Elliott Wave Technical Analysis: Vechain Crypto Price News For Wednesday, July 16

Image Source: Pexels

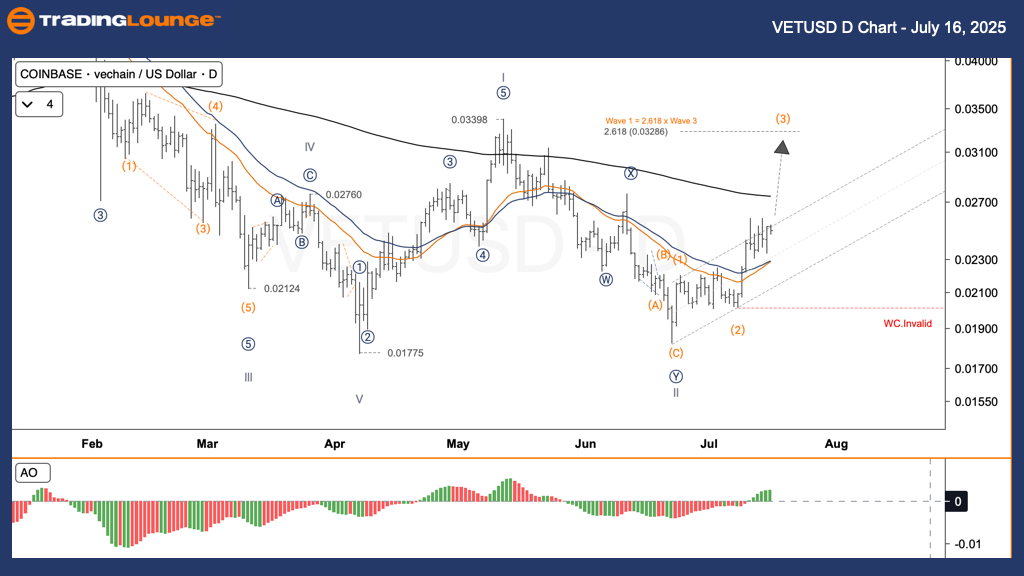

Vechain (VETUSD) – Elliott Wave Analysis – Daily Chart

Technical Analysis – TradingLounge

Function: Follow-Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Invalidation Level: $0.02000 (W.C. Invalid)

Overview:

Vechain (VETUSD) is currently forming sub-wave (3) within the larger wave III structure after completing wave II. The target for wave (3) is projected near the 2.618 Fibonacci extension of wave (1), approximately at $0.03286 USD. To maintain this bullish impulse structure, the price must remain above the key support zone at $0.02000 USD. A break below this level would invalidate the current wave count.

Trading Strategy:

- ✅ Swing Trade (Short-Term Traders):

-

- If a base forms at wave (4) along the way, it could offer an opportunity to add to existing positions.

- 🟥 Wave Cancel (Invalidation Zone):

-

- Critical Support: $0.02000 USD

- A move below this invalidates the bullish setup.

Vechain (VETUSD) – Elliott Wave Analysis – 4-Hour Chart

Technical Analysis – TradingLounge

Function: Follow-Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Invalidation Level: $0.02000 (W.C. Invalid)

Overview:

On the 4-hour chart, VETUSD continues within sub-wave (3) of major wave III after confirming the end of wave II. The short-term bullish target remains around $0.03286 USD (2.618 extension of wave (1)). As long as the price holds above $0.02000, the structure is considered valid and bullish.

Trading Strategy:

- ✅ For Swing Traders:

-

- Potential buy zones may form at minor corrections like wave (4), creating opportunities to increase exposure.

- 🟥 Wave Cancel Level:

-

- Must-Hold Support: $0.02000 USD

- Falling below this level cancels the current wave count.

Technical Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Unlocking ASX Trading Success: Unibail-Rodamco-Westfield - Tuesday, July 15

U.S. Stocks: Apple Inc.

Elliott Wave Technical Analysis: British Pound/Australian Dollar - Tuesday, July 15

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more