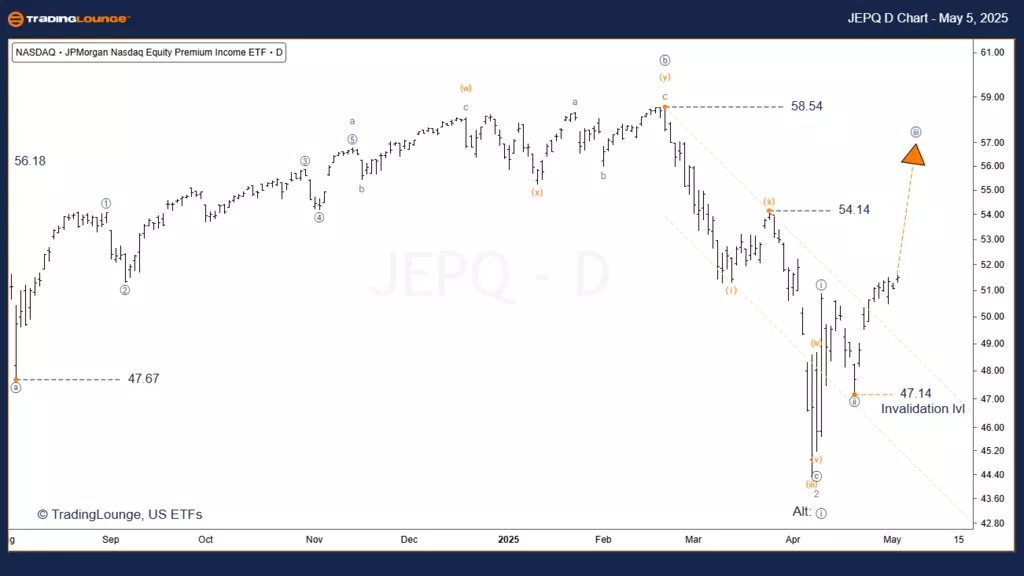

JPMorgan Nasdaq Equity Premium Income ETF – JEPQ Elliott Wave Technical Analysis

JPMorgan Nasdaq Equity Premium Income ETF – JEPQ (1D) Elliott Wave Technical Analysis

Daily Chart

Function: Major trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction: Rally

Details:

The bullish trend remains intact and is still in its early development.

The rally should surpass the $58.54 level, fully confirming the third wave's presence.

Signs of an extension in wave [iii] suggest the potential for a prolonged rally before facing a [iv] correction.

The $47.14 support level is critical for any potential pullback.

Invalidation Level: $44.40

JPMorgan Nasdaq Equity Premium Income ETF – JEPQ (4H) Elliott Wave Technical Analysis

Hourly Chart

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave [iii]

Direction: Rally

Details:

The rally is expected to continue, with a gap-up highly probable.

Confirmation of wave [iii] came with the $50.85 breakout.

We anticipate a strong momentum influx, as the third of the third wave is unfolding. The rally might encounter resistance around the $57.11 level.

Any drop below $49.00 would be a significant concern.

Invalidation Level: $47.15

Conclusion:

The summarized Elliott Wave analysis indicates:

JEPQ is currently unfolding in wave 3, suggesting stronger momentum ahead.

A gap-up is likely, and the rally could exceed the $57.11 marker.

Traders must adhere to Elliott Wave principles and monitor invalidation levels closely to minimize risk.

Technical Analyst: Simon Brooks

More By This Author:

Unlocking ASX Trading Success: Insurance Australia Group Limited - Monday, May 5

Natural Gas - Elliott Wave Technical Analysis

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Monday, May 5

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more