Looming Ceilings

Ever since last week, the market has been slicing the heads off bears left and right, with the Dow up thousands of points and the ES up about three hundred. It’s been unrelenting.

(Click on image to enlarge)

My view is that all this is going to accomplish is that the surviving twelve bears on the entire planet will just have another opportunity to short at good prices. There may be more upside in some sectors, but there are definitely some ETFs where I can point to logical, and major, resistance levels, such as the DIA “diamonds”…

(Click on image to enlarge)

…….the worldwide equities EFA……….

(Click on image to enlarge)

(Which, on a much longer timescale, illustrates how beautifully we are mashed up against that incredibly important broken trendline):

(Click on image to enlarge)

……the IWM small caps…….

(Click on image to enlarge)

………and the consumer discretionary XLY:

(Click on image to enlarge)

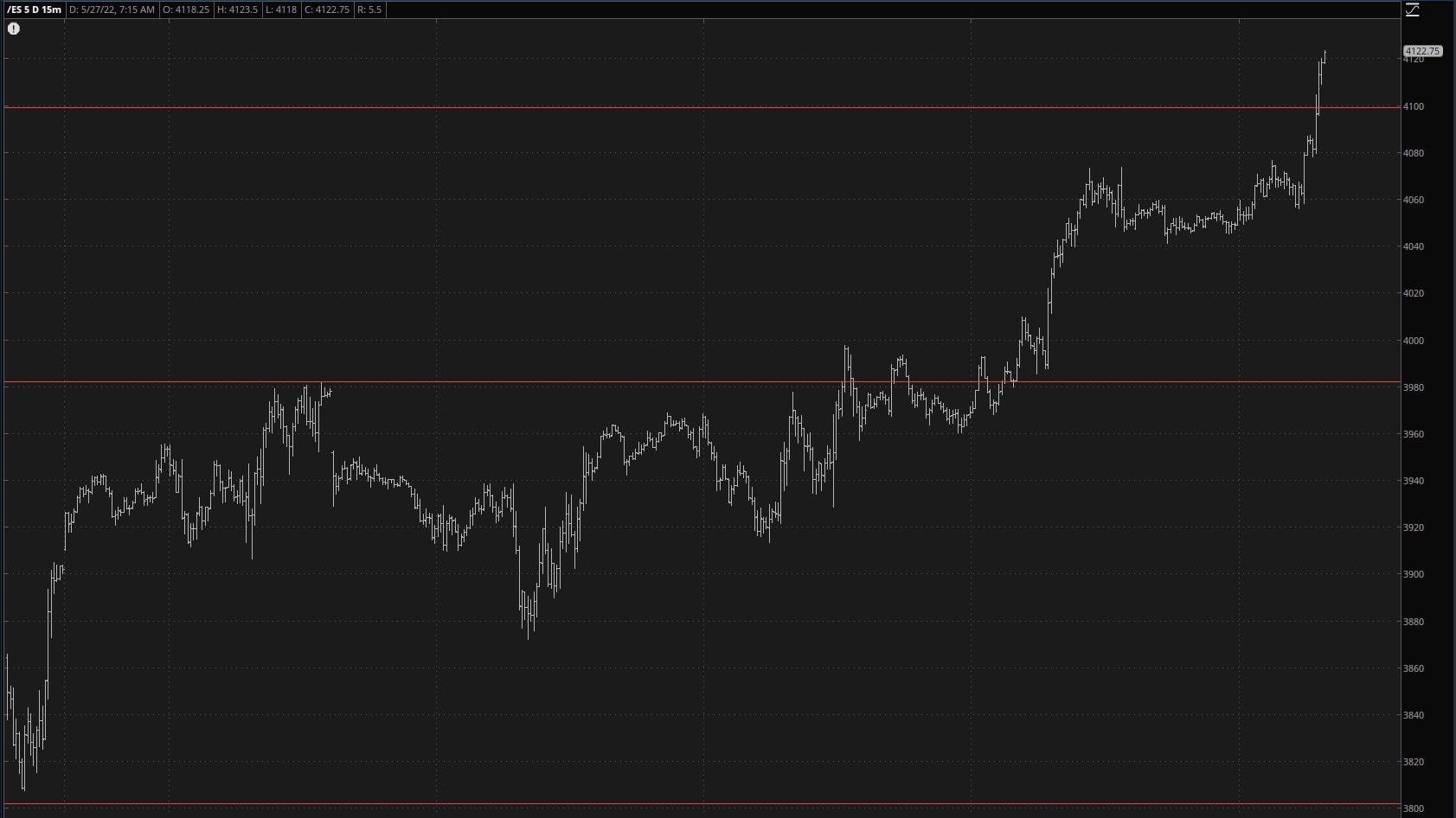

I’ve mentioned 4100 (approximately) as a key level on the /ES futures, and we’ve pushed past that (strictly speaking, the retracement is at 4165.02, so we have NOT exceeded the line, as today’s peak has been 4126 as of the composition of this post):

(Click on image to enlarge)

The /NQ futures also look enticing.

(Click on image to enlarge)

In spite of the fact this is probably a sensational time to go “all-in” with shorts, I am simply too bloodied and dazed and cautious to do so; thus I remain merely two-thirds committed to positions. Emotions are terrible for good trading, and I regret that mine are still in fully-functioning operation.