Beating The Market With Both Low And High Risk Names

The author's used copy of The Andromeda Strain.

The Apparent Paradox Continues

I used the image above in my last post, The Andromeda Strain Paradox, because an apparent paradox in Portfolio Armor's security rankings mirrored one in the eponymous Michael Crichton novel. In the novel, the only survivors of a plague are an old alcoholic and a healthy infant, who seem to have nothing in common. In our security rankings, we're seeing market-beating performance from two sets of securities with little in common: low risk names that are inexpensive to hedge with optimal puts, and high risk names that are expensive to hedge with them.

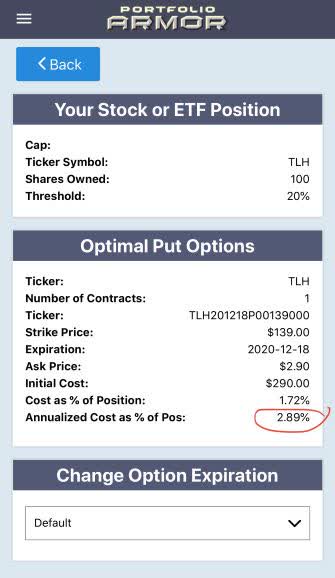

An example of a low risk name by this metric now is the iShares 10-20 Year Treasury Bond ETF (TLH), which is currently on our top names list.

Image via the Portfolio Armor iOS app.

And an example of a high risk name by this metric is Square Inc. (SQ), which is currently on our cash substitutes list.

