Bitcoin: Higher And Higher Into Year-End

Bitcoin (BTC) has come a long way from its lows last spring and summer. After a massive 55% correction, Bitcoin is now up by around 115% from its bottom, and the world's number one digital asset likely has a lot more upside ahead. While some market participants claimed that the end was near with Bitcoin approaching $30K, I maintained my bullish long-term outlook. I became increasingly bullish on Bitcoin when the digital asset held the $30K support level throughout the summer and began powering higher towards $40K. Now, while we may see a pullback or a consolidation phase following the huge recent run-up, I remain bullish on Bitcoin into year-end. With prices around all-time highs ("ATHs") and an ETF coming to market, exposure to BTC should spike demand, and we could see the world's leading digital asset reach substantially higher prices in the coming months.

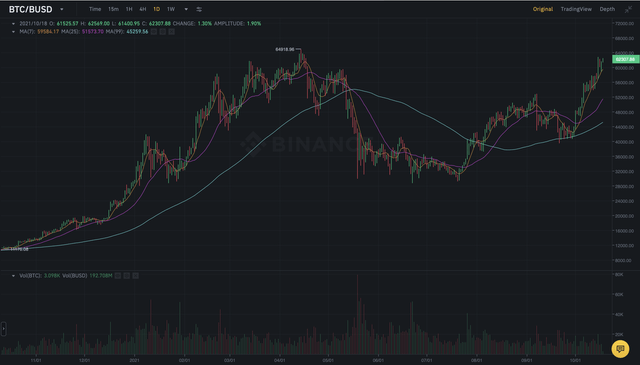

BTC - Over The Last Year

Source: binance.com

BTC had quite the rollercoaster ride over the last year. The digital asset traveled from $11K to $65K, then down $30K, and now back up to over $60K again. While this price action may seem extreme, I can't say that it is entirely unexpected, given the digital asset market's volatile nature and relative immaturity.

The key takeaway is that prices moved up too much and too quickly in the early part of 2021. Bitcoin badly needed a correction, and the digital asset melted into a prolonged consolidation phase around crucial $30K support. The critical $30K support level was retested and tested for a third and final time in late July before BTC finally set off on a new bullish uptrend.

Now BTC is approaching new ATHs again. While we will likely see another healthy pullback/consolidation phase soon, the recently started bullish trend is well intact, and BTC will probably climb notably higher into year-end.

The Bitcoin ETF Moment

The Bitcoin ETF moment is finally here, as the SEC is poised to allow the first U.S. Bitcoin futures exchange-traded fund to begin trading. The ProShares Bitcoin Strategy ETF (BITO) is set to start trading on the NYSE on Tuesday. In addition, the Grayscale Bitcoin Trust (OTC: GBTC) is preparing to launch an ETF conversion. We are likely looking at other Bitcoin/crypto ETFs down the line, which should propel prices higher as we advance.

Right now, many market participants are still restricted when it comes to owning Bitcoin. Yes, people can use crypto exchanges and the futures market, but buying an ETF is different. Crypto exchanges are still a mystery to many people. Some market participants find the process confusing, others don't want to use them, and others don't trust them. Futures trading is also reasonably limited when measured in terms of the average retail trader. Many market participants don't dabble in the futures market and prefer to stick to the good old stock/ETF playbook.

Here is where the Bitcoin ETF comes in. This product will enable millions of Americans to get exposure to Bitcoin. This dynamic is the next step in solidifying Bitcoin's place as a mainstream investment vehicle. Think about it. People can already buy Bitcoin through crypto exchanges, they can trade it in the futures market, and now they will be able to own it with the ease of an ETF. This phenomenon should cause demand for Bitcoin to increase substantially in the coming months, and Bitcoin will likely surge into year-end.

How Much Higher Will Bitcoin Go?

Bitcoin - Long-term Chart

Source: bitcoincharts.com

Bitcoin moves in waves, and each wave top is substantially higher than the previous peak. We see the $10 (roughly) top followed by a $100 peak, the $100 peak followed by a $1,000 top, the $1,000 peak followed by a $20,000 top, and here we are now. We recently saw a short/intermediate-term top around $65K, after which a significant correction brought BTC down to $30K. However, I don't think this was a top to the current bullish cycle, nor did we see a bear market in Bitcoin.

