Moody’s Downgrades 10 Small- To Mid-Size Banks, 6 More Under Review

(Click on image to enlarge)

IAT chart courtesy of StockCharts.Com

CBS News reports Banks Get a Downgrade from Moody’s.

In its report, Moody’s highlighted that some of the issues that caused the banking crisis earlier this year haven’t disappeared; banks are still at risk for depositors to withdraw their funds, while the current higher-interest rate environment is knocking down the value of investments lenders made when rates were super low.

The rating agency added that asset risks are also rising for small- and mid-sized banks, especially those with large corporate real estate (CRE) holdings.

“Elevated CRE exposures are a key risk given sustained high interest rates, structural declines in office demand due to remote work, and a reduction in the availability of CRE credit,” it noted.

Smaller banks are especially at risk, given that they have “sizable unrealized economic losses” that could cause investors to lose confidence, it stated in the Monday report.

Ten Downgrades

- Commerce Bancshares

- BOK Financial Corporation

- M&T Bank Corporation

- Old National Bancorp

- Prosperity Bancshares

- Amarillo National Bancorp

- Webster Financial Corporation

- Fulton Financial Corporation

- Pinnacle Financial Partners

- Associated Banc-Corp

Six Under Review

- Bank of New York Mellon Corporation

- Northern Trust Corporation

- State Street Corporation

- Cullen/Frost Bankers

- Truist Financial Corporation

- U.S. Bancorp

Eleven Negative Outlooks

- PNC Financial Services Group

- Capital One Financial Corporation

- Citizens Financial Group

- Fifth Third Bancorp

- Huntington Bancshares

- Regions Financial Corporation

- Cadence Bank

- F.N.B. Corporation

- Simmons First National Corporation

- Ally Financial

- Bank OZK

IAT Regional Bank ETF Monthly Chart

(Click on image to enlarge)

IAT chart courtesy of StockCharts.Com, annotations by Mish

Technically speaking, the chart looks like a disaster in waiting from an Elliott Wave perspective. A 5th wave seems due and possibly just started.

Support is at 22 level, That’s about a 42 percent drop from here.

Fundamentally Speaking

Every bank listed above will be fearful of new loans. They are all hoping to ride out the storm, praying for rate cuts that may be a long time away.

Meanwhile, the collective lot is tightening credit standards.

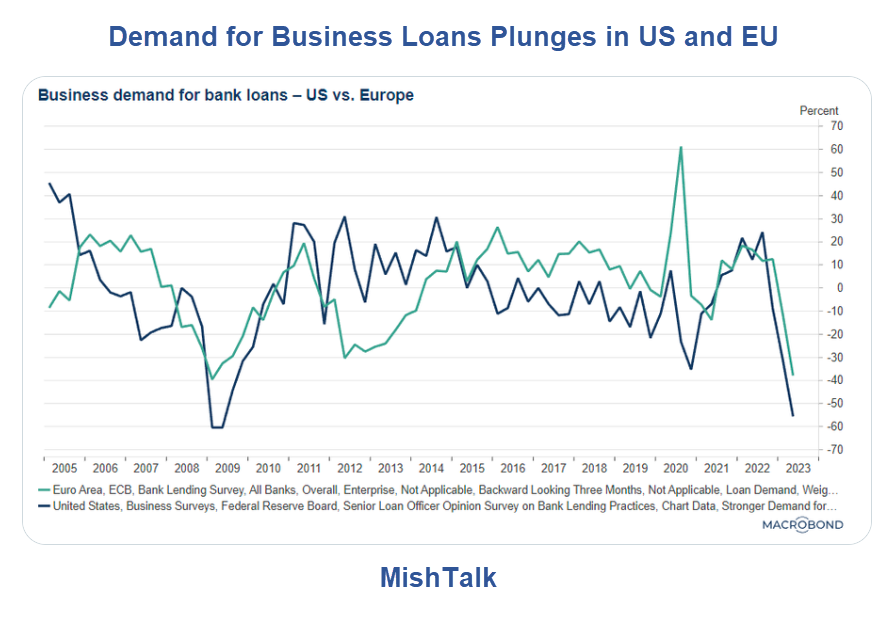

US and EU Corporations Slam the Brakes on Demand for Business Loans

Yesterday, I noted US and EU Corporations Slam the Brakes on Demand for Business Loans

Attitude Change

Q: Why are Companies Slamming the Brakes?

A: Recession risk and profit riskIt’s not just companies who are slamming the brakes. Tighter lending standards across the board shows banks are doing the same.

Large and small banks alike are getting clobbered on rising yields. This led to the collapse of Silicon Valley Bank (SVB).

Banks raise lending standards, the economy slows a bit, corporations get fearful of falling profits so they do not want to expand.

The cycle feeds on itself until something breaks. And it’s breaking now.

The Cycle Feeds On Itself

These downgrades will cause further tightening of lending standards, and not just by the banks cited by Moody’s.

Every bank will now be fearful of a rating downgrade.

Soft Landing?

A crashing demand for loans does not add up to the now widely believed soft landing thesis.

For further discussion, please see China Exports and Imports Collapse, Harbinger of the Global Economy?

More By This Author:

Hoot Of The Day: US Policy Dramatically Increases The Need For Political Risk InsuranceUS And EU Corporations Slam The Brakes On Demand For Business Loans

Purchasing Power Parity Silliness And The Myth China Passed The US In GDP

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more