3 Growth Tech Stocks To Buy And Hold: VRT, SPOT, APPF

The S&P 500 hit new highs on Thursday after Wall Street bulls dove back into Nvidia and other technology stocks after Taiwan Semi’s (TSM) impressive earnings results.

The chip-making powerhouse’s growth and outlook signaled strong, AI-boosted demand. Taiwan Semi’s clients include Nvidia, Apple, and other market-driving technology stocks.

The backdrop of solid earnings growth and lower interest rates should support the bull market even though the stock market could experience volatility in the near term, fueled by the chaos of earnings season, the coming presidential election, and beyond.

Buy AppFolio Stock on the Dip for Huge Upside?

AppFolio, Inc. (APPF) is a real estate and property management-focused technology company. AppFolio’s offerings include accounting, communication, maintenance, marketing, leasing, investment management, and more.

AppFolio helps clients in all corners of real estate from single and multi-family to commercial, student housing, and beyond.

AppFolio boasts that it offers the “industry’s favorite real estate investment management software,” and its growth has been impressive. AppFolio grew its revenue by an average of nearly 30% in the trailing five years. The company grew its total units under management by 9% to 8.4 million in the second quarter.

Image Source: Zacks Investment Research

AppFolio is expected to boost its sales by 25% in 2024 and 20% next year to climb from $620 million in FY23 to $935 million in FY25. AppFolio is projected to grow its adjusted earnings by 146% in 2024 and 30% next year. Plus, APPF has topped our EPS estimates by an average of 30% in the trailing four quarters.

APPF stock has climbed 120% in the past five years to top the S&P 500’s 100%. Yet the stock is down 25% from its July peaks and trading 40% below its average Zacks price target. AppFolio stock is trading at some of its most oversold RSI levels over the past five years and it might find support near its 2024 lows.

AppFolio’s balance sheet is stellar and seven of the eight brokerage recommendations Zacks has are “Strong Buys.” All in, investors might want to put AppFolio on their radars ahead of its Q3 earnings release on Thursday, October 24.

Buy Soaring Spotify Technology Stock Near New Highs?

Spotify Technology (SPOT) changed the music industry like Netflix transformed TV and movies. Spotify grew its Premium Subscribers by 80% between Q2 FY20 and Q2 FY24, while monthly active users surged 110%. Spotify reportedly held 32% of the global streaming music market share in 2023, blowing away No. 2 Apple Music’s 15%.

Spotify’s growth efforts, price hikes, and efficiency commitments helped recharge the company and the stock. Spotify’s FY24 EPS estimate has soared 300% over the last 12 months, with its FY25 figure up 160%.

Spotify is projected to swing from an adjusted loss of -$2.95 a share last year to +$6.24 per share in 2024 and surge 40% next year. Spotify is projected to grow its revenue by 19% in 2024 and 15% next year to reach $20 billion—to double its revenue between FY20 and FY25.

Image Source: Zacks Investment Research

Spotify stock has skyrocketed 370% since the end of 2022, including a 95% YTD run. SPOT finally broke above its 2021 highs to a new record last month. SPOT recently slipped below its 21-day moving average and it might experience more profit-taking in the near-term.

That said, Spotify trades at a 40% discount to the Zacks Tech sector and 40% vs. its highs in terms of forward sales. SPOT has already cooled off to reach neutral RSI levels. Now might be a good time to consider Spotify with its Q3 results due on November 12.

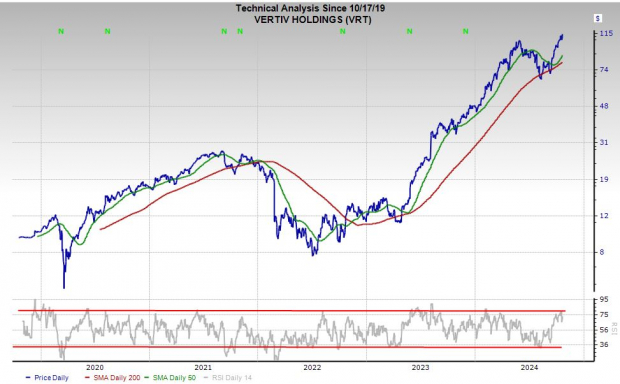

Why Vertiv is a Must-Buy AI Stock

Vertiv's (VRT) power, cooling, and IT infrastructure solutions and services operate across data centers, communication networks, and beyond. VRT helps keep the backend computing infrastructure that drives the modern economy running smoothly. Vertiv has partnered with the current king of AI, Nvidia (NVDA) , to solve future data center efficiency and cooling challenges.

Vertiv's CEO said that AI-boosted expansion is leading to VRT’s impressive growth runway.

Image Source: Zacks Investment Research

Vertiv is projected to grow its revenue by 13% in 2024 and 14% next year to help boost its bottom line by 46% and 30%, respectively. Vertiv’s improved EPS outlook helps it earn a Zacks Rank #2 (Buy).

Vertiv shares have soared over 1,000% in the last five years, including a 200% jump in the past 24 months. VRT has ripped to fresh highs recently and it might face selling pressure as it climbs higher above its 21-day.

Vertiv reports its Q3 results on Wednesday, October 23. Any pullback to its 21-day, 50-day, or 200-day might represent appealing opportunities for investors to buy the picks and shovels AI stock.

More By This Author:

Bull of the Day: Willdan Group, Inc.Under-The-Radar Stocks To Buy To Profit From This Wall Street Megatrend

2 Uranium Stocks To Buy Now And Hold For Huge Nuclear Energy Upside

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more