MOAT: Simply The Best US Large Cap Blend ETF

VanEck Vectors Morningstar Wide Moat ETF (BATS:MOAT) bases its holdings on the Morningstar Wide Moat Focus Index. That means that in most markets the fund will invest 80% or more of its total assets in securities that Morningstar, Inc. analysis has determined to have sustainable competitive advantages based on a proprietary methodology that considers both quantitative and qualitative factors.

What Morningstar's analysts are looking for are those larger firms that they believe are selling at a market, and marked, discount to what they believe should be a higher price, based upon technical factors they use, fundamental analysis of income and balance sheet, and what competitors in the industry and sector are selling for. They do what makes sense: they try to buy low and sell higher, when that discount to fair value has evaporated. The minimum they seek are companies whose shares are more than 10% undervalued. In actual practice, the discounts to presumed fair value are typically more in the 15%-25% range.

The fund reconstitutes its holdings quarterly, not so often that they are always chasing their tail (or a recent one-week market correction or advance,) but often enough to stay on top of the companies that represent compelling value. They do this at the end of March, June September and December.

In their most recent review, for instance, MOAT replaced a couple of financial shares that had run (what they believe was) too far, too fast past "fair value" -- Charles Schwab (SCHW) and Bank of America (BAC). With the news filled with stories of possible regulatory scrutiny or even breakup of the most successful high-tech firms, both Facebook (FB) and Microsoft (MSFT) had stalled and therefore looked undervalued to Morningstar.

What I like best about the Van Eck Vectors Morningstar Wide Moat Focus ETF is that it always looks forward, not backward. By that I mean it uses the research of more than 100 analysts at Morningstar who are focused on which companies they expect to do best in the coming quarters. But rather than just buy those best (or "best guess by the collective wisdom of the analysts"!) companies, MOAT then goes beyond best ideas and takes the important second step: a particular stock may be a great idea, but is it also selling at an attractive discount to fair value? If it is not, then no matter how flowery the prose recommending it, that company does not make the cut.

There is actually a third step in that the ETF tries to stay within a universe of just the 40-50 most highly regarded and most attractively priced. (Currently there are 49 holdings.) This final discipline means, just because there are 100 stocks that might qualify (like after a bear correction) only the 40-50 of those "really really" highly regarded and "really really" most attractively priced make it into the portfolio.

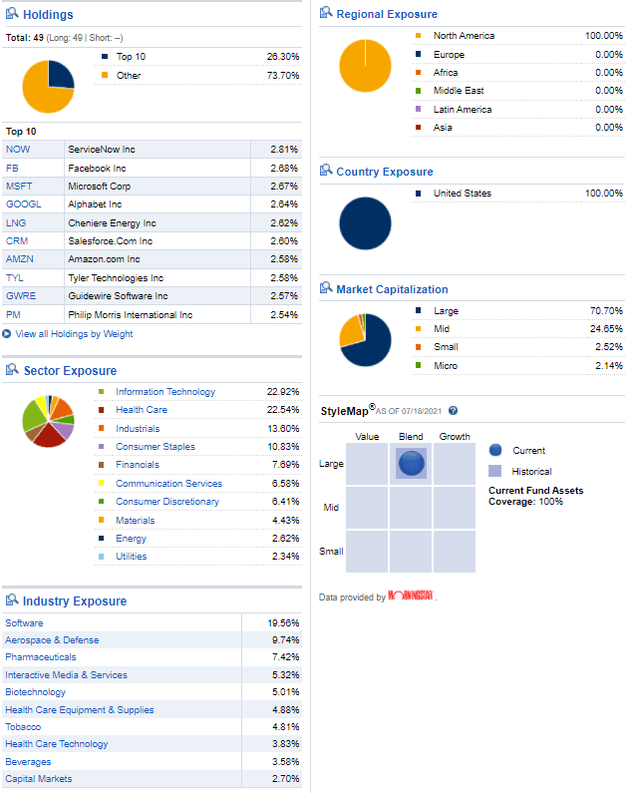

Here is a breakdown of MOAT's current holdings, their regional and country exposure, their primary market capitalization, and their sector and primary industry exposure. This last does not add up to 100%; I truncated the smaller industries that may only be represented by one or two companies.

Source: fidelity.com

The Big Takeaways are (1) this is currently a 100% US portfolio. I could find nothing in their charter that precludes MOAT from owning non-US firms, but there is a sister firm that currently does that, which I will discuss in a forthcoming article. (2) Info Tech, normally considered solely growth, and Health Care, usually seen as defensive value, are neck-and-neck and pretty much equally represented. (3) ~71% of the portfolio is large cap. But future successes and deep values are where you find them, so there is a healthy chunk of ~25% of mid cap firms that are just below or hovering right around that $1 billion number we normally think of as the beginning of large cap.

For those who would like more granularity, I have included below all 49 current holdings. There are a number of old friends in this list that I coincidentally hold in my personal portfolios, for clients, and own or have owned in our Investors Edge portfolio.

Source: fidelity.com

There are a few in the above list that I would not consider owning outright. But I am a realist: I am not arrogant to presume that I have a lock on all the good ideas. I have made far more money for myself and my clients over the years by diversifying beyond my own circle of competence and seeking others who bring something special to the party.

I think MOAT is a best-in-class example of this discipline.

Disclaimer: Unless you are a client of my advisory firm, Stanford Wealth Management, I do not know your personal financial situation. Therefore, I offer my opinions above for your due diligence ...

more