Foreign Stocks Still On Track To Outperform US In 2025

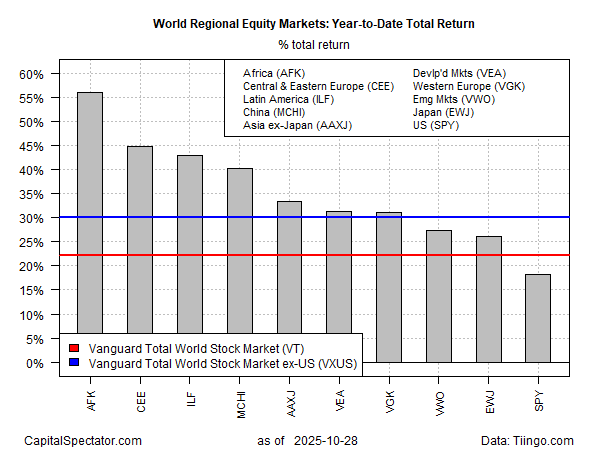

Global equities strategies are having a moment this year. Although US tech is still red hot and the investment darling, American shares overall are lagging the rest of the world on a year-to-date basis, according to a set of ETFs through Tuesday’s close (Oct. 28).

The SPDR S&P 500 ETF (SPY) in isolation looks strong, posting a 18.3% year-to-date gain. That’s a solid above-average performance vs. the market’s long-run history. But it’s subpar vs. foreign stocks generally in 2025. For example, a global stock fund ex-US (VXUS) is far ahead in the horse race, posting a 30.1% total return this year.

Reviewing stocks on a regional basis highlights even stronger performance, led by shares in Africa via AFK, which has surged 56.1% so far this year.

US stocks, by contrast, are in last place in 2025. The ranking highlights a key feature for asset allocation in the calendar year: minimizing global diversification for equities has been a non-trivial drag on relative performance.

The bullish turnaround in offshore markets has revived interest in global diversification, but 2025 is still an outlier over the longer sweep of performance history. The debate centers on whether the relative strength in foreign stocks is a one-off event that will revert to form in 2026.

Only time will tell, but it’s useful to track sentiment for foreign stocks relative to US shares via a pair of ETFs for perspective. The chart below reminds that while investors have favored global equities ex-US this year, a longer view of the trend (starting in 2011) suggests the jury’s still out for deciding if the US has lost its leadership on a longer-term basis.

(Click on image to enlarge)

For now, this year’s rally in stocks ex-US looks like another temporary bounce in ongoing trend of US leadership, as depicted by the falling line, which is the ratio of global shares ex-US (VXUS) vs. US shares (SPY). It remains to be seen if the VXUS:SPY trend turns up in the months ahead and delivers a different story. Meantime, the debate about whether outperformance in foreign shares is signal or noise continues.

More By This Author:

Macro Briefing - Tuesday, Oct. 28

Macro Expectations: Betting Markets

Macro Briefing - Monday, Oct. 27