2 Uranium Stocks To Buy Now And Hold For Huge Nuclear Energy Upside

Uranium demand is projected to outstrip supply as the world races to expand nuclear energy almost overnight. The U.S. in late 2023 headed up a coalition of countries across four continents pledging to triple nuclear energy capacity by 2050.

The Bull Case for Uranium

The rapid revival of nuclear power sent uranium prices to their highest levels in over 15 years, soaring from $30 at the start of 2021 to $100 in January 2024. Despite a pullback, uranium prices hover around $80, up roughly 60% since the start of 2023.

Alongside rising demand come supply worries, which are made worse by the geopolitical backdrop. Russia reportedly supplies around 14% of global uranium concentrates, 27% of conversion, and 39% of enrichment, while Kazakhstan produces 43% of the world’s uranium—(for comparison, OPEC member countries produce about 40% of the world’s crude oil).

The CEO of the world’s largest uranium miner, Kazatomprom, recently warned that the war in Ukraine is making it harder to supply the West, according to a recent Financial Times story. “It is much easier for us to sell most, if not all, of our production to our Asian partners — I wouldn’t call [out] the specific country… They can eat up almost all of our production, or our partners to the north,” Meirzhan Yussupov told the Financial Times.

Kazatomprom’s boss said the company remains dedicated to diversifying its geography. Still, the warning is a reminder that the rest of the world needs to quickly ramp up uranium production.

On top of that, Vladimir Putin said on Wednesday that Moscow should consider limiting exports of uranium as retaliation for Western sanctions. These stories sent uranium stocks soaring.

The U.S. enacted in May the Prohibiting Russian Imports Act to ban imports of uranium products from Russia, with the DOE able to issue waivers for certain imports.

The U.S. government’s newfound support for nuclear energy sparked domestic uranium companies to restart mining and begin new operations. But restarting the U.S. uranium mining industry won't happen overnight.

Globally, 440 nuclear reactors across 32 countries provide about 10% of the world’s electricity. There are roughly 65 new nuclear reactors under construction around the world, with an additional 110 planned.

The world is going all-in on nuclear to help drive the energy transition.

Today we dive into one Canadian and one U.S.-based uranium stock that investors should consider buying now and holding for the long haul as they help fuel the new nuclear power age.

Buy Cameco Stock and Hold the Uranium Miner Forever?

Cameco (CCJ) is one of the only viable, large-scale uranium miner stocks most regular retail investors can buy, and it is trading 55% below its average Zacks price target.

Cameco is a Canadian uranium miner and a leading supplier of uranium refining, conversion, and fuel manufacturing services. CCJ is well positioned to benefit from its standing as an established miner and refiner in a stable part of the world.

Cameco is the second-largest uranium producer in the world, according to the World Nuclear Association, driven by two of the highest-grade mines on the planet located in northern Saskatchewan, Canada.

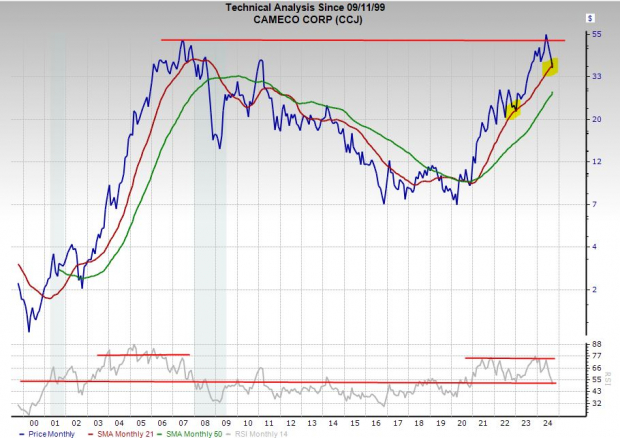

(Click on image to enlarge)

Image Source: Zacks Investment Research

Cameco said its 2024 outlook remained “on track” when it reported its Q2 results on July 31. CEO Tim Gitzel said full-cycle support has emerged for nuclear energy, “reinforced by positive public opinion, promising policy decisions, and market-based solutions.”

Cameco is projected to grow its adjusted earnings by 68% in FY24 and 82% in FY25 to soar from $0.57 a share in FY23 to $1.74 a share in 2025. Cameco is expected to grow its revenue by 16% in 2024 and 9% in 2025 to reach $2.43 billion. Cameco’s outlook includes large downward earnings revisions that came alongside the pullback in uranium prices.

