Exploring Trends Across Asset Classes, Mega-Caps, And Banks

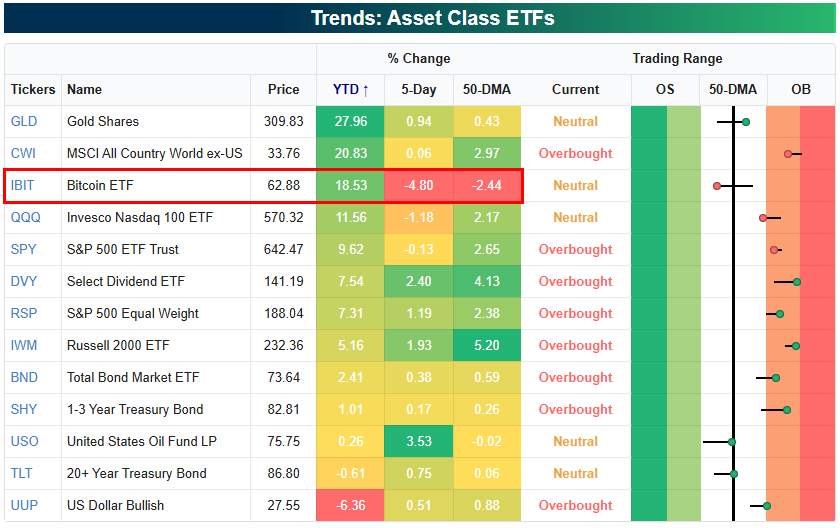

Equities have stalled out in the last half of August as a buyer's strike ahead of the seasonally weak month of September takes hold. Below is a look at where equity ETFs and other asset-class ETFs stand within their trading ranges using our Trend Analyzer tool. Notably, gold (GLD) is now solidly in the lead in terms of year-to-date percentage change after Bitcoin (IBIT) has fallen off dramatically in the last week. Of the various asset class ETFs shown, Bitcoin (IBIT) is easily down the most week-over-week with a drop of 4.8%. On the flip side, oil (USO) is up the most with a gain of 3.5%.

(Click on image to enlarge)

Looking at the mega-caps, the best performer over the last week has been Tesla (TSLA), which remains the worst performer of the group on a year-to-date basis. Alphabet (GOOGL) is the only other mega-cap in the green over the last week, while the rest of them are down 1%+. So far, Microsoft (MSFT) is the only one that has moved back below its 50-day moving average.

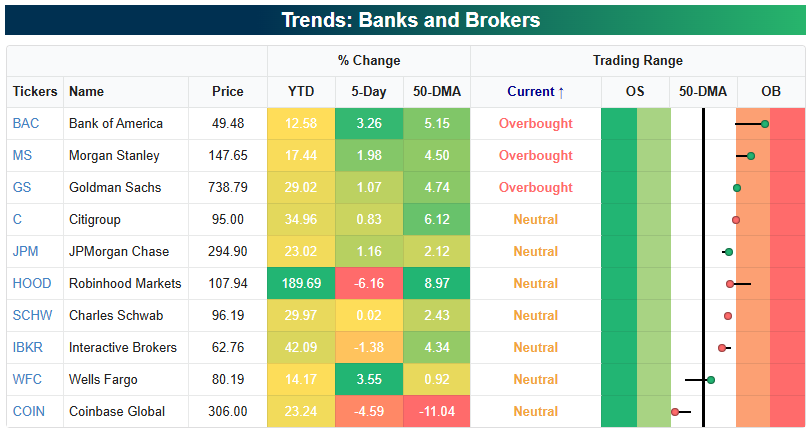

One other area of the market worth looking at is the banks and brokerage firms. While Bank of America (BAC) is up the least year-to-date of any of the stocks shown, it's up the most over the last week with a gain of 3.3%. BAC is also now the most overbought stock of the bunch as it trades nearly two standard deviations above its 50-day moving average. On the flipside, Coinbase's (COIN) 4.6% drop over the last week leaves it as the only name in the group that's below its 50-DMA.

(Click on image to enlarge)

More By This Author:

If Alphabet "Missed The AI Boat", What Does That Mean For Microsoft?

A Whipsaw Week

Nvidia and Microsoft: Broken Uptrends?

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more