Looking Ahead To 2025; 12 Charts To Track

Image Source: Pixabay

In April of last year, I took a look at the market potential for a downturn that ultimately never materialized. That scenario was negated by the break of the March high during the summer, followed by a sequence of higher highs and higher lows as part of a bull market cycle. So, what will this year bring?

First off, I took a look at search-sentiment. How many people have searched for the term "market crash" in the United States? More often than not, these spikes --when they occur-- are more associated with major market bottoms than with market tops.

When we match the search spikes to a chart of the S&P 500, we can see how nearby market lows turned into major market lows.

The odd one out could be the June 2024 search spike, as there was barely a pause in the advance -- which is not something we have seen during other search-spikes, with the possible exception of the February 2018 spike. However, what I do like about the 2024 spike is how it occurred around a solid psychological support of 5,000 in the S&P 500.

(Click on image to enlarge)

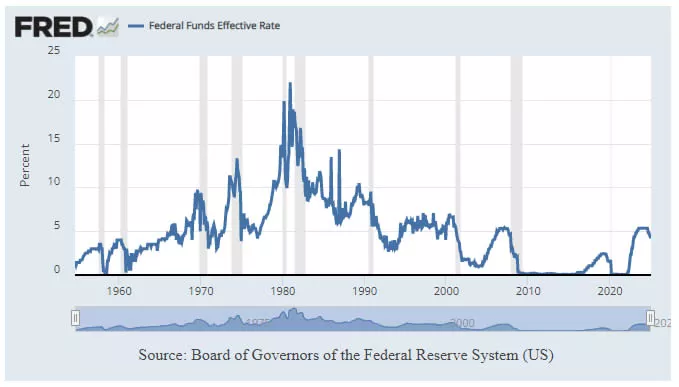

After an extended period of near-zero interest rates caused by the credit crisis, we have now returned to a more typical rate rising cycle that brings with it the associated risk of recession. Historically, Fed rates are relatively low, although consumers voted for change during the election. Economic conditions are skewing more bearish, but there is room for the Fed to maneuver if needed.

When we look more at breadth metrics, we have a more mixed picture. The one chart that is screaming a major market low is the relationship between consumer discretionary and staples ETFs (originally featured by J.C. Parets). Supporting technicals in 2023 mirrored that of the low in 2009. Whether we have a secular low in place will become apparent in the months ahead, but it's a positive start.

(Click on image to enlarge)

But when we look at the relationship between the Dow Transports and the Dow Industrial Average, we can see a downward trend as the Dow Transports drop back into their prior base while the Industrial Average kicks on. This trend shift may suggest a cooling period is on the horizon. When this relationship comes with a spike low, then a major market low will be in place.

(Click on image to enlarge)

For the Dow Transports, hitting the 11,000 level in 2026 would be the measured move target.

(Click on image to enlarge)

Investor sentiment has been shifting more bearishly, particularly after the election. When we get the bearish inversion, as happened in 2023 and 2022, we will be more comfortable calling a major swing low. Realistically, it will take a test of the 200-day MA to get there.

(Click on image to enlarge)

The equal weighted S&P 500 index is actually closer to a test of its 200-day MA.

(Click on image to enlarge)

When we look at S&P Bullish Percents and Percentage of Stocks Above 50-day and 200-day MAs, things look much better for bulls. These metrics suggest a major low is in place, and if not, then a significant positive divergence will take shape in 2025.

(Click on image to enlarge)

2024 was a year of rising new 52-week highs for the S&P 500 and Nasdaq. However, as the year closed out, we have started to see that shift and swing back in favor of new 52-week lows; 2025 could be a little rocky in this regard.

(Click on image to enlarge)

I don't know what to make of the next chart, as we are far away from the conditions of the 2009 lows or even the 2020 low, and I don't see the S&P 500 offering the strong 'buy' this chart suggests, given that we haven't yet tested the 200-day MA in the equal-weight or 'regular' S&P. This is certainly one to re-evaluate in the year ahead.

Additionally, the inverted yield curve suggests we are more likely to see further selling in 2025.

(Click on image to enlarge)

When I look at a cross section of sectors, I see a Dow Jones World Index, Dow Industrial, and Technology sector that has peaked, with Basic Materials already in decline. I also see a dollar still in ascendancy but a few years from a top, and a commodities market on the rise after a spike low in 2020.

This is a monthly chart, so while my previous comments suggest there is room for further upside, we need to consider a period of slowdown --if not decline-- may only be a few years away for equity markets. The next era of commodity (and/or crypto) bugs is already upon us.

(Click on image to enlarge)

Certainly, the arrival of "President Musk," and the breakout in Bitcoin (and strength in crypto in general) forming a lovely cup-and-handle pattern, will define the rest of this decade.

The relationship between the Pring Inflation and Deflation Index suggests we haven't yet hit an opportunity low for commodity buying, despite the rise in the commodity index. This is another one for commodity bugs to watch; prepare for a breakout in the bullish wedge.

(Click on image to enlarge)

As we head into 2025, it does look like we can expect to see some weakness in markets, although I would not expect a violation of 5,000 support in the S&P 500. This may give us one more surge in markets before a significant top comes into play.

Ideally, to have the S&P 500 play out a sideways move like it did in 2015/2016, with the 5,000 mark as the range support low, would leave things nicely set. If the 5,000 level doesn't hold as support, then a 50% Fib retracement to 3,200 range (the 2020 high) would reflect a larger correction than the cross section chart suggests is coming, but I don't see this happening in 2025 (or 2026).

More By This Author:

Russell 2000 Recorded Accumulation Day As Technicals Turned Net BearishSemiconductor Index Mini-Breakout

Nasdaq Surge As Russell 2000 Stumbles