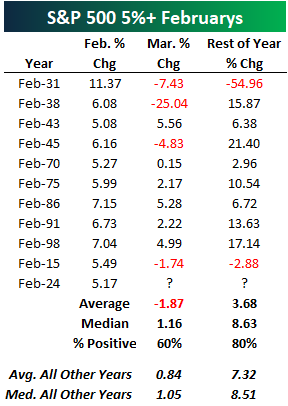

A 5% February: What Worked And What Didn't

The S&P 500 finished February with a gain of more than 5% for just the 11th time in the index's history since 1928. Below is a look at prior 5%+ gains in February along with the S&P 500's performance in March and for the remainder of each year. The last time we had a 5% February was 2015. That March, the S&P fell 1.74%, and the index fell 2.88% from the end of February through year-end. Let's hope we don't see that type of action for the remainder of 2024, although a repeat of 2015 would be a lot better than what investors experienced in 1931 when the S&P rallied 11.37% in February only to fall 54.96% for the rest of the year!

Below is a look at our key ETF performance matrix highlighting total returns across asset classes in February, year-to-date, and year-over-year. Mid-cap growth (IJK) was the best area of US markets in February with a 9.58% gain. Dividend stocks (DVY) were the weakest area with a gain of just 1.16% during the month. Looking at sectors, Consumer Discretionary (XLY), Industrials (XLI), and Materials (XLB) actually performed the best in February, beating out Tech's (XLK) gain of just 4.7% even though the semis (SMH) were up 14%.

Outside of the US, China (ASHR) finally had a big month along with Israel (EIS), which gained 8.6%. Mexico (EWW) and Spain (EWP) were the only two country ETFs that fell in February.

Natural gas (UNG) once again fell sharply, adding to its year-over-year decline of more than 50%. Finally, fixed-income ETFs were broadly lower in February, led down by the 20+ Year Treasury ETF (TLT).

(Click on image to enlarge)

Within the S&P 500, there are 67 stocks that show up in at least one of eight "AI" ETFs traded here in the US. As shown below, the 67 "AI" stocks in the S&P were up an average of 5.7% in February compared to a gain of 3.6% for the 433 non-AI stocks. On the year, the 67 "AI" stocks are up 5.9% versus a gain of 2.6% for the non-AI stocks. Given how much some of the most well-known AI names like NVIDIA (NVDA) are up so far in 2024, it's surprising to us that there isn't even more separation in performance between the AI and non-AI groups.

More By This Author:

The Best And Worst Performing Stocks Of February 2024

Beware Of February 29th

US Takes A Breather

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more