How To Build A "Lifetime" Portfolio -- Step 1

Why obsess about what will happen this coming week? That's the job of people who get paid by the word. Why not take the road less traveled and ignore 90% of the hullabaloo?!!

This is the time of year when most investment writers predict what will happen in 2015. What I'd rather offer, however, is what is "most" likely to happen this year, next year, or the next 10, 20 or 50 years.

The short and glib answer is the one proffered by J.P. Morgan when asked what the market would do next. "It will fluctuate," he replied. That may sound offhandedly dismissive of the question, but in fact there is much truth, and the beginnings of what we now call Modern Portfolio Theory (MPT) in his pithy response!

Modern Portfolio has much to recommend it and much to eschew. The basic idea is solid: MPT is a way to optimize your returns based on your acceptable level of market risk. You accomplish this by diversification among various asset classes. If you can remember as far back as January 2014, almost every pundit was predicting a disastrous year for bonds, a so-so year for US stocks to digest the gains of 2013, and sector bets all over the place. I don't know of a single analyst who predicted that the best-performing sector in the USA would be utilities, yet there they are, proudly atop all markets.

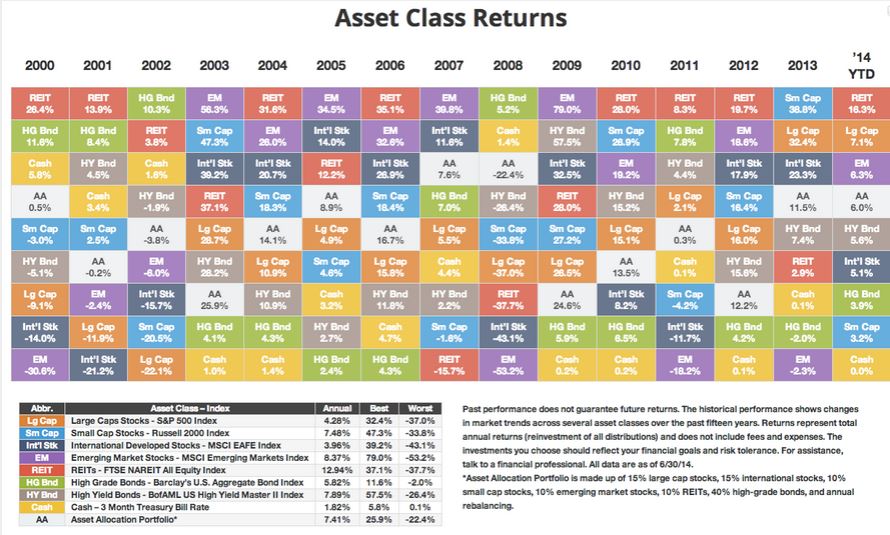

The matrix below shows what asset class performed best over the past few years. (These are asset classes, not business sectors, so you won't see utilities there, but you will see "REITs" and both "High Grade" and "High Yield" bonds, both of which are equally-interest-rate-sensitive.) If you look carefully at every year, you will note the results vary considerably. The same holds true over all other, even more extended, periods. Diversification works! Yes, you will sometimes fail to beat the market, "market" being shorthand to most investors for the "Large Caps" represented by the S&P 500, but over most periods other than an out-and-out bull romp in US stocks that means you are likely to do much better.

You'll note, for instance, that in 2000, the large caps, as measured by the S&P 500, were the 3rd-worst performing asset class. In 2002, they were "dead last." In fact, if you look closely, you'll note that not once was the S&P 500 the top-performing asset class - including the past 6 remarkable years!

Being open to other asset classes is the heart of Modern Portfolio Theory, but also the heart of Asset Allocation theory, and the heart and soul of our approach to building a Lifetime Portfolio. In a period of low and declining or stable interest rates, the aforementioned utilities, bonds and REITs often outperform stocks, and with considerably less volatility and heartburn.

MPT has also become associated with the notion that, since no one can predict what will happen on any given market day (or week, month, year, etc.) why bother? Why not instead select the asset classes that give you a level of risk you are comfortable with and then get reasonable returns year in and year out? Rigorous academic research shows that you will typically come out ahead after even a few years of doing this than you will if you try to "beat the market."

