Elliott Wave Technical Analysis VeChain Crypto Price News

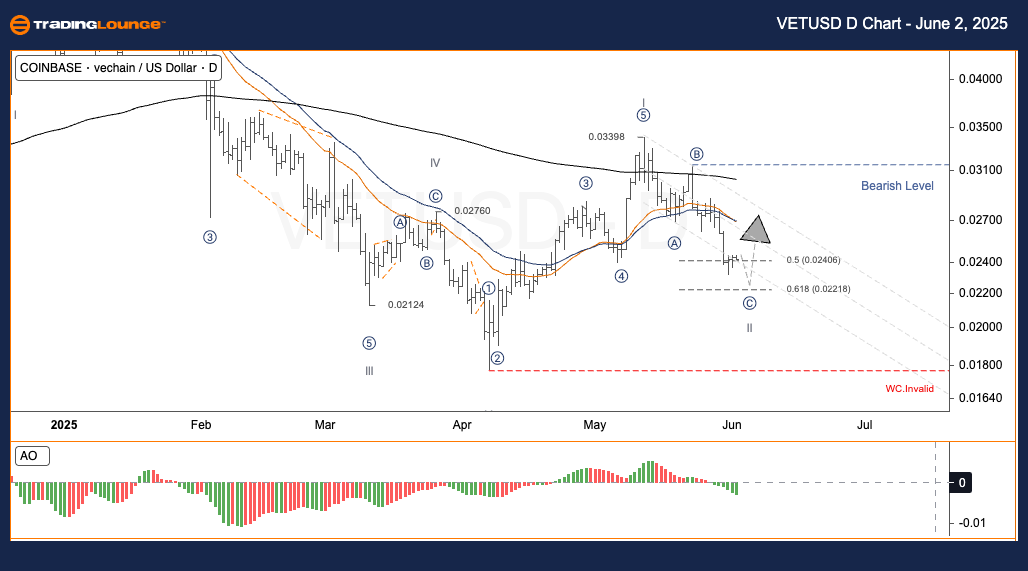

Elliott Wave Analysis - TradingLounge Daily Chart,

Asset: VeChain / U.S. Dollar (VETUSD)

VETUSD Elliott Wave Technical Analysis

- Function: Trend Following

- Mode: Motive

- Structure: Impulse

- Position: Wave II

- Direction of Higher Degree: Pending

- Wave Invalid Level: Not Specified

VETUSD Trading Strategy - Daily Chart

Following the major Wave V bottom at $0.0212, VETUSD advanced to $0.0315 during the sub-wave ⑤. This rise marks the beginning of a correction phase labeled A-B-C, signaling a pause in the larger bullish structure.

Currently, VETUSD is nearing the end of wave C. The price is testing a key Fibonacci support area between 0.5–0.618 retracement levels. Historically, this zone often acts as a launchpad for new upward movements after corrections.

Trading Strategies

- For Swing Traders

-

- Look for a dip-buying chance between $0.022 and $0.024 if a reversal signal appears.

- Risk Management

-

- Place a stop-loss order under $0.018 to control risk exposure.

Elliott Wave Analysis - TradingLounge H4 Chart,

Asset: VeChain / U.S. Dollar (VETUSD)

VETUSD Elliott Wave Technical Analysis

- Function: Trend Following

- Mode: Motive

- Structure: Impulse

- Position: Wave II

- Direction of Higher Degree: Pending

- Wave Invalid Level: Not Specified

VETUSD Trading Strategy - H4 Chart

VETUSD rose from $0.0212 to $0.0315, ending sub-wave ⑤. Since then, it has entered a corrective A-B-C pattern, aligning with the broader bullish cycle.

As wave C approaches its end, the Fibonacci 0.5–0.618 support zone becomes critical. It is often where market reversals form post-correction.

Trading Strategies

- For Swing Traders

-

- Watch for dip entries in the $0.022–$0.024 range, confirming a reversal pattern.

- Risk Management

-

- A stop-loss below $0.018 is advised to manage potential downside.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

SP500, Nasdaq , Bitcoin & Top Tech Stocks Analysis

Indian Stocks - Kotak Bank

Elliott Wave Technical Analysis VanEck Semiconductor ETF

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more