Low And High Risk Names Combined

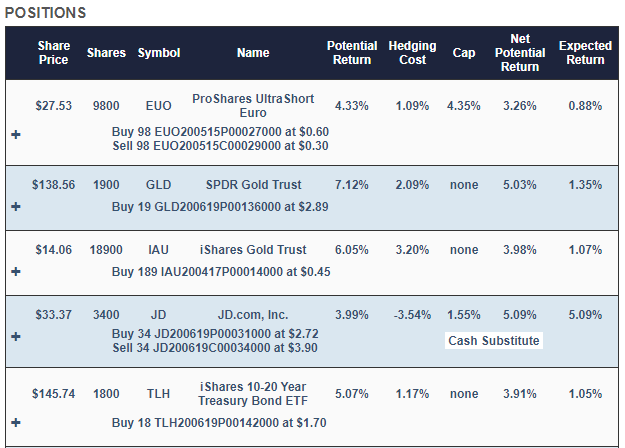

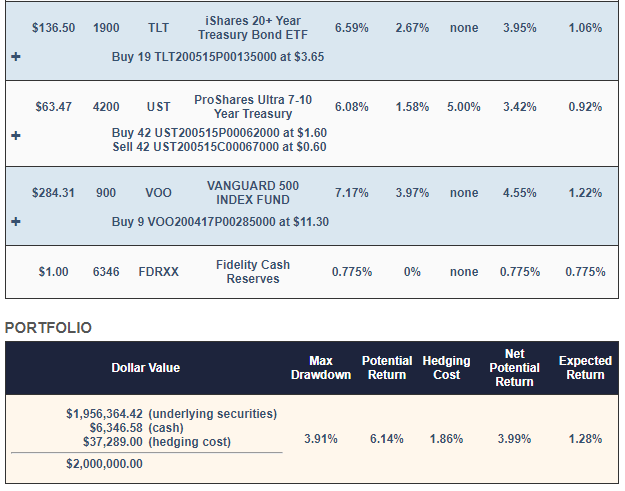

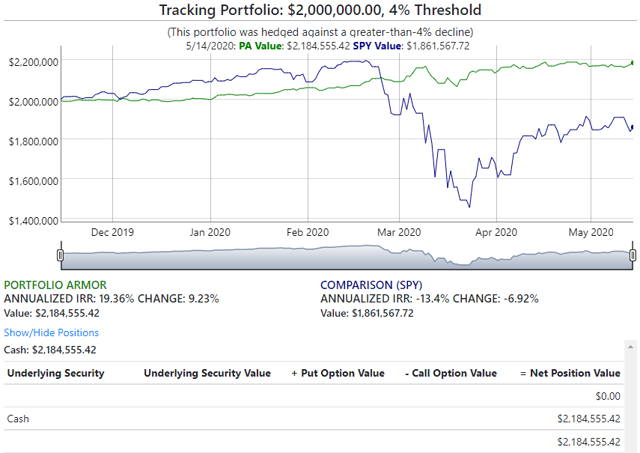

Here's an example of a hedged portfolio comprised of mostly low risk names like TLH, TLT, and GLD, along with high risk name JD.com (JD). This portfolio was created in mid-November for an investor unwilling to risk a decline of more than 4% over the next 6 months.

Wait A Minute - Why Was JD In This Portfolio?

Why was Chinese Internet stock JD in a portfolio for a conservative investor unwilling to risk a >4% decline? It was there to absorb cash left over from rounding down dollar amounts of the other securities to round lots (to minimize hedging costs). Although risky unhedged, JD was collared against a >4% decline in the portfolio. Collaring it that way generated a net credit which lowered the overall hedging cost of the portfolio. The worst case scenario for this portfolio - if every underlying security in it went to $0 - was a drawdown of 3.91%.

Another Conservative Portfolio Crushes It

In a recent post (Typical Returns For Conservative Portfolios), I mentioned portfolio from October hedged against a >4% decline that posted a >9% return and said that kind of return was atypical. Maybe I spoke too soon. The portfolio above, from mid-November, posted a better-than-9% return as well.

This portfolio was up 9.23% after 6 months, while SPY was down 6.92% over the same time frame (to see an interactive chart of this portfolio click here).

Performance Of The Underlying Names, Unhedged

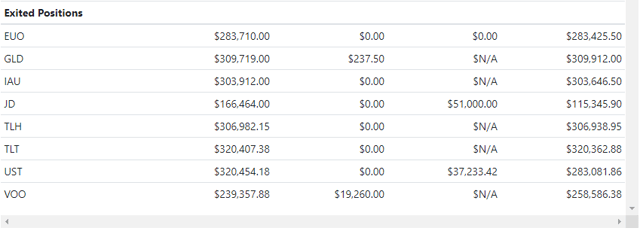

The unhedged performance of the underlying names highlights how we saw strong returns from both low risk names like TLT and TLH (up 22.57% and 20.85%, respectively) and the high risk name, JD (up 45.84%).

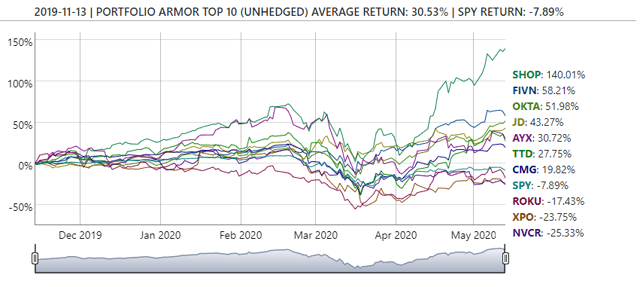

The 4th Best Cash Substitute From Mid-November

JD's 45.84% return since mid-November made it the 4th-best performing name from our cash substitute list then. Here's how all the cash substitutes from mid-November did.

The number one name, Shopify (SHOP), I've written about recently. I don't know anything about the 2nd and 3rd best performers there, FIVN and OKTA.

Adjusting How We Pick Our Top Names

As performance data from past picks comes in, Portfolio Armor recalibrates its security selection process. If the cash substitute list continues to post dominating returns like cohort above, we will see more cash substitutes make it on the top names list. Maybe the resolution of the apparent paradox here is that there are strong returns to be found among both high and low risk names, and it's best to avoid the ones in the middle. Either way, we'll continue to go where the data takes us.

Comments

No Thumbs up yet!

No Thumbs up yet!