To oversimplify: If your risk tolerance is low, you might create a portfolio of 40% high grade bonds, 20% REITs, 20% high yield bonds and 20% large cap stocks. If you are comfortable seeking greater returns with greater risk, you might select 10% each of high grade and high yield bonds and REITs, with the other 70% of your portfolio split among US Large and Small Caps, International Large and Small Caps, and Emerging Markets.

In any scenario you construct, you want to let your profits grow while feeding the areas you have selected that aren't doing as well. The usual way this is done is to rebalance at some defined period every year (or less). A variation of this is to pick a certain percentage, say 20%, and if one asset class gets "out of whack" by that amount you add to it if it is down, or sell off some of it if it exceeds the 20% higher than your chosen percentage allocation.

If you wanted to hold 20% of your portfolio in large caps, for instance, if that asset class appreciates 20% and is now therefore 24% of your total portfolio (20% of 20 is 4), you would "re-balance" to bring that part of the portfolio back to your risk comfort level, using the proceeds to buy, at lower cost, some of the other asset classes that are "currently" lagging.

Does this sound boring? It may be, but which sounds better: a 7.4% annual return over 14 years or a 4.3% return? The bottom line on the above chart is that the simplest asset allocation plan imaginable, 40% high grade bonds, 15% each U.S. large caps and international stocks, and 10% each of small caps, emerging markets and REITs, rebalanced annually, still beat the currently-in-vogue "just buy an S&P 500 index fund; active management doesn't work" mantra.

This "just buy an S&P 500 index fund; active management doesn't work" fable becomes popular once we are well ensconced in a bull market - and dies just as quickly when the market plummets. As the data above shows, the drawdown for the S&P 500 was -37% in 2008. The biggest drawdown for the asset allocation model (AA) was -22.4%. For comparison, our Growth and Value portfolio, in which we used our own variations on asset allocation described below, was down 18.7% that year. On a million-dollar portfolio, the S&P would have declined in value to $670,000; our G&V to $813,000, with less position risk and less volatility.

How We Diverge From the Standard Model

There are scores of ways you might select an asset allocation model that works for you, from changing the percentage allocations to increasing the asset classes to adding a little sentiment, fundamental, historic or technical analysis.

We try not to sway too far from the basic principles of asset allocation. We like to think we are merely adding a dollop of common sense and placing history on our side.

We believe:

- Rebalancing based on the calendar is folly. In the chart above, the results tabulated are for a rebalance once a year at the beginning of each year. Macro-trends evidence themselves any time of the year; both black and white swans swoop and dive based upon events, not calendars. We take action when our asset allocation percentages diverge from our intended allocation.

- Underlying the concept of asset class investing is the assumption that markets are efficient and that investors act rationally. We might give some credence to the first assumption, but the second is patently false! We believe we can benefit from investor emotions. An example today might be early nibbling at the huge integrated oil companies that can slash CapEx and make a profit on their current properties if the price of oil falls even another 50%. Buy them when they're cheap; don't obsess if something you buy for 10 times forward earnings and a 5.9% yield falls so that you "might have" bought it at 8 times forward earnings and a 6.4% yield.

- At times when interest rates are rising, we might be as little as 0-20% in bonds and REITs combined. When falling, we might be at 60-70%. We are dynamic, not static. [This is a very big divergence from the academics' idea of asset allocation. That's their way; this is our way.]

- "To every thing there is a season." We augment our asset class investing to take advantage of the fact that small caps tend to enjoy the bulk of their outperformance in the first two quarters of the year, that pre-presidential election years are often excellent market years as both parties crank up the PR machines, etc.

- We don't chase any single asset class like S&P 500 large caps, REITs, small caps or any other. Nor do we obsess if we fall behind in comparison to any one asset class for an extended period. We maintain our discipline and do our best to grow our portfolios steadily. Sometimes we have setbacks, sometimes we are out of sync, but we've always bounced back.

In Part II, I will discuss the asset classes that are historically most and least correlated with the S&P 500 (U.S. large caps) and with each other, so you can begin to consider how you might construct a Lifetime Portfolio that works for you. I'll also discuss the types of mutual funds and ETFs our research and analysis leads us to, including examples and some of our specific current holdings.

>> Continue to Building A Lifetime Portfolio, Part II: What To Consider Owning Now

As Registered Investment Advisors, we believe it is our responsibility to advise that we do not know your personal financial situation, so the information contained in this communiqué ...

more

Thanks for the well done article. How would rising interests rates impact asset allocation?