Instead, prices overshot to the upside, which led to a badly needed correction. Now, we can probably see the current wave proceed higher to new ATHs. In a base case scenario for the current wave, I talked about Bitcoin topping out at around $75-100K. However, the $75K figure is too conservative now, and I am moving my top-out estimate range to $100-150K for this cycle.

The Bottom Line

Despite the probability for a near-term pullback/consolidation period, I believe Bitcoin is poised to move substantially higher into year-end. A constructive technical setup and the introduction of the first official Bitcoin ETF in the U.S. should provide the necessary momentum to fuel the next leg of the Bitcoin rally. Furthermore, GrayScale's ETF conversion and other possible future ETF contenders should cause further increases in demand for Bitcoin and other digital assets. Ultimately, Bitcoin probably has ample room to appreciate as we advance into year-end. I suspect that the next major top in Bitcoin will occur at $100,000-150,000, and the current wave may end sometime in Q1 2022.

Risks to Consider

While I am bullish into year-end and early 2022, investing in Bitcoin is a high-risk activity. First, we could see a considerable pullback in a "sell the news" event post the ETF launch. Bitcoin is highly volatile, and a 20% correction (or more) is quite possible. A 20% move lower from here ($62K) would put BTC back at $50K. Also, once an intermediate to a longer-term top comes, Bitcoin will very likely enter a bear market. Expect a 70-85% (on par with other declines) meltdown once the bear market arrives. So, even if Bitcoin tops out at $100,000, it will decline to the $15-30K range, and if BTC tops out at $150,000, it will likely drop into the $20-45K price range.

Additionally

Bitcoin remains a volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other detrimental elements could negatively impact Bitcoin's popularity and affect its price. Therefore, a position size of 3-5% of total portfolio holdings may be appropriate for investors with low to mild risk tolerance. For investors with higher risk tolerance, 10% or more of portfolio holdings may be suitable.

Looking Back on Some Names

I offered up some stock ideas in my last Bitcoin article. Let's see how they are doing right now.

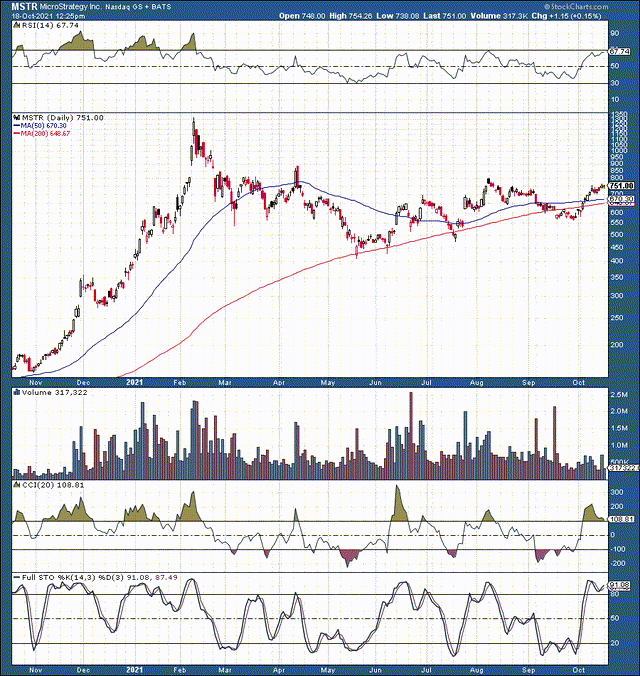

MicroStrategy (MSTR)

Source: stockcharts.com

When I discussed MSTR in my previous Bitcoin article in early August, shares were trading at around $620, and now the stock is at $750 (21% gain).

