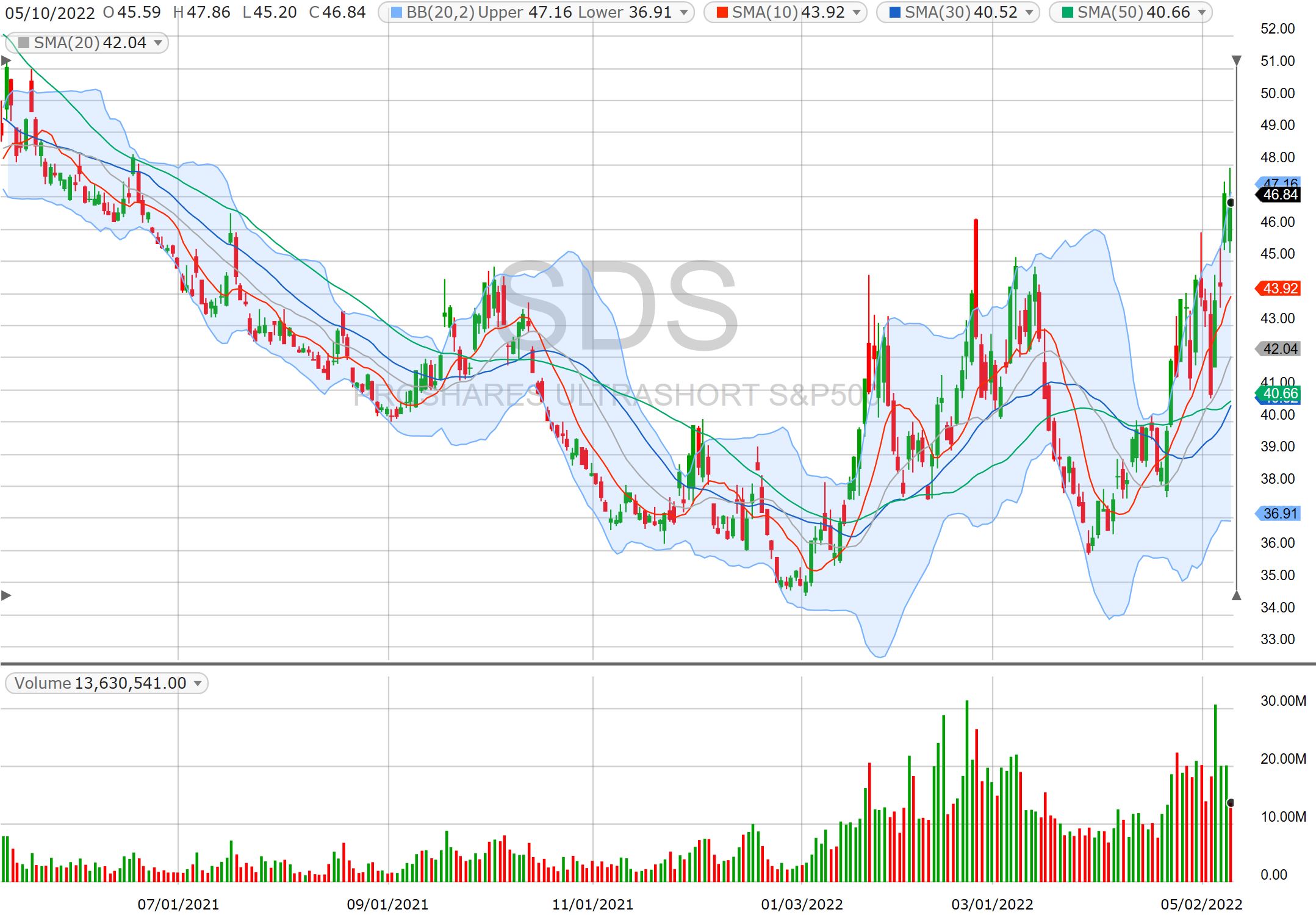

(Click on image to enlarge)

SDS, the ultrashort S&P500 ETF, is quite volatile. But, it is definitely heading up as S&P500 took a big hit this past week.

Also, the Dow is actually holding up quite well. So, if you're looking for individual stocks to short, you might want to take a look at some of the Dow components that are still holding up, for instance CAT, AXP, IBM. Oil stocks are still very healthy. Discount stores such as DG and DLTR are starting to see some weakness, while COST has pulled back quite a bit.

Good morning and HappyTrading! ™

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no ...

more