Elliott Wave Technical Analysis: Polkadot Crypto Price News For Tuesday, June 3

Image Source: Pixabay

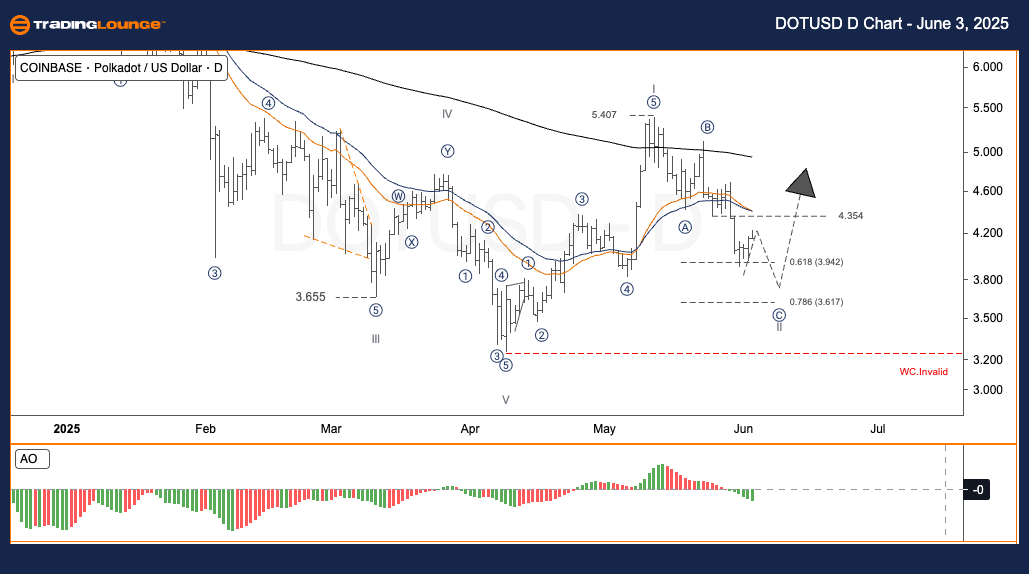

Elliott Wave Analysis – TradingLounge Daily Chart, Polkadot / U.S. Dollar (DOTUSD)

DOTUSD Elliott Wave Technical Analysis

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Position: Wave 2

- Next Higher Degrees Direction: N/A

- Invalidation Level: N/A

Trading Strategy – Daily Chart

DOT is undergoing a wave II correction. Once completed, wave III may begin, which often exhibits strong momentum in Elliott Wave theory. Wave I ended at $5.407 and followed a clear five-wave pattern. Currently, wave II unfolds as an ABC correction. Target levels for wave C are:

- Fib 0.618 ≈ $3.94

- Fib 0.786 ≈ $3.62

Suggested Strategies

- ✅ For Short-Term Traders (Swing Trade):

-

- Monitor price action near $3.62–$3.94.

- Look for bullish reversal patterns (e.g., Pin Bar, Engulfing).

- 🟥 Risk Management:

-

- Set Stop Loss below $3.40 (invalid level for wave count).

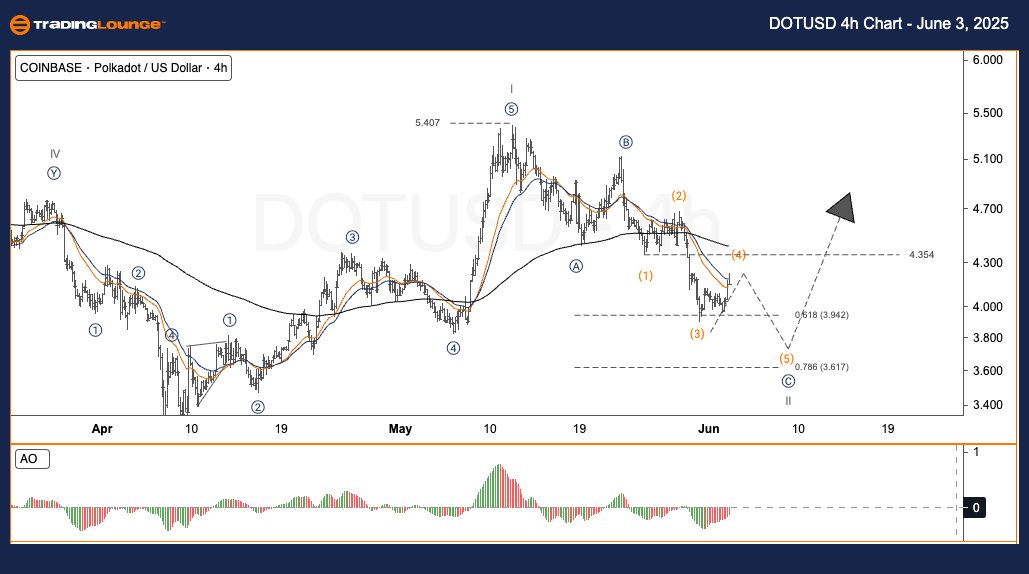

Elliott Wave Analysis – TradingLounge H4 Chart, Polkadot / U.S. Dollar (DOTUSD)

DOTUSD Elliott Wave Technical Analysis

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Position: Wave 2

- Next Higher Degrees Direction: N/A

- Invalidation Level: N/A

Trading Strategy – H4 Chart

Polkadot (DOT) is in wave II correction phase, setting the stage for a wave III rally. The first wave (Wave I) ended at $5.407 with a five-wave internal structure. The market now corrects through wave II in an ABC formation. Price targets for wave C are:

- Fib 0.618 ≈ $3.94

- Fib 0.786 ≈ $3.62

Suggested Strategies

- ✅ For Short-Term Traders (Swing Trade):

-

- Wait for a test of the $3.62–$3.94 zone.

- Identify bullish reversal signals.

- 🟥 Risk Management:

-

- Place Stop Loss below $3.40.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Unlocking ASX Trading Success: Insurance Australia Group Limited - Monday, June 2

Elliott Wave Technical Analysis Walmart Inc.

Elliott Wave Technical Analysis: British Pound/Australian Dollar - Monday, June 2

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more