Mixed Housing Reports

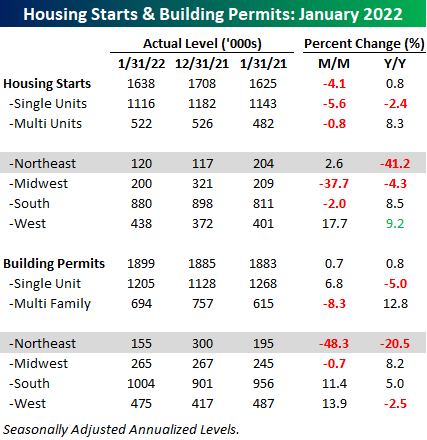

Today’s report on Building Permits and Housing Starts from the US Census came in mixed relative to expectations and last month’s readings. Versus expectations, Housing Starts were weaker while Building Permits unexpectedly rose. As shown in the table below, the weakness in Housing Starts this month continued to come from single-family units which have faced delays due to shortages of materials and labor. On a regional basis, the Northeast was notably weak with the year/year reading falling more than 41%. Unlike Housing Starts, Building Permits showed strength among single-family units, rising 6.8% despite still being down 5% y/y.Multi-family units, on the other hand, saw the complete opposite pattern play out as the m/m reading dropped 8.3% while the y/y reading was still up over 12%.On a regional basis, the Northeast was once again the weakest area of the country as the m/m reading dropped nearly 50% while the y/y reading dropped just over 20%.

Trends in housing starts have been a great leading indicator of the economic cycle over the years as the 12-month average of total HOusing Starts tends to peak and rollover well in advance of a recession. Updating the chart with January’s levels, the 12-month average made another cycle high in January, but the rate of increase is starting to flatten out. For example, this month’s increase in the 12-month average was the smallest m/m increase since February 2021. It’s still far from rolling over, but momentum in housing has clearly slowed.

While actual starts may not be rolling over, homebuilder stocks have already done so. After stalling out in the mid to high eighties three times in late 2021, the sector has seen a sharp pullback in 2022. With interest rates rising and lack of adequate materials and labor to meet demand, it’s no mystery what is driving the weakness in the sector. Current levels look like an interesting juncture for the group, though, as XHB has been hanging around right around $70 for the last few weeks. That is also a level that acted as support multiple times in the second half of last year. As long as these levels hold, the technical picture for the group does not raise any red flags, but should this support level break down, it could start the beginning of a new leg lower for the group.

(Click on image to enlarge)

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more