Investing In An Important Process

![]()

Finding strategies to decarbonize three key industries—steel, cement, and chemicals—that contribute around 16% of the world's carbon emissions is crucial if we want to prevent a climate emergency. And there are several decarbonization pathways for each one.

Decarbonization is becoming an increasingly difficult problem for steel industry operators worldwide. The industry is currently under pressure to lessen its carbon footprint from both a commercial and environmental standpoint.

Hydrogen can, however, be used as a fuel to generate heat and as a chemical-reducing agent to eliminate pollutants. In reality, all of the main European steel producers are developing or testing steel production methods based on hydrogen.

Although being one of the elements with the greatest abundance on earth, hydrogen is rare in its purest form. Energy is needed in large quantities to separate hydrogen from its molecules. Despite the variety of these energy sources, the most widely used method for producing hydrogen is one that uses a lot of carbon dioxide. The majority of the hydrogen generated worldwide is "grey hydrogen," created by the steam methane reforming (SMR) process, which also produces carbon dioxide. On the other hand, hydrogen production that involves carbon collection, utilization, or storage of released carbon dioxide is referred to as "blue hydrogen."

The sole carbon-neutral method for creating hydrogen (assuming that renewable energy sources can be employed) is the electricity-intensive process known as "green hydrogen.”

Similar to the EAF process, the primary cost drivers for the pure hydrogen-based manufacturing process, or the maximal use of green hydrogen-based DRI, include raw material and electricity costs as well as processing and labor expenses. The production of hydrogen (which is primarily governed by the cost of electricity for water electrolysis) and running the EAF and caster on renewable energy are the two areas with the greatest cost variances and uncertainties.

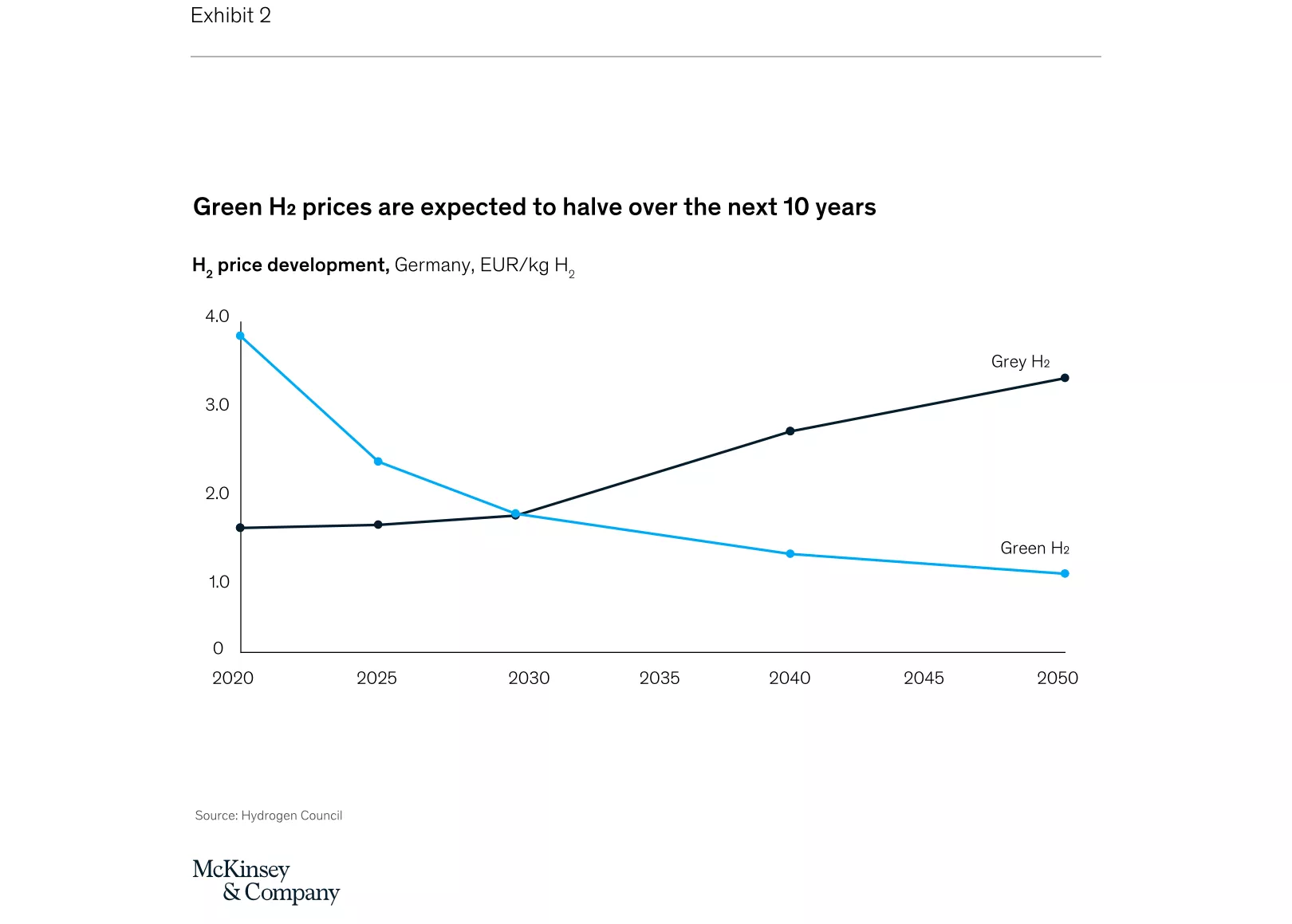

Green hydrogen prices today are high, but these are expected to decrease rapidly over time (Exhibit 2).

In the case where Net Zero Emissions are reached by 2050, hydrogen demand from industry is expected to expand by 44% by 2030.

With that in mind, here are seven green hydrogen stocks and exchange-traded funds, to consider:

Bloom Energy Corp. (ticker: BE)

Plug Power Inc. (PLUG)

Fusion Fuel Green PLC (HTOO)

Ballard Power Systems Inc. (BLDP)

Global X Hydrogen ETF (HYDR)

Direxion Hydrogen ETF (HJEN)

Defiance Next Gen H2 ETF (HDRO)

More By This Author:

Capitalization, Style - Wave-Trend Summary, Week Ending April 14

Equities, Fixed, Commodities - Wave-Trend Summary, Week Ending April 14

Disinflation / Deflation Sentiments Are Hard To Disregard

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF.