2025 May Be A Difficult Year

SPX Monitoring purposes; Sold long 1/6/25 at 5975.38 = gain 1.59%; Long SPX on 12/31/24 at 5881.63.

Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD:Long GDX on 10/9/20 at 40.78.

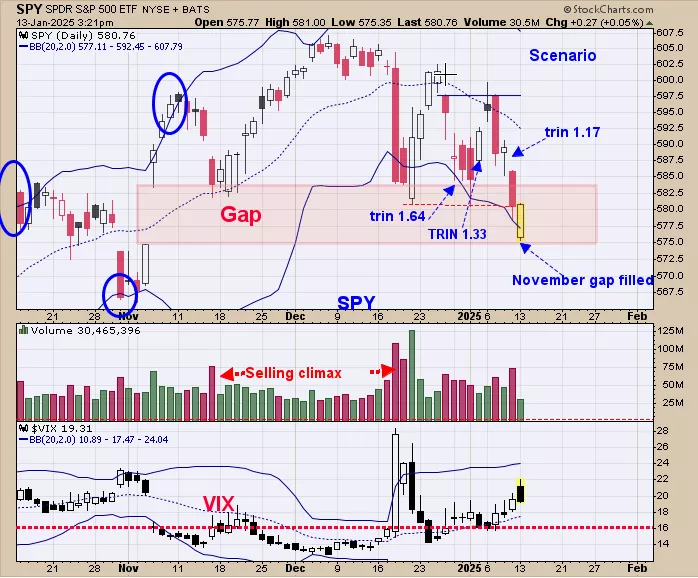

(Click on image to enlarge)

We are up 29.28% for 2024; SPX up 23.67% for the year. The bottom window is the 100 day average of the TRIN which is near 5 months of TRIN closes. We have shown the 63 day average of the TRIN (3 months of trin closes) in recent reports which we pointed out, leaned bearish.The 100 day TRIN reaching 1.00 and lower (current reading is 1.00) is a bearish intermediate sign for the market. The lowest reading in the recent past came on 12/27/24 with a close of .98. Chart above goes back to 2010 and we marked times with red and blue lines when 100 day TRIN < 1.00.Going back to 2010 (15 years) there where 8 times 1.00 was reached of which 6 marked significant tops (75%). Our point is that 2025 may be a difficult year.

This week is option expiration week which lean bullish. We did check the 1, 3, 5, and 10 day TRIN and all are 1.00 or lower and not an ideal setup for a rally. We would like to have seen some of the 1, 3, 5 and 10 day TRIN near 1.20 or higher to suggest panic low is forming. Market may attempt a rally this week but does not have enough energy (panic) to go far. A stronger low may come late this month according to seasonality. Notice that SPY did close the November gap that we though was a possibility (gap in shaded pink).Staying neutral for now. The bigger trend may be toping (according to the 63 and 100 day TRIN).

The second window down from the top is the weekly Bullish percent index for the Gold Miners/GDX ratio” and the top window is the RSI for this ratio.Intermediate term buy signals are triggered for GDX (XAU) when the RSI for this ratio falls below 25 (last week close came in at 23.68). Most signals of this type last 6 months or longer. There have been eleven signals since 2007 and one failure in 2013 which works out to be a 91% success rate. Another impulse rally is or has started in GDX.

More By This Author:

Market Could Remain Mixed

Large Declines Can Occur

Defining The Next Low

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more