Everyone Is Talking About Silver, But Don't Forget Gold

.webp)

Photo by Zlaťáky.cz on Unsplash

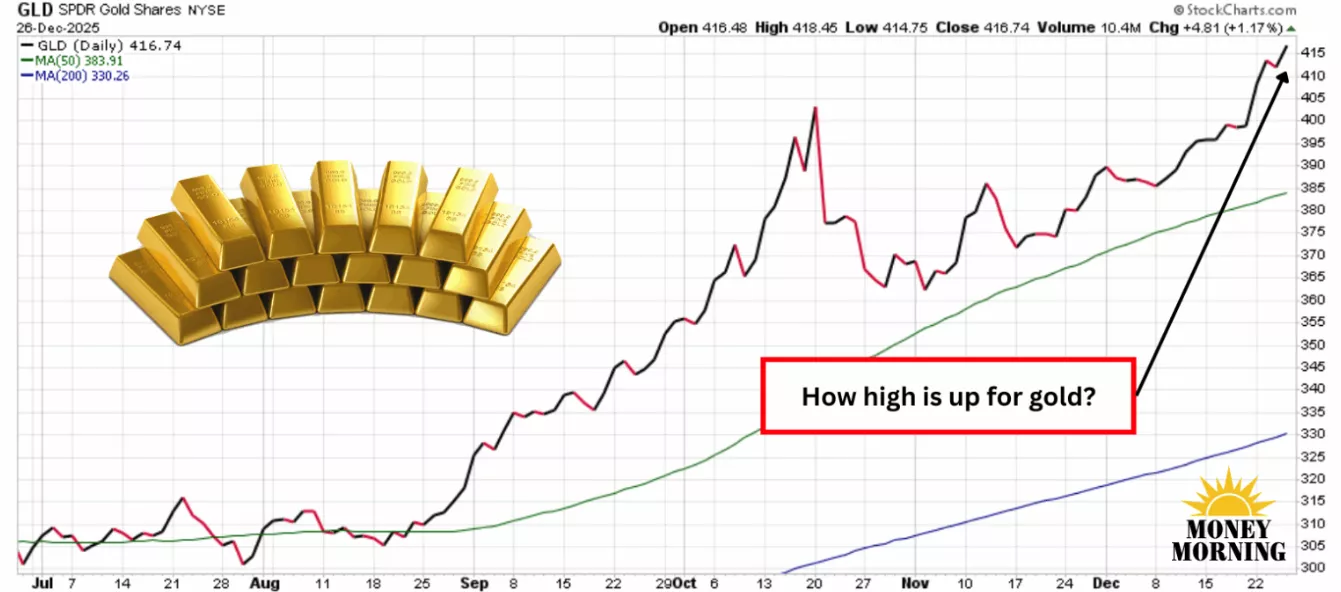

Silver's explosive rally is grabbing headlines, but don't forget gold, which is also surging to record highs. Many traders believe the best way to capitalize on gold's enduring bull market is by investing in gold mining companies, which promise leveraged exposure to rising metal prices.

Yet, reality tells a different story. Over long periods, gold mining stocks have significantly underperformed the metal itself, with only brief, sporadic bursts of outperformance. Even in the current surge, where spot gold has soared dramatically to $4,562 per ounce – shattering previous records – miners have lagged in sustained gains.

With gold prices at all-time highs and safe-haven demand booming, excitement is building that miners are finally poised for a major breakout. But betting on miners over direct gold exposure would be a mistake, and the SPDR Gold Shares ETF (GLD) is your best bet.

Why Miners' Leverage Often Fails in Practice

In theory, gold miners should outperform the metal dramatically. As fixed costs like labor and equipment stay relatively stable, a rising gold price flows straight to the bottom line, creating operational leverage. If production costs are $1,200 per ounce and gold jumps from $3,000 to $4,500, profits per ounce explode. This built-in amplification makes miners appealing during bull runs.

But reality diverges sharply due to added risks. Beyond price leverage, miners face geographic exposure – political instability, permitting delays, or regulatory changes in key producing countries like South Africa, Russia, or Australia. Management quality also varies: poor decisions on hedging, acquisitions, or capital allocation can erode gains while financial health introduces more uncertainty.

These "unknown unknowns" introduce volatility that often offsets leverage benefits. Historical data shows gold itself consistently outperforming miner indexes over multi-year periods, with miners shining only in short periods before reverting.

Direct ownership of gold avoids these pitfalls. No management missteps, no jurisdictional risks – just pure exposure to the metal's supply-demand dynamics, driven by central bank buying, geopolitical tensions, and inflation hedging. But skip buying physical bullion or coins: storage costs, insurance, and illiquidity make unloading difficult during volatility.

Why GLD Is Gold's Best Option

Exchange-traded funds (ETF) like the SPDR Gold Shares ETF are the better option, and GLD is the largest and most recognized gold ETF, with over $154 billion in assets under management and massive daily trading volume.

GLD holds physical gold bars in secure vaults, tracking the spot price minus a modest expense ratio. Its shares mirror gold's performance closely, delivering gains without the hassles of physical ownership.

Alternatives exist, like the iShares Gold Trust (IAU), which also holds physical bars with a slightly lower expense ratio. But GLD's scale, brand recognition, and superior liquidity make it the go-to for most investors seeking efficient, hassle-free gold exposure.

Bottom Line

Quality miners remain compelling investments for those seeking leverage. Newmont (NEM) or Barrick Mining (B) offer diversified operations with strong balance sheets, while royalty/streaming companies like Wheaton Precious Metals (WPM) eliminate direct mining risks by financing production in exchange for future output at fixed costs – providing amplified upside with lower downside.

But for a pure, uncomplicated capture of gold's record-breaking rise with no signs of easing, a core holding in GLD stands out as the smartest play. Amid silver's spotlight, gold's steady ascent deserves your attention today.

More By This Author:

These 3 High-Flying Stocks Could Crash Hardest If The AI Bubble Pops

3 Fantastic Dividend Growth Stocks To Buy And Hold Forever

If the Crypto Winter Has Arrived, Should You Be Buying Bitcoin Now?