Wall Street loves Cameco, with 11 of the 13 brokerage recommendations Zacks has at “Strong Buys,” alongside two “Buys.” The bulls know that Cameco will play a major role in the growing nuclear energy industry for decades. The company also pays a dividend with a sustainable payout ratio.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Cameco stock has skyrocketed 320% in the past five years. CCJ stock tumbled after it surged to new all-time highs in May, trading 30% below its peaks.

Cameco stock trades 54% below its average Zacks price target, and it recently found support at its 52-week lows and its 21-month moving average. CCJ trades in line with its 10-year median at 25.1X forward earnings.

Why Centrus Energy is a “Strong Buy” Uranium Stock

Centrus Energy Corp. (LEU) is a diversified supplier of nuclear fuel and services for nuclear power plants in the U.S. and globally. Centrus is benefitting from growing U.S. government support for the domestic uranium industry.

The Bethesda, Maryland-headquartered firm is also helping drive forward the next generation of centrifuge technologies and beyond to help restore domestic uranium enrichment capabilities.

Centrus in late 2023 inaugurated the first new U.S.-technology, U.S.-owned uranium enrichment plant to begin production since 1954.

Centrus also delivered High-Assay Low-Enriched Uranium to the U.S. Department of Energy last year. The current fleet of nuclear reactors run on uranium fuel enriched up to 5%. HALEU (High-Assay Low-Enriched Uranium) is enriched between 5% and 20% and is required for the next-gen SMRs.

Centrus works with some upstarts in the small modular nuclear reactor space, including Bill Gates-backed TerraPower.

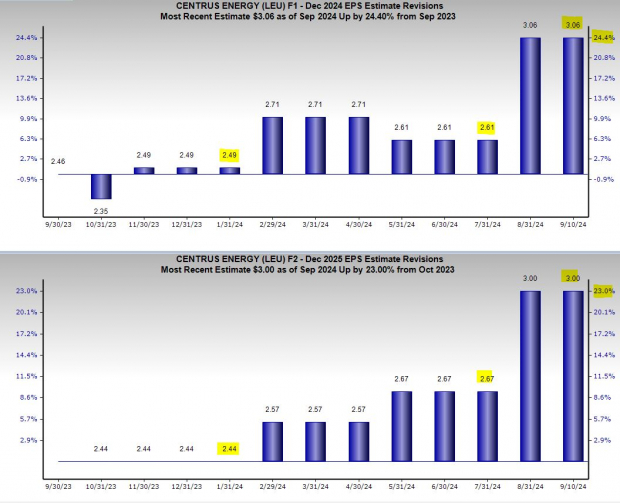

(Click on image to enlarge)

Image Source: Zacks Investment Research

Centrus on September 11 announced a contingent supply commitment with Korea Hydro & Nuclear Power to “support construction of new uranium enrichment capacity at Centrus' American Centrifuge Plant in Piketon, Ohio."

"The purchase commitment from KHNP covers a decade of deliveries of Low-Enriched Uranium to help fuel Korea's large fleet of reactors.”

Centrus crushed our Q2 EPS estimate in early August and boosted its guidance. LEU's positive earnings revisions help it earn a Zacks Rank #1 (Strong Buy).

LEU's chief executive said Centrus is “vigorously competing for this funding (more than $3.4 billion in appropriations from Congress – the largest federal investment in uranium enrichment in decades) as we believe it represents a historic opportunity to restore America's nuclear fuel supply chain with U.S. technology.”

(Click on image to enlarge)

Image Source: Zacks Investment Research

Centrus stock skyrocketed from under $5 in 2019 to well over $60 a share in late 2021 (as the market and growth stocks peaked). LEU trades 50% below its 2021 levels and lightyears beneath its pre-financial crisis highs.

Centrus trades 72% below its average Zacks price target even though it soared 10% on Wednesday, alongside CCJ and other uranium stocks.

Centrus could be poised to break out higher after finding support at its 50-month moving average, with LEU back above its 200-week as well.

Centrus trades at a 35% discount to its Zacks industry and at a solid discount to LEU’s five-year median at 12X forward 12-month earnings.

More By This Author:

3 Strong Tech Stocks To Buy In September: TSM, SPOT, APP3 Market-Crushing Stocks To Buy For Value And Growth In September

3 Nuclear Energy Stocks To Buy And Hold Forever

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more

Cameco's ownership of Westinghouse is a big risk given that company's history

I agree with you.

I had not heard of LEU before this article and will almost certainly buy-in soon