Upon reallocation, we'd buy fewer US "regular" bonds and select instead foreign bonds where the central banks are lowering rates rather than raising them...

Mr. Shaefer, do you change your definition of 'lifetime' - or the allocations - according to the investor's age?

First of all, Ms VV, let me say: What a great handle, go-by or whatever it is we call the way we identify ourselves on TalkMarkets! "Vintage Vixen" is very clever. (And... do you know if anyone ever told Audrey Hepburn she looks an awful lot like you?)

The answer to your question, as you probably noticed in my answer to Ms. Edwards, is that we absolutely take the investor's age into account. But age is actually only one factor. Each investor has their own temperament, goals, risk tolerance, drawdown instructions, time they want to devote to the market, assets, etc.

I had an 89-year-old client I had to restrain from over-trading after I made him a good profit on an individual equity. He insisted I sell it even though I thought it still had a bright future. When I asked why he said, "I've never had a stock go up! I just want to take the trade tickets down and show the guys I golf with."

I've also worked with young people whose adult recollections of the markets begins in 2007 as real estate begins to slide, then 2008 when their parents lost hugely, etc. They are often TOO cautious, so I show them the long term trendlines. I post the 144 year trendline of the S&P and its precursor in our monthly investment letter, and point out to these young and cautious that they likely have another 40 or more years ahead of them -- "Let time and compounding work for you!" I tell them.

Does this approach work if you use ETF proxies for the different asset classes? (Also, I am looking forward to reading Part 2.)

Absolutely, Ms. Brown! I think low cost ETFs, closed-ends and no-load, no transaction fee mutual funds are the only way to gain broad diversification across asset classes without spending 1.7 zillion dollars in commissions and such. I promise to give some concrete examples in part 2.

PS -- because there is always some individual security that grabs our attention, has a great story or really does warrant our consideration, I typically do strategic asset allocation with 90% of our client portfolios, and keep ~10% in cash or stocks a client cares about or stocks I believe are most appropriate for them. I do the same and indulge my desire to play a little bit -- with a little bit of the total portfolio.

you rebalance YOY so it's really a yearly not a lifetime MPT model.-where are REITS weighted for a 2015 porfolio? are you going to show us the 2015 model?

Hi Frank, to answer your question, Part 2 has been published and can be read here:

www.talkmarkets.com/.../building-a-lifetime-portfolio-part-ii-what-to-consider-owning-now

Thank you for your comment, Ms. Edwards. Actually, we do NOT reallocate YOY! As I said above "Rebalancing based on the calendar is folly... Macro-trends evidence themselves any time of the year; both black and white swans swoop and dive based upon events, not calendars. We take action when our asset allocation percentages diverge from our intended allocation."

"What if" part of our strategic asset allocation had been to keep x% in something stable like, say, the Swiss franc? (It isn't but we're saying "what if?") Would we wait a year to reallocate? Not only no, but uh-uhh...The ripples from this action are still being felt in a number of asset classes, so we reallocate as one class becomes considerably over- or under-weighted or (the puritans of MPT are now shuddering in their ivory towers) when we believe a macro geopolitical event can "change everything."

Each of our clients has different goals, temperaments, risk tolerance, drawdown parameters, etc., so it is meaningless to say where REITs are in "a" 2015 portfolio. I will tell you, instead, where they register for me personally. In my portfolio, REITs currently comprise an outsize 12%. It was 7% previously and kept growing. But right now I believe the small caps, laggards last year, will do well so I have specifically added a more speculative, lower-volume-than-I'd-like ETF comprised of both small cap REITs and small cap real estate companies.

Like anything else, look for opportunities the market doesn't see yet, pay attention to trends, interest rates, the Fed, liquidity, regulations, regional opportunities (ie Noth Dakota and Texas and the fracking slowdown effect of real estate)

thank you!

Thanks for taking so much time to answer everyone's articles, Joseph. When can we expect Part 2 from you?

Great chart, where is it from?

You can see the chart at the author's site, www.stanfordwealth.com/wealth-management.html.

Ms. Hunt is correct that you can find the chart on our website HOWEVER -- I am so glad she said that because (a) the website *I* got it from was credited in the original but did not make the journey when it was cut and pasted into our website. Thank you, Ms Hunt. I've now given credit where credit is due. And (b) you can now see the updated version, which includes all of 2014, on our site.

Thanks!