Large Cap Tech Eyeing Massive Implication Level Says Joe Friday

There is just no sugarcoating it: Technology stocks are the hottest sector on the planet.

And if the broader stock market wants to keep its upside momentum, it will need tech stocks to remain a market leader.

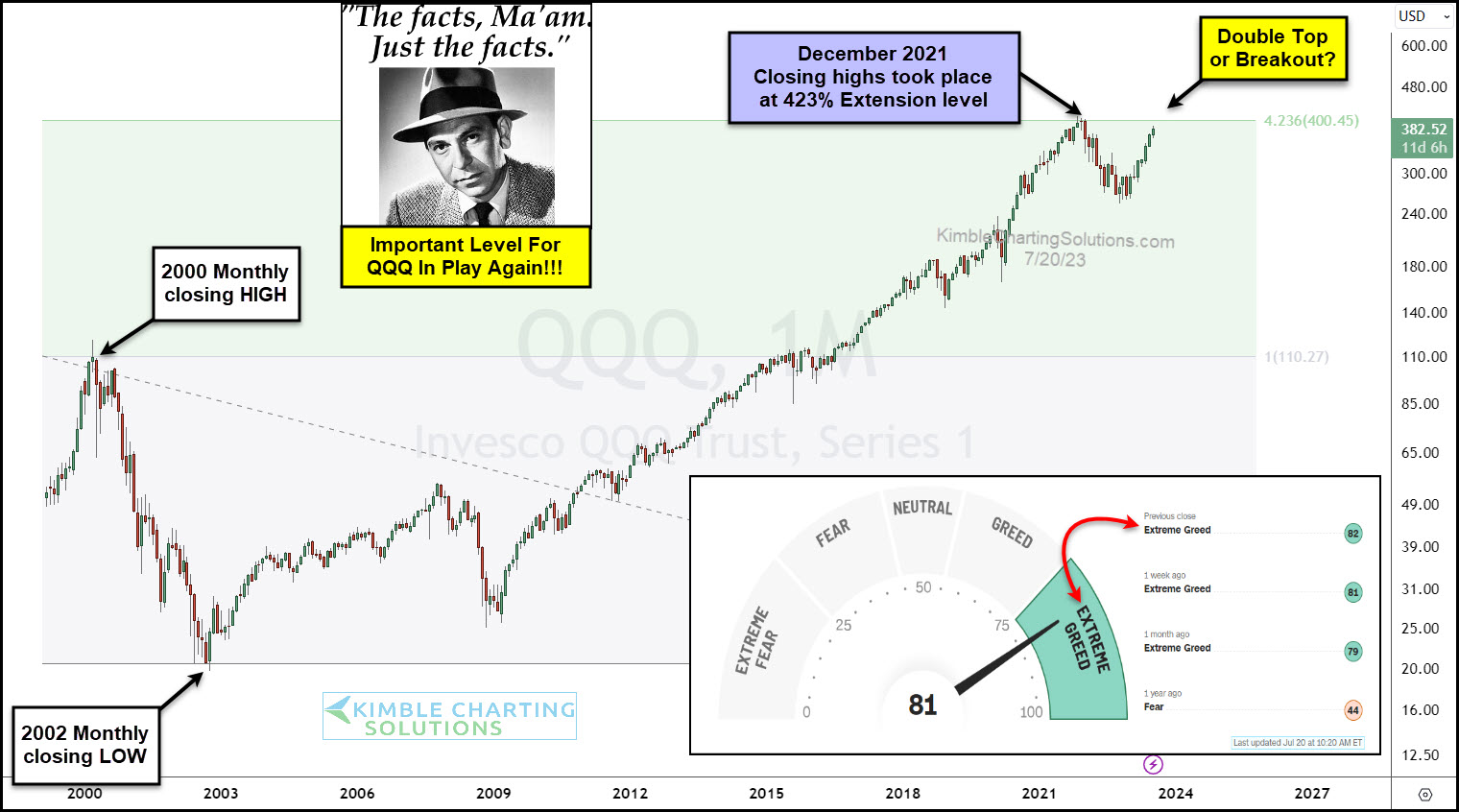

Today we look at a long-term “monthly” chart of the Nasdaq 100 ETF (QQQ).

And as you can see, the QQQ’s have made quite a turnaround in the past year… reversing from investor “fear” (near market lows) to investor “extreme greed” as we approach the December 2021 highs.

It is noteworthy that the prior highs formed right at the 423% Fibonacci extension level, based upon the 2000 highs/2002 lows.

So with “extreme greed” in the marketplace, it will be interesting to see if large cap tech stocks stall out at double top resistance… or if they breakout (perhaps after a little pause) to new all-time highs and keep the party going.

Just The Facts Ma’am; Clearly, this is an important price point for the QQQ’s, market leadership, and the broader market.

(Click on image to enlarge)

More By This Author:

Are Semiconductors (SMH) Setting Up For A Historic Breakout or Double Top?

US Dollar Repeating 2000 Topping Pattern Currently?

US Dollar To See Further Weakness? Gold Bulls Hope So

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.