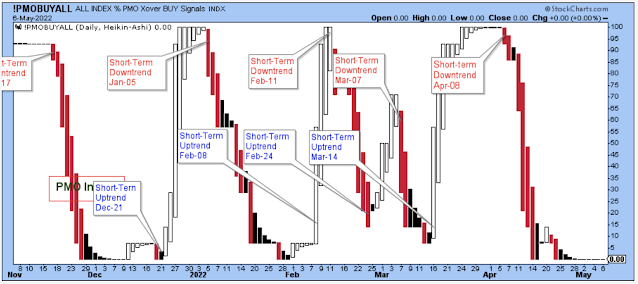

Looking For The Next Short-Term Uptrend

The short-term downtrend continues. The PMO index is at the bottom of the range, which means that you should be looking for signs of the next short-term uptrend. However, the market is so weak that the game plan is different, and this obviously isn't the time to just buy the dip. So, for the second weekend in a row, even with the PMO at the bottom of the range, I am continuing to hold onto short positions.

When the PMO index is at its lows, the market sets up for a short-term rally. As we saw on Wednesday, the market is volatile and the next rally could be huge and painful for the shorts.

The bullish percents are at low levels and they show the same thing that has been shown by the PMO index. The weak bullish percents could set up the market up for a rally.

This chart shows that short-term momentum is also at the lows, which is another setup for a rally, but it also shows the market has been breaking down. This is why I continue to hold shorts. I have a few long positions that I really want to continue to hold, so I need the shorts to blunt the pain if my longs start to fall hard.

But also, I want to make money from these shorts. Shorting is difficult and risky, but if there was ever a time to do it, this is it, and I want to take advantage of the opportunity.

The small-caps have rolled over, and there is lots of room to move lower before finding support. Still, there is the potential for significant pain if these small-caps rally back up to resistance.

Europe has rolled over, too, and the story is more negative for these stocks.

Junk bonds are pointed decisively lower after breaking support. Because junk bonds are highly correlated to stocks, it is obvious that this chart says now isn't the time to own stocks.

I don't have much more to offer this week because we all know the bearish story, and you don't need me to tell you that now isn't the time to be buying stocks, except for maybe some in really focused areas.

Trading short positions while the market is oversold short-term is outside of my usual routine, and I struggled a bit this past week. But I plan to do better in the week ahead by having plenty of cash and focusing on fewer positions.

Bottom Line: I have some longs that I want to hold onto, so I feel the need to protect the longs with offsetting shorts. Plus, the market is so weak that I feel like I can profitably trade using short positions.

As I recall from past bear markets, utilities are the very last group to hold onto their uptrend, and when this group finally rolls over, that is when you can confidently say that the bear is in complete control.

Maybe in this cycle the last group standing will be energy and not utilities? That is quite a breakout for energy, as shown in this 20-year monthly chart.

Steelmakers have had a very nice run and the uptrend is still intact, although it is under pressure. I'm watching this area.

REITs are showing signs that they may top out soon.

One of the last areas of strength among growth stocks looks like it is breaking down.

Even battery makers and suppliers are breaking down.

Outlook Summary

- The short-term trend is down for stock prices as of April 8.

- The economy is at risk of recession as of March 2022.

- The medium-term trend is down for treasury bond prices as of Jan. 3 (prices down, yields up).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more