"Gold Is Now Technically Toast"

Image via Time 4 Toast.

Why It's Tough To Be Bullish On Gold

Whenever you read investment commentary, it's useful to ask what the person writing it is trying to sell you. I sell a hedging app, so it's in my interest to highlight risks where they appear. The man who said "gold is technically toast" has nothing to sell you though. He is Nicky Shiels, the head of metals strategy at MKS (Switzerland) SA, and was quoted by Bloomberg in their article on gold on Monday ("The Flash Crash Shows Why It's Tough To Be Bullish On Gold Now"). Here is the full quote:

Gold is now technically toast and requires some resilience to stave off some key levels. On the topside, retaking of $1,750 would help instill confidence.

Bloomberg editor Joe Wiesenthal's takeaway on that piece, which he linked to in the tweet below, was that the macro picture didn't favor gold.

I won't say there can never be a good environment for gold again.

— Joe Weisenthal (@TheStalwart) August 9, 2021

But I do believe that Gold Bug Macro continues to just be totally debunked. https://t.co/pnYM8KC0BU pic.twitter.com/Rf50XJKrU9

Consistent with that, the "silver lining" mentioned for gold in that article wasn't related to the macro picture at all, but the expectation that demand for jewelry in places like India might provide support for gold prices if gold dropped too low.

The article didn't mention it, but what surprised me about gold's flash crash is that it happened in an environment where Chinese data showed a huge inflationary spike.

OOPS! #China's producer price index (PPI), which measures costs for goods at the factory gate, jumped 9% year on year in July way faster than expected, fueling global #inflation fears. pic.twitter.com/ikCz6ID1IY

— Holger Zschaepitz (@Schuldensuehner) August 9, 2021

If there's any macro environment where gold should go up, it's one where we're getting prints like that.

You Should Consider Hedging

As I mentioned in my previous post, written before the flash crash, you should consider hedging if you have a large position in gold. I won't belabor that point now, but if you're not hedged, it may be worth hedging precious metals on a bounce. I'll try to post updated hedges here for gold or silver, using GLD or SLV as proxies on a bounce.

Let's turn our attention now to what went up on Monday.

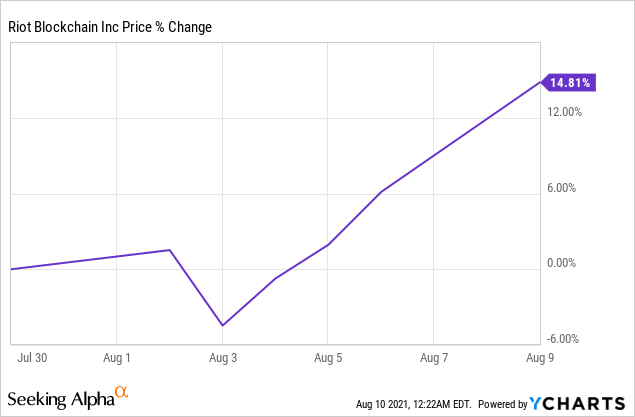

Riot Blockchain

I wrote about the Bitcoin miner Riot Blockchain (RIOT) a couple of weeks ago.

Shifting the odds in your favor. $BTC.X $AYSI $RIOT #BTC https://t.co/rbwHSzbJtq

— Portfolio Armor (@PortfolioArmor) July 31, 2021

Riot Blockchain shares were up 8.18% on Monday as Bitcoin broke out of its three-month range. They were up 14.81% since that post was published.

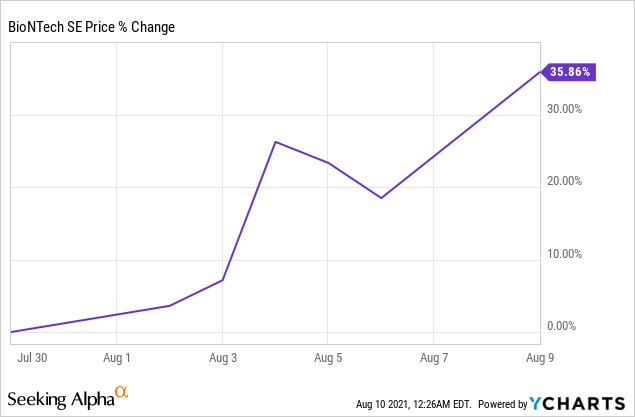

BioNTech

I wrote about the Covid vaccine maker BioNTech (BNTX) last week,

State of Fear gets extended with the Lambda Variant; vaccine companies continue to cash in. $BNTX $PFE $MRNAhttps://t.co/FNMf1MqIMU

— Portfolio Armor (@PortfolioArmor) August 5, 2021

And the week before,

Expect governments to use the threat of renewed lockdowns to drive vaccinations. $BNTX $PFE https://t.co/DEIqXAAVbF

— Portfolio Armor (@PortfolioArmor) August 1, 2021

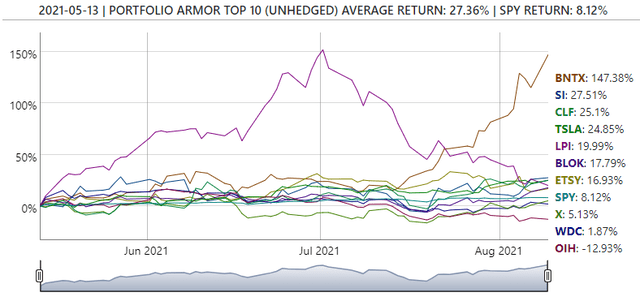

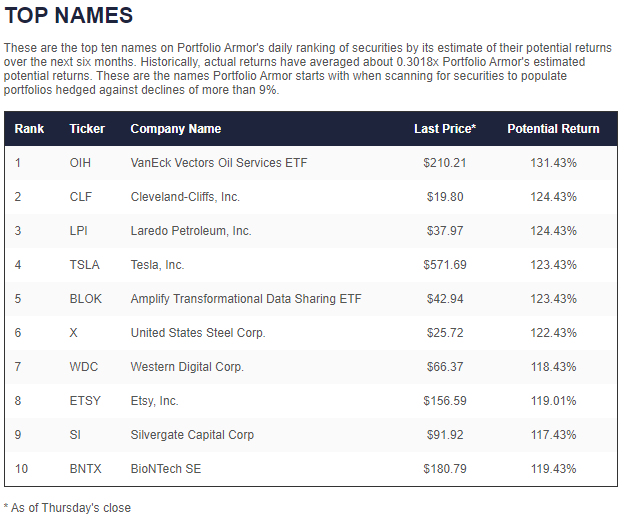

As I noted in those articles, BioNTech was one of my system's top names on May 13th.

Screen capture via Portfolio Armor on 5/13/2021.

BioNTech was up 14.97% on Monday. It was up almost 36% since my August 1st post,

And it was up more than 147% since it first appeared in our top ten on May 13th.

Safety First

If you are sitting on gains in either RIOT or BNTX, I suggest you consider hedging to lock in some of those gains. I say that not just because I have a hedging app, but because it's a prudent thing to do.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more