Global Equities Rose Last Week As Bonds, Commodities Fell

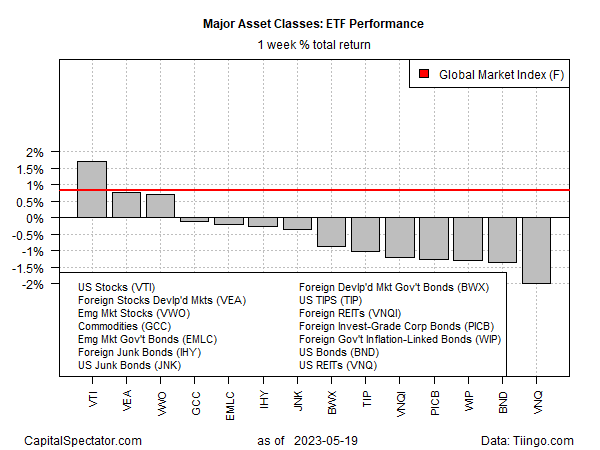

US shares led rallies in equities markets around the world in the trading week through Friday, May 19, based on a set of ETFs. The rest of the major asset classes lost ground.

Vanguard Total Stock Market Index Fund (VTI) gained 1.7%, rising to the highest level since February. The latest increase sets up the fund for higher odds of a bullish breakout if it can move decisively above the current price.

The immediate headwind for risk assets is the evolving uncertainty surrounding the US debt ceiling and the potential for default of Treasuries. President Biden and House Speaker McCarthy are scheduled to meet again today to discuss possibilities for a political compromise. Markets will be keenly focused on the outcome for assessing the risk of a US default, which could strike as early as next month without a deal, according to some estimates. Goldman Sachs projects the X-date could arrive as early as June 8-9.

Last week’s biggest loss for the major asset classes: US real estate. Vanguard Real Estate Index Fund (VNQ) slumped 2.0%. The decline suggests that the ETF remains caught in a bearish trend that’s persisted for well over a year.

The Global Market Index (GMI.F) rebounded last week, rising 0.8%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

The major asset classes continue to post mixed results for the one-year window, with most ETF proxies reporting a loss for this span. The performance leader over the past year: foreign shares in developed markets ex-US (VEA), which is up more than 10% for the trailing one-year period. Commodities (GCC) are the loss leader with a 16.5% decline.

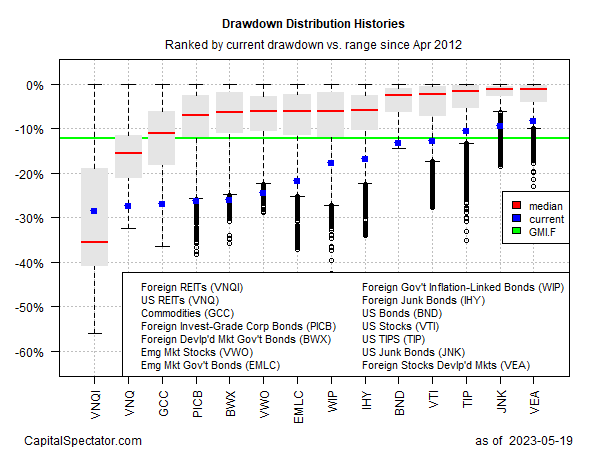

Most of the major asset classes are still posting relatively deep drawdowns. The deepest: foreign real estate shares (VNQI), which ended last week with a near-30% peak-to-trough decline. Stocks in foreign developed markets (VEA) reflect the softest drawdown for the major asset classes: -9.5%.

More By This Author:

U.S. Q2 GDP Nowcasts Point To Pickup In GrowthLong Treasuries Top Bond Market Returns This Year

Recession Forecasts Persist As U.S. Economic Growth Muddles On

Disclosure: None.