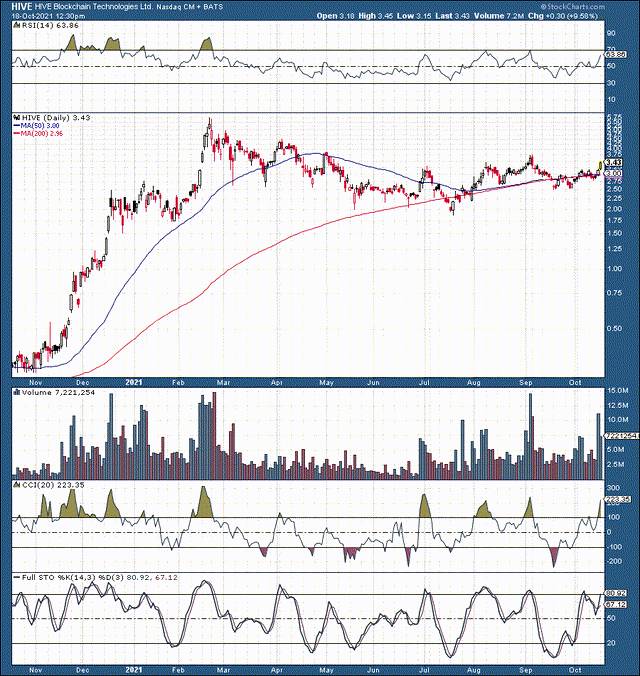

HIVE Blockchain (HIVE)

Source: stockcharts.com

HIVE was at $2.57 when I discussed the stock in my last piece, and now shares are at $3.43 (34% increase).

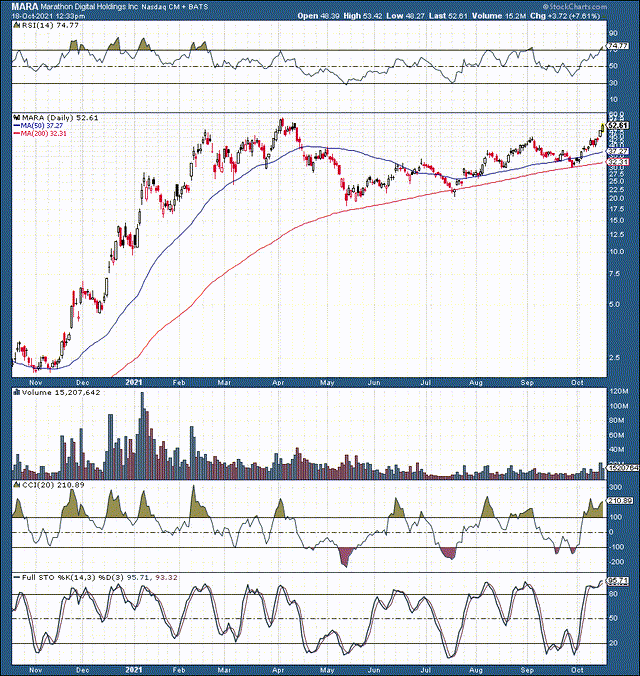

Marathon (MARA)

Source: stockcharts.com

MARA was below $28 in my last piece, and now the stock is approaching $53, a 90% increase.

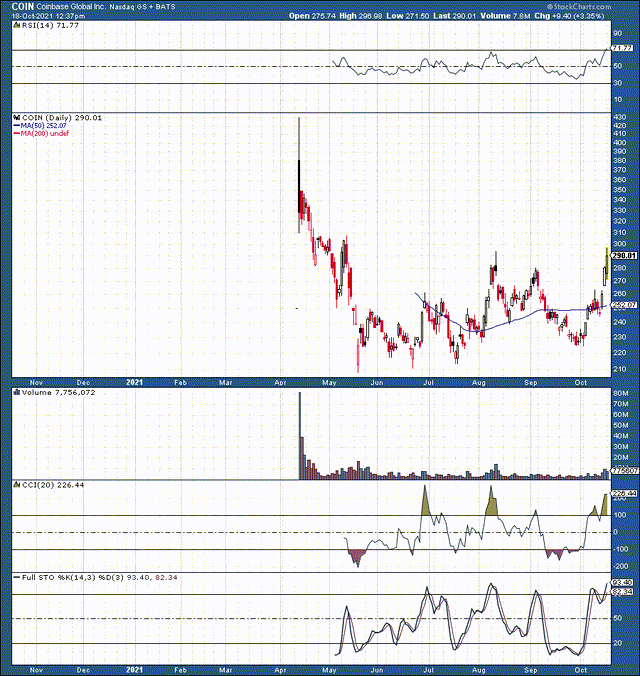

Coinbase (COIN)

Source: stockcharts.com

Coinbase was at $236 when I wrote about the company in my previous article, and now it is $290, a 23% gain.

The Takeaway

I still think that the underlying names can go higher, but please remember that their price action will likely track Bitcoin's. Therefore, they can go up very fast, but they can also drop very quickly. Also, we could see a pullback phase here if Bitcoin consolidates in the near term. Therefore, it is essential to choose your entry points carefully now.

Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my ...

more