High-Beta Stocks Take The Lead For Equity Risk Factors In 2025

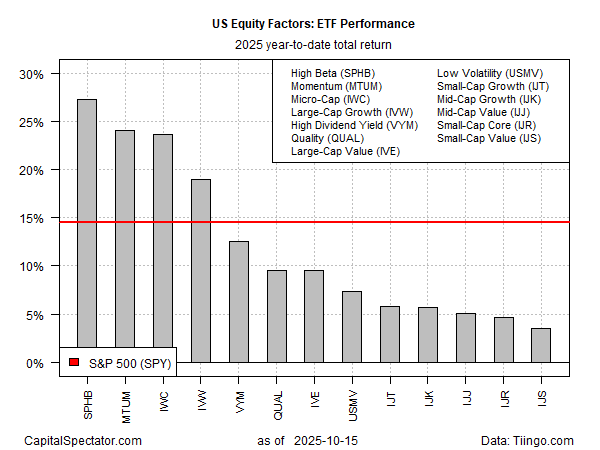

A handful of equity risk factors are outperforming the broad stock market this year, and within the elite winner’s circle, so-called high-beta shares are leading the field, based on a set of ETFs through Wednesday’s close (Oct. 15).

The Invesco S&P 500 High Beta ETF (SPHB) is up a sizzling 27.3% year to date. The strong run this year puts the fund well ahead of the stock market overall, which has rallied 14.5% via the SPDR S&P 500 ETF (SPY).

SPHB targets the stocks in the S&P 500 with the highest sensitivity to market movements, or beta, over the past 12 months.

The ETF is also outperforming the rest of the factor field. It’s closest competitors for year-to-date results: the momentum factor (MTUM) and micro-cap stocks (IWC), both of which are also beating the broad market in 2025. The fund’s current top-3 holdings — a trio of tech firms — account for roughly 5.9% of the portfolio: Micro Technology (MU), Tesla (TSLA) and Intel (INTC), according to Morningstar.com.

(Click on image to enlarge)

Earlier in the year, the high beta strategy (SPHB) had been trailing equities overall (SPY) by a wide margin. But SPHB’s recovery has accelerated in recent months and has become the performance leader as the trading year heads into 2025’s final 2-1/2-month stretch.

All the equity risk factors are posting gains year to date, but results vary widely. The weakest performer: small-cap value stocks (IJS), which is up a tepid 3.5% this year.

More By This Author:

Macro Briefing - Wednesday, Oct. 15

Bond Market Continues To Downplay Inflation Risk

Macro Briefing - Tuesday, Oct. 14

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. ...

more