Elliott Wave Technical Analysis: Theta Token Crypto Price News For Thursday, May 22

Image Source: Pixabay

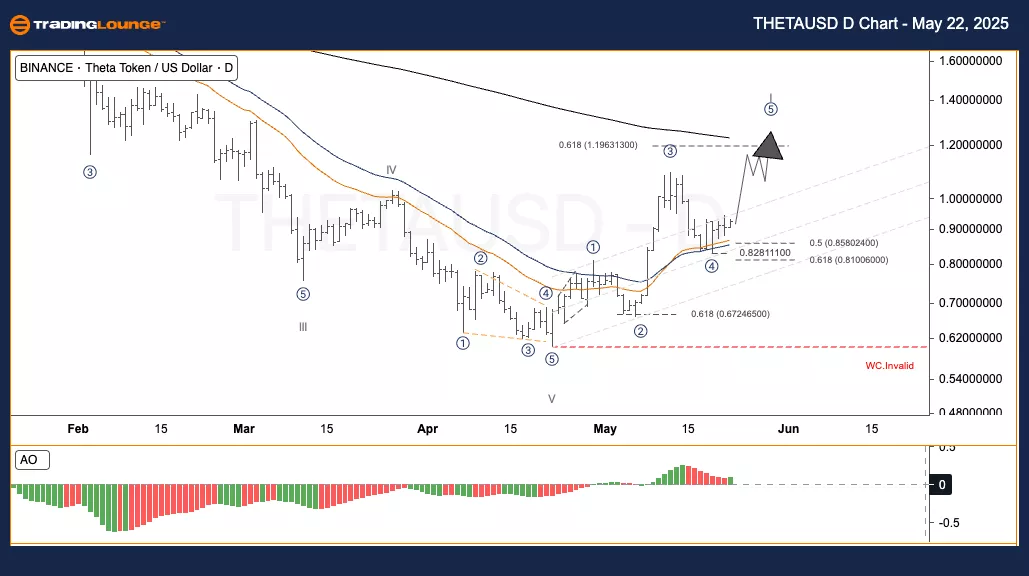

Elliott Wave Analysis – TradingLounge Daily Chart, Theta Token / U.S. Dollar (THETAUSD)

THETAUSD – Elliott Wave Technical Overview

Function: Trend-following

Mode: Motive

Structure: Impulse

Current Position: Wave 4

Next Direction at Higher Degrees: Awaiting development

Invalidation Level: Breach near $0.620 will invalidate the structure

Theta Token (THETAUSD) – Trading Strategy

Since completing the downward V wave in April, Theta has initiated a strong rebound. The market now moves in a motive wave pattern, progressing toward wave (5) that will finalize major wave I of the uptrend. Waves ① through ④ have formed, and wave ⑤ has just begun, aiming for the 0.618 Fibonacci Extension of waves 1–3 at approximately $1.196. A drop below $0.620 wuld invalidate the current structure and require a reassessment.

Trading Strategies

Strategy Type

✅ Swing Trade Strategy for Short-Term Traders

Momentum or swing traders can look for a small pullback as a potential entry point for long positions.

Wave ⑤ target range: $1.19 to $1.25

Risk Management

🟥 Stop-loss guidance: Below $0.82 or at a firm base near $0.72

Elliott Wave Analysis – TradingLounge H4 Chart, Theta Token / U.S. Dollar (THETAUSD)

THETAUSD – Elliott Wave Technical Overview

Function: Trend-following

Mode: Motive

Structure: Impulse

Current Position: Wave 4

Next Direction at Higher Degrees: Awaiting development

Invalidation Level: Breach near $0.620 will invalidate the structure

Theta Token (THETAUSD) – Trading Strategy

As the downward wave V ended in April, THETA began forming a new motive wave structure. This pattern progresses into wave (5), which is intended to complete major wave I of this upward cycle. With waves ①–④ completed, wave ⑤ is active, with a price target aligned to the 0.618 Fibonacci Extension of waves 1–3, placing it near $1.196. Breaching the $0.620 level will nullify this wave count.

Trading Strategies

Strategy Type

✅ Swing Trade Strategy for Short-Term Traders

Momentum or swing traders may wait for a pullback before initiating long trades.

Wave ⑤ price target: $1.19 – $1.25

Risk Management

🟥 Suggested stop-loss levels: below $0.82 or anchored at $0.72

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Elliott Wave Technical Forecast: Newmont Corporation - Wednesday, May 21

Elliott Wave Technical Analysis: Dell Technologies Inc. - Wednesday, May 21

Elliott Wave Technical Analysis: U.S. Dollar/Canadian Dollar - Wednesday, May 21

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more