Elliott Wave Technical Analysis: Uniswap Crypto Price News Today

Elliott Wave Analysis – TradingLounge Daily Chart |

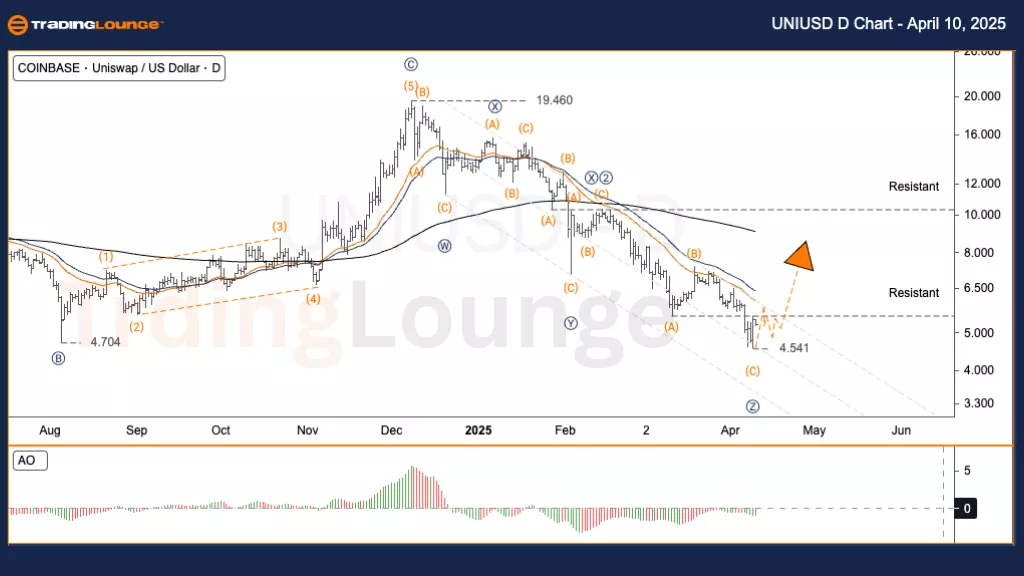

Uniswap / U.S. Dollar (UNIUSD)

UNIUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Next Direction (Higher Degree): Wave Z

Invalidation Level: Not specified

Uniswap / U.S. Dollar (UNIUSD) – Trading Strategy

The Elliott Wave pattern indicates the W–X–Y–X–Z corrective phase is likely complete. This suggests a possible price reversal after forming the final wave "Z" and the earlier triangle “e” wave. UNIUSD fell sharply from a high of $19.46 and found support in the $4 to $5 range, which may now represent a bottom.

Trading Strategies

Strategy

Swing Trade (Short-Term)

Look for a breakout with volume or confirmation above the $6.50 to $7.00 range.

Risk Management

Place a stop-loss below the $4.70 support level for tighter risk control.

Elliott Wave Analysis – TradingLounge H4 Chart |

Uniswap / U.S. Dollar (UNIUSD)

UNIUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Next Direction (Higher Degree): Wave Z

Invalidation Level: Not specified

Uniswap / U.S. Dollar (UNIUSD) – Trading Strategy

The H4 chart supports the idea that the W–X–Y–X–Z correction has ended. There’s a potential bullish turn as the market reacts from the last wave "Z" and triangle “e” formation. The price previously dropped from $19.46 to the $4–$5 support zone, which might now be forming a solid bottom.

Trading Strategies

Strategy

Swing Trade (Short-Term)

Seek breakout confirmation or volume increase around $6.50–$7.00.

Risk Management

Tight stop-loss below $4.70 to manage downside risk.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Insights For S&P 500, Nasdaq 100, DAX 40, FTSE 100 & ASX 200

Elliott Wave Technical Analysis: Car Group Limited - Wednesday, April 9

Elliott Wave Technical Analysis: AbbVie Inc. - Wednesday, April 9

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more